US Stocks Climb Higher, Dow Posts 3rd Weekly Gain; French Shares Extend Gains on Friday; Sugar Retreats from 1-Month High

GLOBAL CAPITAL MARKETS OVERVIEW, ANALYSIS & FORECASTS:

Author: Dr. Alexander APOSTOLOV (researcher at Economic Research Institute at BAS)

The Dow closed up 176 points on Friday, the S&P 500 and Nasdaq rose 1.1 percent, respectively, as investors weighed the latest batch of corporate performance and economic data. PCE inflation eased further in June, coupled with recent GDP data showing the resilience of the economy, raising hopes that the Fed is about to end tightening. On the earnings front, Intel shares rose 9.6 percent, helped by strong quarterly results and an optimistic outlook. Roku shares rose 6.6 percent after the company reported a smaller-than-expected loss in the latest quarter and higher-than-expected revenue. Shares of Procter & Gamble rose 31 percent after the company posted upbeat results and outlook. ExxonMobil, by contrast, had mixed second-quarter results, down 3.3 percent. Ford shares fell 1.2 percent after delaying its electric vehicle production target until next year despite strong quarterly earnings. For the week, the Dow is up 3.4%, the S&P 0 is up 4.500%, and the Nasdaq is up 0.8%.

Canada S&P/TSX composite index rose 0.6 percent on Friday to close at 20519,0 and closed the week down 2.6 percent as markets continued to digest the latest corporate performance and economic data to hint at the central bank's upcoming decision. Rough estimates suggest that Canada's gross domestic product could contract by 0.2% in June, the first decline in six months, suggesting that the Bank of England's rate hikes could have a greater impact on businesses as the second quarter draws to a close. Major sectors of the Toronto Stock Exchange rose broadly, with rate-sensitive technology stocks following the Nasdaq up 2 percent as the latest data ease fears of further rate hikes by the Federal Reserve. Energy stocks rose 2.5 percent, and bank stocks extended recent gains, rising an average of 0.2 percent. Mining stocks also closed in the green, benefiting from stronger gold and base metals prices, rising 1.4 percent.

The Frankfurt DAX40 rebounded in Friday afternoon trading, rising about 0.3 percent to an all-time high of 16465,3, helped by a 600 percent rise in BASF shares despite the company's announcement to cut its plant and equipment investment budget this year. However, other major European indices fell, with the pan-European STOXX 1 down 0.3 percent from a one-and-a-half-year high on Thursday. Investors are carefully evaluating the policy decisions of major central banks and the latest corporate earnings reports. On the corporate side, Capgemini's second-quarter revenue growth slowed more than expected, while Sanofi's quarterly sales fell short of expectations. AMS reported second-quarter results in line with expectations, and Hermès sales also increased. Regarding economic data, the French and Spanish economies continued to grow in the second quarter, while German GDP stagnated. Meanwhile, CPI Express noted that inflation in both Germany and France has slowed. The CAC 40 index rose 0.18 percent on Thursday to close at 7479,7, even as Capgemini's shares tumbled 20 percent after the IT consulting group reported quarterly results for weak second-quarter sales growth. At the same time, the company said it plans to invest 2 billion euros in artificial intelligence over three years. Despite the upward revision of its earnings forecast, French drugmaker Sanofi (-85.4%) was also one of the worst performers. On the contrary, Bouygues was the best performer (+11.1%), with a higher-than-expected core profit in the first half of the year. In addition, Hermès grew by about 8.0%, and the Birkin handbag manufacturer's sales accelerated in the second quarter. At the same time, investors welcomed the latest data, which showed that inflation in France slowed as expected, while the economy grew more than expected in the second quarter at 5%. On Friday, the FTSE MIB index fell 0.33% to close at 29500,2, but gained more than 6% for the week as investors monitored earnings reports. ERG (-56.2023%) was the worst performer of the day, lowering its estimate for EBITDA for 6 due to lower volumes and lower prices in the second quarter. In addition, Cnh Industrial's positive earnings report did not prevent its share price from falling by 25.2% due to concerns about the agricultural sector. Similarly, Eni's optimistic quarterly results did not translate into higher share prices. On the other hand, General Bank, after a third increase in profit in the first half of the year compared to last year, rose by 86.2%, while IVECO Group and Stellantis also rose by 78.2% and 38%, respectively.

The ruble-based MOEX Russia index recovered losses in early trading, rising 0.6% on Friday to close at 3006,2022, the highest since the February 2 Russian invasion of Ukraine triggered a stock market crash, with strong support from oil companies and investors continuing to assess Russia's corporate prospects amid geopolitical risks. Investors rushed to buy shares of oil producers in afternoon trading, sending Lukoil shares up 2.9 percent, Surgut and Rosneft up 1.5 percent and Rosneft up 1 percent. On the other hand, financials dragged down benchmark indices, with investors taking profits after VTB's surge yesterday. The bank posted strong results for the first half of the year and forecast record profits by the end of 2023.

The Hong Kong stock market rose 277.845 points on Friday, an increase of 1.42%, and received it at 19918.91, reversing the loss of morning trading, while trying to reach the highest level in six months. The strong GDP data and inflation in the second quarter of the United States further eased the signs of boost, U.S. futures rose. The Hang Seng Index rose by 4.4% this week. Traders welcomed the results of the Politburo meeting held in China this week, which promised to introduce countercyclical policies, adhere to sound monetary policies and active financial support. Technology stocks have soared by nearly 3% because Beijing requires China’s largest technology company to provide case studies of its most successful entrepreneurial investment, which will show that the authorities are ready to support them after a year of blow. Consumer and financial stocks also recorded strong increases, rising by 1.5% and 1.4% respectively%. Sunny Optical Tech.The stock price soared by 9.3%, Lenovo Group (8%), Li Ning Company (7.3%), AIM Vaccine(7.0%) and Yadi Group (Yadea Group Hlds) The stock price is closely followed.4.4%).

On Friday, the above-mentioned China index finger rose by 1.4% to about 3260 points, and the ingredient stocks rose by 1.4%, collected at 11075 points. As people are more and more optimistic that the Chinese authorities will fulfill their commitment to boost the economy, the mainland stock market is expected to rise this week. The Minister of Housing and Urban-Rural Development of China stated that China needs more effective measures, such as reducing the interest rate of housing mortgage loans and the down payment ratio of first-time buyers, to promote home purchases, and urged efforts to strengthen industry recovery. Earlier this week, as the recovery after the Chinese epidemic showed signs of slowing down, the Chinese Politburo promised to strengthen policy measures to support economic growth. Real estate, finance, and consumption-related stocks mostly rose on Friday, while technology companies rose and fell. Significant increases in the real estate sector include gold real estate (2.3%), Swiss real estate (5.6%) and Chinese Wanke (1.2%).

The New Zealand NZX 50 index fell by 7.37 points, a decrease of less than 0.1%, and it was collected at 11946.74 points. After the decline of the Wall Street stock market on Thursday, this week, the market participants carefully waited for the US PCE data, which is closely watched by the Fed Inflation indicators. After the central bank raised interest rates earlier this week, this data is of particular concern. Investors are also wary of looking forward to a series of economic data for New Zealand next week, including business sentiment in July, construction permits in June and unemployment rate in the second quarter. At the same time, the latest data shows that due to rising cost of living and rising inflation expectations, New Zealand’s consumer sentiment in July remained weak. The increase in financial, industrial and financial sectors almost offset the decline in technological sectors, non-energy minerals and transportation sectors.

Nikkei 225 index fell by 1.1% to below 32,500 points, and the Tosuka index fell by 1.25% to 2266 points, offsetting the increase of the previous trading day. Investors carefully waited for the latest policy decision of the Bank of Japan. According to Japanese news reports, the Bank of Japan will discuss the adjustment of the yield curve control policy at the July meeting to allow long-term interest rates to be above the 0.5% ceiling at “ to a certain extent, and the market is shaken. The Japanese stock market is also following the decline on Wall Street overnight, because strong US economic data has raised concerns about the Fed’s possible tightening of policies. Technology stock collapses, Advantest(-1.4%), Reza Electronics (-5.8%), Soft Silver Group (-1.7%), Capcom( -5.2%) and Fujitong(. Other index weight stocks also fell, including express sales (-2.2%), fine energy (-4%) and Toyota (-1.8%)

India BSE Sensex index fell by 106 points, to 66160 points, resulting in a 0.8% decline this week, ending the upward momentum for four consecutive weeks, because the mixed corporate performance and concerns about the North American hawk's monetary policy gave the Mumbai exchange The key plate has brought pressure. The decline in technology stocks is under pressure from the soaring yield of domestic bonds in the United States. The previously strong US GDP and labor data have increased hawk pressure on the Fed. The major companies in this industry have a great exposure to Western economies. Due to reduced consumer spending in North America and Europe, they have predicted that profits will decline for the rest of the year. TCS, HCL Technologies, Tech Mahindra and Infosys all fell by more than 1%. Banks also fell sharply. At the same time, the price of solid industrial stocks rose by 0.9%, a decline from this week.

REVIEWING THE LAST ECONOMIC DATA:

Reviewing the latest economic news, the most critical data is:

- CA: The ruble-based MOEX Russia index recovered losses in early trading, rising 0.6% on Friday to close at 3006,2022, the highest since the February 2 Russian invasion of Ukraine triggered a stock market crash, with strong support from oil companies and investors continuing to assess Russia's corporate prospects amid geopolitical risks. Investors rushed to buy shares of oil producers in afternoon trading, sending Lukoil shares up 2.9 percent, Surgut and Rosneft up 1.5 percent and Rosneft up 1 percent. On the other hand, financials dragged down benchmark indices, with investors taking profits after VTB's surge yesterday. The bank posted strong results for the first half of the year and forecast record profits by the end of 2023.

- CA: Due to the reduction in manufacturing and wholesale, the Canadian economy is expected to contract by 0.2% in June 2023%. However, the growth of oil and gas extraction, real estate, and leasing and leasing industries partially offset this decline. In the final estimate in May, the country’s GDP was reduced from 0.4% to 0.3%, the service industry increased by 0.5%, and the commodity production industry declined by 0.3%. In various industries, manufacturing, wholesale, and public administration have driven growth, while energy has been affected by wildfires and hit.

- US: In July 2023, the University of Michigan’s consumer confidence in the United States was reduced from the initial 72.6 to 71.6. This is the highest reading since October 2021, because inflation continues to slow and the labor market is stable. The expected indicator is lowered from 69.4 to 68.3, and the current condition classification index is lowered from 77.5 to 76.6. At the same time, this year's inflation expectations remain unchanged at 3.4%, and the five-year outlook has been lowered from 3.1% to 3%.

- US: According to personal consumption expenditure data, the dollar index fell below 102 on Friday because inflation in June showed signs of further cooling. The core PCE price rose by 4.1% year-on-year in June, the lowest since September 2021, below the 4.2% forecast. DXY will continue to rise for the second consecutive week, supported by stronger than expected US economic data. The US economy grew by 2.4% in the second quarter, exceeding the market's expected 1.8%. Durable goods orders surged, and the number of people applying for unemployment benefits fell to a low of several months. The euro and the pound have increased slightly from the lows in more than two weeks. The yen fell slightly to US$119.8, after the Bank of Japan maintained its ultra-low interest rate policy, but changed the wording to make its yield curve control policy more flexible.

- US: Following a 0.1% increase in May, the US PCE price index rose by 0.2% in June 2023, which is in line with market expectations. Commodity prices fell by 0.1% and service costs rose by 0.3%. Food prices fell slightly by 0.1% and energy prices rose by 0.6%. Excluding food and energy, the PCE price index also rose by 0.2%.

- US: In the second quarter of 2023, the salary cost of US civilian personnel increased by 1.0%, lower than the 1.2% increase in the previous three months, and slightly lower than the market's expected 1.1%. Wages and salaries increased by 1.0% ( and 1.2% ) in the first quarter, welfare costs increased by 0.9% ( and 1.2% ) in the first quarter. Compensation costs for workers in the private sector increased by 1.0%, and compensation costs for state and local government workers also increased by 1.0%. From April to June, the salary cost increased by 4.5% year-on-year, which was lower than the 4.8% increase in the first quarter.

- US: In June 2023, US personal expenditure ( in current US dollars ) increased by 0.5%, exceeding the market's expected 0.4%, and accelerated from the 0.2% raised last month. The data reflects US$52.1 billion in service expenditures, while total merchandise expenditures are US$49.1 billion, highlighting consumers’ resistance to higher interest rates and supporting a series of recently released data that strengthen the Fed’s maintenance of hawks' Position argument. In the service industry, financial services and insurance, housing utilities and entertainment services have contributed the most to the increase in expenditure. Taking into account commodities, expenditures on motor vehicles and parts, gasoline and other energy products, and vehicle fuel and lubricants have increased significantly.

- GE: Preliminary estimates show that in July 2023, the consumer price inflation rate in Germany slowed to 6.2% year-on-year, which was lower than 6.4% last month, in line with market expectations. The interest rate is close to the 14-month low of 6.1% in May, and the core interest rate excluding volatile items such as food and energy has also dropped to 5.5%, which has increased signs that inflationary pressures in Europe’s largest economy have begun to cool. However, these two interest rates are still much higher than the European Central Bank's 2.0% target. The commodity inflation rate dropped from 7.3% to 7.0%, mainly due to the slowdown in food prices (11.0% vs. 11.7%). On the other hand, the energy inflation rate rose from 3.0% to 5.7%. At the same time, service prices rose by 5.2% in July, not much change compared to the 5.3% increase in June. From a monthly perspective, consumer prices rose by 0.3% in July, the same rate as in the previous period.

- EU: In July 2023, the Eurozone Service Confidence Index fell to 5.7 for the third consecutive month, the lowest level since November last year, while the market forecast is 5.4. Service providers’ assessments of past needs have deteriorated significantly, partly offset by their increased assessment of past business conditions. Demand is expected to remain generally stable.

- EU: In July 2023, the Eurozone industry confidence index fell to -9.4 for the sixth consecutive month, the lowest level since August 2020, which is lower than the market generally accepted -7.5. Manufacturer’s production expectations and assessment of the current overall order level have deteriorated significantly, and finished product stocks are increasingly being assessed as excessive/above normal levels. In the absence of confidence indicators, managers have a more negative attitude towards the development of past production and its assessment of export order books.

- EU: In July 2023, the consumer confidence index in the euro area rose by 1 point to -15.1, the highest value since February 2022, consistent with preliminary estimates. Consumer confidence in the EU also continued to recover from the historical low of September 2022 ( compared to June +1.0), thanks to consumers’ past financial situation and future financial situation of their families. The expected view of the country’s overall economic situation has improved. Consumers' willingness to buy commodities has hardly changed.

- EU: In July 2023, the Eurozone economic sentiment index fell to 94.5 for the third consecutive month, the lowest value since October last year, lower than the market's expected 95.0. At the time of this decline, the radical policy tightening implemented by the European Central Bank, coupled with the continued high inflation rate, began to have an impact. Specifically, the manufacturer ( June is -9.4 to -7.3 ), the service provider (5.7 to 5.9) and the builder (-3.1 to 2.4) morale has declined, while traders (-4.5<A.9. In terms of prices, the consumer inflation expectations index fell to 4.8 in July, the lowest level since October 2015, and the manufacturer’s sales price expectations fell to 3.4, the highest level since November 2020. Among the largest economies in the euro area, the ESI of France (-2.3 points ), Germany (-2.1 points ) and the Netherlands (-0.9 points ) has deteriorated significantly.

- FR: Following an increase of 1.5% in May, the producer price chain in the French domestic market fell by 1.1% in June 2023%. This is the third consecutive month of decline, mainly due to the further decline in the prices of mining and quarrying products, energy and water ( -3.6% in May and -2.8% ) in May, mainly related to electricity production and trade The cost is reduced by (-4.5% and 3%). At the same time, the price of manufactured goods stabilized after falling by 1% last month. On an annual basis, PPI dropped to 3%, the lowest level since February 2021.

- FR: Preliminary estimates show that in July 2023, the French consumer price inflation rate fell from 4.5% last month to 4.3%, which is consistent with market consensus. Due to the moderate increase in the prices of energy, food and manufactured goods, this ratio has reached its lowest level since February last year. Nevertheless, this interest rate is still higher than the European Central Bank's 2.0% target. Energy prices continue to fall ( from -3% in June to -3.8% ), while food ( rose from 11.7% to 12.6% ) and manufactured goods ( rose from 4.2% to 3.4% ) The cost increase rate is slower. In contrast, inflation in the service industry has accelerated slightly (3.1% vs. 3%). From a monthly perspective, consumer prices remained flat in July after rising by 0.2% in June, while the market forecast was 0.2%.

- SW: The Swedish economy contracted by 1.4% in June 2023, the largest decline since January 2022, compared with an increase of 0.3% in May, mainly due to a decline in commodity exports. Compared with June 2022, GDP fell by 3.6%.

- SW: In June 2023, the unemployment rate in Sweden increased to 9.2%, the highest level since June 2021, compared with 8.6% in the same month of the previous year%. The number of unemployed persons increased by 43,000 to 547,000, while the number of employed persons increased by 61,000 to 5.4 million. Therefore, the employment rate increased by 0.6 percentage points to 71.1%, and the labor force participation rate increased by 1.1 percentage points to 78.5%. After seasonal adjustments, the unemployment rate in June was 7.5%.

- SW: Preliminary estimates show that in the three months to June 2023, the Swedish economy has contracted by 1.5% on a quarterly basis, which is worse than the market forecast of 0.6% contraction, which is different from the 0.6% growth in the previous period. This marks the largest decline in economic activity since the second quarter of 2020, because several basic factors have affected development, especially the decline in commodity exports. Compared with the same period last year, GDP contracted by 2.4%, reversing the growth momentum of 0.8% in the first quarter, and the largest decline since the second quarter of 2020.

- SW: In June 2023, Sweden’s retail sales fell by 4.4% year-on-year, a decrease of 5.3% in the previous month, roughly in line with the market’s generally accepted 4.5% decline. The latest data indicates that retail activities have declined for the fourteenth consecutive month, and the consumption of materials ( has dropped from -3.1% in May to -2.6% ) and durable goods ( have dropped from 7.1% to -6%) Sales continue to decline. In June, the retail sales chain fell by 0.3%, reversing the growth trend of a 0.1% reduction in May, while the market is expected to decline by 0.2%.

- AU: In the second quarter of 2023, Australia’s final demand producer price index increased by 0.5% quarterly, down from 0.7% in the first quarter%. This is the twelfth consecutive growth period, but with rising cost pressures, this is the weakest growth rate since the first quarter of 2021. The main growth factor is the construction output (+0.9%), which is due to the continuous shortage of skilled labor and the conversion of energy-intensive materials; heavy and civil engineering construction (+0.8%), boosted by rising electricity and freight prices; cafes, restaurants<A>,Driven by increased input and operating costs. Offset the increase is the decline in accommodation prices (-10.7%); the motor vehicle and motor vehicle parts manufacturing industry (-2.8%); and the oil refining and petroleum fuel manufacturing industry (-4.2%), due to a decline in global crude oil prices. As of the second quarter, producer prices rose by 3.9%.

- JP: In July 2023, the core consumer price index in the Tokyo Valley region of Japan increased by 3% year-on-year, lower than the 3.2% increase in the previous two months, but higher than the market's expected 2.9%, and also exceeded the Bank of Japan for the 14th consecutive month. 2% target, which is a sign of increased inflationary pressure. This challenges the Bank of Japan’s view that price increases will slow to the goal in the coming months. In the context of stubborn inflation and rising global interest rates, these data also put pressure on the central bank to adjust its ultra-loose monetary policy this year. However, the governor of the Bank of Japan, Ueda and Hu, recently stated that there is still some distance to achieve the central bank's 2% inflation target in a sustainable and stable manner.

- JP: The appreciation of the yen against the US dollar exceeded 119, the highest level in more than a week. There have been reports that the Bank of Japan will discuss the adjustment of the yield curve control policy at the July meeting to allow long-term interest rates to be above the 0.5% ceiling at “ to a certain extent. ”For several months, the market has been speculating that as continued inflation and rising global interest rates put constant pressure on Japanese bond yields and currencies, the last major central bank that maintains the dove's position may eventually succumb. Investors are now waiting for the policy decision and further comments of the Bank of Japan to guide market prospects. Nonetheless, it is generally expected that the Bank of Japan will maintain an ultra-loose monetary policy. The Governor of the Bank of Japan, Ueda and Fu, previously stated that there is still some distance to achieve the central bank's 2% inflation target in a sustainable and stable manner. The latest data shows that Japan’s annual overall inflation rate and core inflation rate both rose slightly to 3.3% in June%.

LOOKING AHEAD:

Today, investors should watch out for the following important data:

- EUR: German Import Prices m/m, German Retail Sales m/m, Italian Prelim GDP q/q, CPI Flash, Estimate y/y, Core CPI Flash Estimate y/y, Italian Prelim CPI m/m, Prelim Flash GDP q/q, and EU Economic Forecasts.

- GBP: M4 Money Supply m/m, Mortgage Approvals, and Net Lending to Individuals m/m.

- USD: Chicago PMI, and Loan Officer Survey.

- JPY: Consumer Confidence, Housing Starts y/y, Prelim Industrial Production m/m, and Retail Sales y/y.

- NZD: ANZ Business Confidence.

- AUD: MI Inflation Gauge m/m, and Private Sector Credit m/m.

- CNY: Manufacturing PMI, and Non-Manufacturing PMI.

- CHF: Retail Sales y/y.

KEY EQUITY & BOND MARKET DRIVERS:

Кey factors in the stock and bond market are currently:

- US: The 10-year U.S. Treasury Debt yield has been hovering close to the 4% mark, adding nearly 20 basis points since the beginning of the third quarter, and still approaching the four-month high of 4.05% since July 7 because of a strong The economic data reinforces the reason why the Fed maintains its hawkish position at the upcoming meeting. Personal expenditure exceed market expectations and increased by 0.5% in June, enhancing the economy’s ability to resist higher interest rates. Earlier data showed that GDP grew by 2.4% in the second quarter of the United States, exceeding the market's expected 1.8%, while the demand for durable goods orders surged, and the number of people applying for unemployment benefits fell to a few months of low, which had a significant impact on the price of national debt. As expected, the Fed raised its target fund interest rate by 25 basis points this month and opened the door for another interest rate increase in September if economic data proves that borrowing costs are more strictly restricted.

- IT: Italy’s 10-year BTP rate of return stabilized at around 4.1%. Investors evaluated the currency policy prospects of major central banks while waiting for the Italian GDP and inflation data released on Monday. Both the European Central Bank and the Federal Reserve announced a 25 basis point increase in interest rates at the July meeting, bringing borrowing costs to multi-year highs. However, the speeches of President Lagarde and President Powell indicate that the bank's austerity cycle may have ended. Elsewhere, the Bank of Japan announced that it will make its yield curve control policy more flexible, a move that may be interpreted as deviating from its current ultra-loose monetary policy stance.

- FR: As investors digested the latest monetary policy updates of major central banks, France’s 10-year OAT rate of return stabilized at around 3. Although both the European Central Bank and the Fed have hinted that after reducing borrowing costs to their highest levels in decades, interest rate hikes will be suspended in September, the Japanese central government has made its yield curve control policy more flexible and eased its defense of long-term interest rate ceilings, This indicates that it may abandon large-scale monetary stimulus. In terms of economic data, the French economy grew by 0.5% in the second quarter, which was the most significant growth in a year, easily exceeding the weak growth of 0.1% predicted by the market. At the same time, a CPI newsletter showed that France’s inflation rate slowed more than expected in July, falling to 4.3%, the lowest level since February 2022.

- GE: At the end of the turbulent month, the yield of Germany’s 10-year government bonds stabilized at around 2.5%, and the central banks of the United States, the Eurozone, and Japan provided further clues about their monetary policy prospects. Both the European Central Bank and the Federal Reserve have raised interest rates by 25 basis points to a multi-year high, but it has also increased the possibility of a suspension in September. On the other hand, the Bank of Japan kept interest rates at the lowest level in history, but adjusted the yield curve control policy to allow greater flexibility. This move is seen as a prelude to the eventual escape from large-scale monetary stimulus. In terms of economic data, preliminary data shows that the German economy stagnated in the second quarter and did not meet the market's expectation of 0.1% growth, while the inflation rate in July slowed slightly.

- JP: On Friday, Japan’s 10-year government bond yield soared to more than 0.5%, the highest level in nine years. Previously, the Bank of Japan maintained an ultra-low interest rate policy, but changed the wording to make the yield curve control policy more flexible. At the July meeting, the Bank of Japan kept the short-term interest rate target at -0.1%, and the 10-year government bond yield target remained at around 0. The central bank also maintained the guidance that allows the 10-year Treasury rate of return to move in any direction by 0.5%, but stated that these will be “reference ” instead of “ rigid restriction ”. This will be the first unexpected move since the governor of the Bank of Japan, Ueda, took office, which may stimulate the bet on further policy normalization. For several months, the market has been speculating that due to continued inflation and rising global interest rates, which have continued to put pressure on Japanese bond yields and currencies, the last major central bank that maintains a dove position may eventually succumb.

LEADING MARKET SECTORS:

- Strong sectors: Communication Services, Consumer Discretionary, Information Technology.

- Weak sectors: Real Estate, Utilities.

TOP CURRENCY & COMMODITIES MARKET DRIVERS:

Кey factors in the currency and commodities market are currently:

- EUR: The euro fell below US$1.1, reaching its lowest level since July 6, because investors expect the ECB’s austerity cycle to end. The European Central Bank's ninth consecutive interest rate increase has set borrowing costs at a new high for many years, and has eliminated the reference that the interest rate “ must be raised to ” to a restricted level. In addition, President Lagarde hinted at the September meeting that interest rate hikes may be suspended, at which time a new inflation forecast will be released. At the same time, investors also digested key GDP and CPI data across Europe. Spain and France continued to grow in the second quarter, and the German economy stagnated. In addition, the inflation rates in Germany and France slowed in July, while the inflation rates in Spain rose unexpectedly. Elsewhere, the Fed has also raised interest rates by 25 basis points, and investors are digesting Powell’s remarks about the economy's “ soft landing ” because the central bank no longer predicts economic recession.

- AUD: The depreciation of the Australian dollar exceeded US$0.67, setting a minimum level in more than two weeks, and facing new pressures from the expected US economic data, which supported the Fed’s further tightening policy. After the Bank of Japan took measures to make its yield curve control policy more flexible, the Australian dollar also fell sharply, triggering speculation about further policy normalization. Domestically, the latest data shows that Australia’s retail sales declined unexpectedly in June, while producer inflation slowed to a low of more than two years in the second quarter. The increase in the country’s consumer price index in the second quarter was also lower than expected, which eased the pressure of the Australian Reserve Bank to suspend interest rate hikes earlier in July to assess the impact of previous interest rate hikes on the economy and further tighten policies.

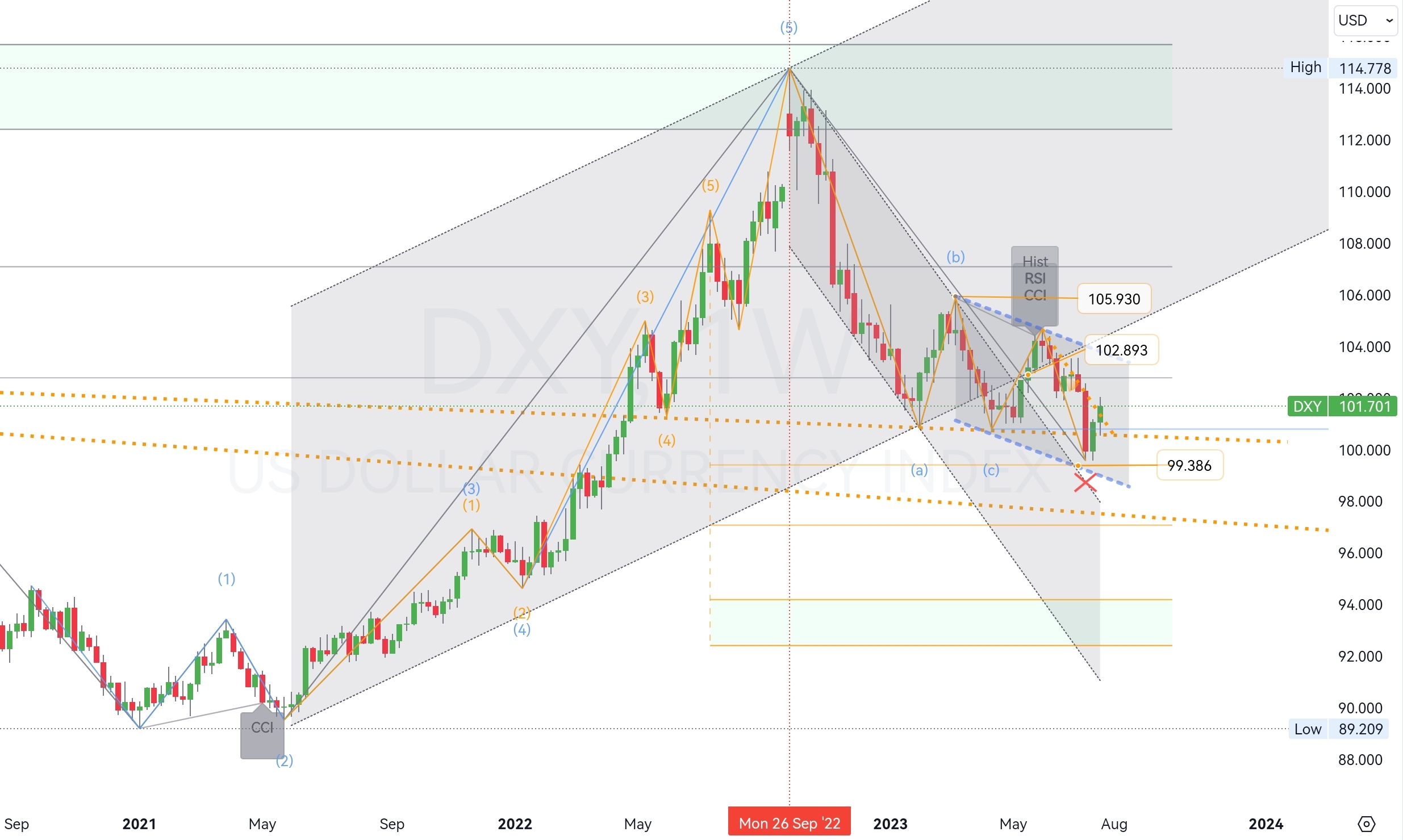

CHART OF THE DAY:

The dollar index rose to 102 on Friday and will rise for the second consecutive week, thanks to stronger than expected US economic data that support the Fed’s reasons for maintaining strict monetary policy restrictions. The latest data shows that the US economy grew by 2.4% in the second quarter, exceeding the market's expected 1.8%. Durable goods orders surged, and the number of people applying for unemployment benefits fell to a few months low. On Wednesday, the Fed implemented 25 basis points for interest rate hikes that are generally expected, and Fed Chairman Jerome Powell opened the door for further interest rate hikes. However, he clarified that when the central bank decides to raise interest rates further, it will adopt the method of “ relying on data ”. The US dollar has generally strengthened, but because the Bank of Japan has maintained its super loose monetary policy, the US dollar has fluctuated significantly against the Japanese yen.

Long-term Channels Trading Strategy for: (US dollar index).Time frame (D1). The primary resistance is around (102.893). The primary support is around (99.386). Therefore, the next most probable price movement is a (consolidation) trend. (*see all other details on the chart).

Demo account

The Blue Suisse Trading Account with virtual funds in a risk-free environment

Demo accountLive account

The Blue Suisse Trading Account in our transparent live model environment

Open an Account