Fed raises rates 25 bps, as widely expected - Wall Street Ends Mixed after Fed Decision; 10-Year Treasuries Gain Momentum Following Fed

GLOBAL CAPITAL MARKETS OVERVIEW, ANALYSIS & FORECASTS:

Author: Dr. Alexander APOSTOLOV (researcher at Economic Research Institute at BAS)

The DAX in Germany and the Stoxx 600 were both down 0.5% on Wednesday because U.S. officials were going to raise interest rates by 25 basis points. Even though Deutsche Bank and Unicredit made more money than expected, the Stoxx bank index went down by 0.3%. Also, Spain's Santander Bank said its net profit went up by 14%, and Italy's UniCredit said it would raise its net profit and shareholder reward goals for the year. The luxury sector also went down. Shares of LVHM fell by 5.2% after the company said that sales in the U.S. had slowed down more than expected. Rolls-Royce, on the other hand, raised its operating profit estimate for the whole year, which caused its shares to rise by 20%. The CAC 40 average fell 1.4% on Wednesday to close at 7,315 points, which was worse than its European peers. After its quarterly report, LVMH shares fell 5%. France's biggest company, which makes up 12.7% of the CAC 40, beat experts' profit predictions for the second quarter, but sales in North America were lower than expected. This made people worry that the recent luxury boom might be coming to an end. The result hurt other stocks in the Paris luxury market, and Hermès shares went down by 2.4%. Orange fell more than 2% after the news came out. On the other hand, buyers liked Stellantis's report, which caused shares to go up by 2.7%. The FTSE MIB kept its early gains and closed just above the flatline at 28,980 on Wednesday. This was enough to extend yesterday's 15-year highs as markets looked at the latest corporate results before the Fed's decision on interest rates. The Milan average did better than other European indexes because Italian big banks did well. For example, UniCredit inched up after reporting better-than-expected profits for the second quarter. Other big banks also did well because of the results. BPER Banca went up 3%, and Banca MPS went up 2%. Stellantis, meanwhile, went up more than 2% thanks to good earnings. On the other hand, after the earnings report, shares of Moncler fell by almost 2%.

On Wednesday, U.S. stocks went up and down by small amounts as traders continued to look at corporate reports and avoided making big bets before the Federal Open Market Committee made a decision later in the day. Microsoft's stock dropped by almost 3% after the company gave disappointing guidance for its quarterly revenue, even though its earnings and sales beat expectations. Snap's stock dropped more than 19% on Tuesday, when the company gave bad projections for the third quarter. Even though their quarterly results were good, Coca-Cola and AT&T both cut their pre-market gains to trade around the flat lines. Alphabet shares, on the other hand, went up more than 5% after the market closed on Tuesday because the company reported better-than-expected earnings and sales. In other news, shares of Boeing went up almost 5% after the company said that higher deliveries of commercial airplanes helped it beat earnings and revenue expectations. After the market closes, Meta, Chipotle, and Mattel will all report.

As investors thought about a rate hike from the Federal Reserve of 25 basis points and a report from the Bank of England, the Canada S&P/TSX Composite fell to 20,520 on Wednesday. This continued a slight drop from the previous session. In the summary, the most recent company earnings were looked at. The biggest losers of the day were energy companies. Both Suncor and Cenovus Energy fell more than 0.5 percent. Also, shares of Canadian National Railway went down after the company said that its second-quarter net income was down 12% from the same time last year. Rogers Communications, on the other hand, went up more than 3% after it raised its annual profit forecast, even though it missed earnings expectations.

The MOEX Russia index, which is based on the ruble, fell 0.2% to close at 2,970 on Wednesday. This was a drop from the previous session, when it hit a 17-month high, as investors continued to think about product prices, geopolitical tensions, and how the ruble affects Russian companies. Changes in how things look. Most of the people who lost money were in the metals and finance industries. Traders took advantage of yesterday's rise to make quick money. Gazprom shares stayed the same at the end of the day, even though gas prices went up again, while Novatek shares went up more than 1% because the company's strong results made up for the fact that its Yamal LNG plant was shut down. Severstal, on the other hand, was the biggest loser among blue chips, with a 1.6 percent drop.

The FTSE 100 hovered around a flat line at 7,690 on Monday, extending its six-session winning streak to a two-month high, as investors digested a batch of corporate earnings ahead of the Federal Reserve's after-hours decision on interest rates. Rolls-Royce shares soared nearly 20 percent after its first-half profit was well above analysts' expectations, with a profit more than double expectations of 680 million pounds. At the other end of the spectrum, shares in Lloyds Bank tumbled 3 per cent and led losses among the blue-chip index after announcing acceptance of bad loan charges dragged its results below analysts' forecasts, while NatWest fell 2.5% after its chief executive resigned amid troubles following the collapse of former UKIP member Nigel Farage. Also in the red, shares in Rio Tinto fell 2% after the company reported a 25% plunge in earnings as copper and aluminum prices and production fell.

Australia S&P/ASX 200 rose 0.2% to above 7,350 on Wednesday, its second straight session of gains, as investors looked ahead to domestic inflation data that could influence the Reserve Bank of Australia's next policy decision. Still, investors remained cautious ahead of expectations that the Federal Reserve will raise interest rates later in the global day. Heavyweight iron ore miners led gains on China's stimulus promises, with BHP Billiton Group (2.4%), Rio Tinto Group (1.5%) and Fortiscu Metals (0.7%) gaining. Other commodity-linked stocks also rose, including Newcrest Mining (1.7%), Mineral Resources (1.9%), South32 (0.7%), Whitehaven Coal (0.5%) and Beaches Energy (3.6%).

New Zealand stocks rose 20.87 points, or 0.17%, to close at 11954.73 on Wednesday, diverging from the previous session's notable losses and reflecting U.S. stocks closing higher on Tuesday ahead of the Federal Reserve's interest rate decision later in the day. Meanwhile, Prime Minister Hipkins met Australian Prime Minister Anthony Albanese in Wellington today and they discussed a number of issues including trade, the economy and defence. Chinese state media said the Politburo would ramp up policy support for a flagging economy by boosting domestic demand, boosting confidence and guarding against risks. Financial stocks rose more than 1% after a report that headline inflation in Australia slowed more than expected in the second quarter. There were also victories in business services, retail trade and manufacturing. Among individual stocks, Briscoe Group was up 4.8%, followed by Winton Land Ltd (4.7%), PricewaterhouseCoopers Wrightson Ltd (3.5%), Teraija Group Ltd (1.4%) and Genesis Energy Ltd. (1.1%).

On Wednesday, the Shanghai Composite fell 0.2 percent to close at around 3,225 points, while the Shenzhen Composite fell 0.5 percent to close at 10,970, giving back some of the previous session's gains as caution prevailed ahead of an expected rate hike from the Federal Reserve. investor sentiment. Meanwhile, mainland stocks rose more than 2 percent on Tuesday after China's Politburo pledged to boost policy support for a flagging economy, with a focus on boosting domestic demand and helping a sluggish property market. On Wednesday, high-growth technology and consumer-related stocks led the decline, with Zhongji Innovation (-1.9%), Oriental Money Information (-1.7%), Foxconn Industrial (-1.5%), Inspur Electronics (-3.1%), Chongqing Changan ( -2.8%) and Wuliangye Yibin (-0.8%) fell sharply.

Hong Kong shares fell 156 points, or 0.8%, to 19,279 in early trade on Wednesday, bucking strong gains the previous day, with traders cautious ahead of the Federal Reserve's interest rate decision later in the day. The central bank is expected to raise borrowing costs by 25 basis points to a target range of 5.25%-5.5%, the 11th hike since March 2022. Investors continued to wait warily for more support for China's faltering economy, amid lingering concerns over local government debt and a housing crisis. Meanwhile, Beijing named a new central bank governor on Tuesday, ahead of the retirement of Yi Gang, the outgoing head of the central bank. The Chinese government also fired its foreign minister after he disappeared from public view in June after seven months in office. The losses were broad-based, led by technology, consumer and financial stocks. Country Garden Services fell sharply (-6.1%), along with Zhongsheng Group (-4.9%), PetroChina (-3.5%), ENN Energy (-3.1%) and JD.com (-2.2%).

Nikkei 225 fell 0.55% to around 32,500 and the Topix fell 0.5% to 2,274, with Japanese stocks struggling to gain traction as investors braced for a U.S. Federal Reserve rate hike later in the global day expectations. The Bank of Japan, which is also due to decide on monetary policy on Friday, is widely expected to maintain ultra-loose monetary conditions. Nearly all sectors were down, with index heavyweights like Kawasaki Kisen (-2.4%), Toyota Motor (-1.2%), Nippon Telephone (-1.7%), Nissan (-2.5%) and NEC (-1.4%) The decline was significant. Meanwhile, Tokyo Electron (1%), SoftBank Group (0.4%) and Renesas Electronics (1.5%) gained.

India BSE Sensex rose 350 points to close at 66,700 on Wednesday, rebounding from a three-day losing streak and moving closer to an all-time high hit last week, as the market digested a batch of corporate earnings and braced for the Federal Reserve's interest rate decision ready. Reliance Industries extended its volatile momentum and posted one of the session's biggest gains with a 1.6 percent gain, boosted by reports that Qatar's sovereign fund was in talks with the company's retail arm. Also, ITC snapped a losing streak with a 2% gain, as investors took advantage of lower valuations following the announced spin-off of its hotel business. Meanwhile, shares of Larsen & Toubro surged 3.5% after the company reported better-than-expected quarterly results and announced its intention to buy back shares.

REVIEWING THE LAST ECONOMIC DATA:

Reviewing the latest economic news, the most critical data is:

- US: U.S. new single-family home sales fell 2.5% to a seasonally adjusted annualized rate of 697,000 in June 2023, compared with a 15-month high of 715,000 in May, below the market consensus of 725,000 sets. Sales in the West fell 11.9 percent to 143,000 vehicles, while sales in the Midwest fell 28.4 percent to 53,000 vehicles. Sales in the South, on the other hand, rose 4.3 percent to 460,000 vehicles, while sales in the Northeast surged 20.6 percent to 41,000 vehicles. The median new home sale price was $415,400, compared with an average of $494,700, compared with $432,700 and $472,000, respectively, a year ago. There were 432,000 homes left for sale at the end of June, equivalent to a 7.4-month supply at the current sales pace.

- US: The revised data showed that U.S. building permits fell 3.7% to a seasonally adjusted annual rate of 1.441 million in June 2023, down from a seven-month high of 1.496 million recorded in May. Volatile multidepartmental approvals fell 11.0% to 517,000, the lowest level since October 2020, while single-family approvals increased 2.4% to a 12-month high of 924,000. Permits fell in the South (-2.6% to 801,000), the West (-3.4% to 338,000), and the Northeast (-22.6% to 106,000), but the Midwest (4.8% to 196,000) rose.

- US: U.S. mortgage applications fell 1.8% for the week ended July 21, 2023, the first decline in three weeks, according to the Mortgage Bankers Association. Applications to refinance home loans fell 0.4 percent, and applications to buy a home fell 2.5 percent, due in part to a 10 percent drop in FHA applications. "The decline in FHA homebuyer applications led to an increase in the overall average homebuyer loan size to $432,700, the highest level since the end of May this year," said MBA economist Joel Kan. Meanwhile, the average contract rate for 30-year fixed-rate mortgages with qualifying loan balances ($726,200 or less) remained unchanged at 6.87%.

- US: The revised data showed that U.S. building permits fell 3.7% to a seasonally adjusted annual rate of 1.441 million in June 2023, down from a seven-month high of 1.496 million recorded in May. Volatile multidepartmental approvals fell 11.0% to 517,000, the lowest level since October 2020, while single-family approvals increased 2.4% to a 12-month high of 924,000. Permits fell in the South (-2.6% to 801,000), the West (-3.4% to 338,000) and the Northeast (-22.6% to 106,000), but the Midwest (4.8% to 196,000) rose.

- US: The average U.S. contract rate for 30-year fixed-rate mortgages with eligible loan balances ($726,200 or less) was unchanged at 6.87 percent for the week ended July 21, 2023, near the highest level since November, compared with last year It was 5.74% in the same period. Meanwhile, the average contract rate on 30-year fixed-rate mortgages with large loan balances (more than $726,200) rose to 6.9 percent from 6.89 percent. U.S. Treasury yields were little changed this week as traders awaited the Federal Reserve's July rate decision.

- US: U.S. mortgage applications fell 1.8% for the week ended July 21, 2023, the first decline in three weeks, according to the Mortgage Bankers Association. Applications to refinance home loans fell 0.4 percent and applications to buy a home fell 2.5 percent, due in part to a 10 percent drop in FHA applications. "The decline in FHA homebuyer applications led to an increase in the overall average homebuyer loan size to $432,700, the highest level since the end of May this year," said MBA economist Joel Kan. Meanwhile, the average contract rate for 30-year fixed-rate mortgages with qualifying loan balances ($726,200 or less) remained unchanged at 6.87%.

- FR: In June 2023, the number of people registered as unemployed in mainland France fell by 111,000 from the previous month to 2.792 million, close to the 12-year low of 2.789 million in March, again indicating that despite Frankfurt's series of aggressive rate hike measures, but the European labor market remains tight. Unemployment fell across all age groups, with those aged 25 to 49 down 6.5 million to 1.639 million, and those under 25 down 5.7 million to 3.711 million. Meanwhile, the unemployment rate for those over 50 edged down by 1,000 to 782,700. Compared with the same month of the previous year, the number of registered unemployed persons decreased by 151,800.

- HK: Hongkong Hang Seng Index fell 69.26 points, or 0.36%, to close at 19365.14 points. Earlier, the International Monetary Fund said China's economic recovery was losing steam due to a slump in the housing sector, weak exports and record high youth unemployment. Traders were also frustrated after U.S. Secretary of State Anthony Blinken spoke of China's "problematic behavior" during a visit to the Pacific island nation of Tonga. Globally, U.S. futures fell, with traders all but certain the Fed would opt for a 25 basis point rate hike later in the day. Still, the index pared early losses as Beijing vowed to step up efforts to boost the economy ahead of the Politburo meeting. On the corporate front, Jack Ma-backed Ant Group plans to restructure and divest some non-core businesses of its finance-related businesses. Technology, consumer, and financial stocks weighed on the index, with China Longyuan Power (-2.9%), CITIC (-2%), JD.com (-1.7%), and Tencent Holdings (Tencent Helds) among the worst losers. (-1.2%).

- EU: Eurozone bank lending to households grew by 1.7% year-on-year to €6.87 trillion in June 2023, the slowest growth rate since May 2016, as the ECB implemented unprecedented tightening in recent months , leading to a continued slowdown in credit demand. Lending to corporations, on the other hand, increased by 3.0%, but this was still the slowest growth rate since November 2021. Growth in credit to the entire private sector, which includes households and nonfinancial businesses, slowed to 2.0 percent in June, the slowest pace since August 2016.

- SW: Sweden's trade surplus narrowed to SEK 1.1 billion in June 2023 from SEK 1.7 billion a year earlier, as exports and imports fell on weaker global demand. Exports fell 2.7 percent, with sales to non-EU countries and the EU down 5.7 percent and 0.2 percent, respectively. Meanwhile, a decline in non-EU purchases (-11.8%) caused imports to fall by 2.4%. On the other hand, imports from the European Union rose by 3.8%. On a seasonally adjusted basis, the trade deficit widened to SEK 1 billion in June from SEK 500 million in May. Considering that in the first half of this year, Sweden had a trade surplus of SEK 18.9 billion compared to a deficit of SEK 3.1 billion in the same period in 2022, exports rose by 7% and imports by 5%.

- AU: Australia's monthly consumer price index (CPI) rose by 5.4% in June 2023, easing from a downward revision of 5.5% in May 2021, in line with consensus. It was the lowest annual rate of inflation since February 2022, driven largely by slower growth in housing and food prices amid falling transport prices. Declining housing costs (7.4% in May vs. 8.3% in May), namely new housing (6.6% vs. 8.3% in May); food and non-alcoholic beverages (7.0% vs. 7.9%); communication (0.6% vs. 1.1% ); education (5.2% vs. 5.5%). Also, transportation prices fell (-0.9% vs. 0.8% in May) and auto fuel prices (-10.6% vs. Strongest annual decline. The monthly CPI measure, which excludes volatile fruits and vegetables and fuel, fell to 6.1% in June from 6.4% in May. Inflation remains well above the Reserve Bank of Australia 2-3 % of the target range.

- AU: Australia's annual inflation rate fell from 7.0% in the first quarter to 6.0% in the second quarter of 2023, below the market forecast of 6.2%. Inflation eased for the second consecutive quarter and was the lowest since the third quarter of 2022, with food prices rising the least in a year (7.5% vs. 8.0% in the fourth quarter). Additionally, the costs of transportation (1.9% vs. 4.3%), housing (8.1% vs. 9.8%), furniture (6.3% vs. 6.7%), health (4.9% vs. 5.3%) and entertainment (6.8% vs. 8.6%) slowed . Meanwhile, inflation accelerated in alcohol and tobacco (4.7% vs. 4.4%) and insurance and financial services (8.5% vs. 6.5%). On a quarterly basis, consumer prices rose 0.8 percent, the weakest in seven quarters, as travel to Southeast Asia and New Zealand fell as prices rose during the Christmas and school holidays before falling. Meanwhile, the Reserve Bank of Australia's adjusted average CPI rose 5.9% year-on-year, the lowest in four quarters, slightly below the consensus estimate of 6.0%, but still above the central bank's 2-3% target. The index rose 1.0% quarter-on-quarter.

LOOKING AHEAD:

Today, investors should watch out for the following important data:

- USD: Advance GDP q/q, Unemployment Claims, Advance GDP Price Index q/q, Core Durable,Goods Orders m/m, Durable Goods Orders m/m, Goods Trade Balance, Prelim, Wholesale Inventories m/m, Pending Home Sales m/m, and Natural Gas Storage.

- AUD: Import Prices q/q.

- EUR: German GfK Consumer Climate, Spanish Unemployment Rate, EU Economic Forecasts, CBI Realized Sales-9 -9, Italian 10-y Bond Auction, Main Refinancing Rate, Monetary Policy Statement, and ECB Press Conference.

KEY Equity & BOND MARKET DRIVERS:

Кey factors in the stock and bond market are currently:

- US: U.S. stock futures were flat on Wednesday as traders digested another batch of corporate earnings and avoided big bets ahead of a Federal Open Market Committee decision later in the day. Microsoft shares fell about 3% in premarket trading after the company's quarterly revenue guidance disappointed, even as its earnings and revenue topped estimates. Snap shares tumbled more than 17% after the company reported weak guidance for the third quarter on Tuesday. Alphabet shares, on the other hand, surged more than 6% in pre-market trading after reporting upbeat earnings and revenue after the close on Tuesday. Elsewhere, Coca-Cola Co rose 1.6 percent after it raised its annual revenue and profit forecast, while AT&T rose more than 2 percent as revenue topped estimates. Boeing Co also rose more than 3 percent after the program maker reported that higher deliveries of commercial planes helped its earnings and revenue top expectations. Meta, Chipotle and Mattel will report after the close.

- US: The average U.S. contract rate for 30-year fixed-rate mortgages with eligible loan balances ($726,200 or less) was unchanged at 6.87 percent for the week ended July 21, 2023, near the highest level since November, compared with last year It was 5.74% in the same period. Meanwhile, the average contract rate on 30-year fixed-rate mortgages with large loan balances (more than $726,200) rose to 6.9 percent from 6.89 percent. U.S. Treasury yields were little changed this week as traders awaited the Federal Reserve's July rate decision.

- US: The Fed is widely expected to raise the target range for the Fed funds rate by 25 basis points to 5.25%-5.5% in July 2023, bringing borrowing costs to their highest level since January 2001 and resumed after a pause in June Reduce Policy. Investors will be watching for any clues about the Fed's future plans, particularly whether it has raised interest rates or still intends to increase borrowing costs further. In June, most officials expected the Fed funds rate to hit 5.6% by the end of the year, implying at least two more hikes. Headline inflation slowed sharply to 3% in June, down from 9.1% a year earlier but still above the 2% target. The labor market has cooled but remains strong, and the economy appears to be avoiding a deep recession.

LEADING MARKET SECTORS:

- Strong sectors: Communication Services, Industrials, Financials, Real Estate, Utilities.

- Weak sectors: Information Technology, Materials, Consumer Discretionary, Energy.

TOP CURRENCY & COMMODITIES MARKET DRIVERS:

Кey factors in the currency and commodities market are currently:

- OIL: U.S. crude oil inventories fell by 600,000 barrels in the week ended July 21, below market expectations of 2.348 million barrels. Elsewhere, crude oil inventories at the Cushing, Oklahoma, delivery hub fell by 2.609 million barrels and gasoline inventories fell by 786,000 barrels, compared with forecasts for a drop of 1.678 million barrels. Distillate stockpiles, which include diesel and heating oil, fell by 245,000 barrels, compared with expectations for a decline of 301,000 barrels.

- NZD: The New Zealand dollar inched down 0.2% to $0.6209 on Wednesday after strengthening in the previous two sessions, as investors remained cautious ahead of the Federal Reserve's key interest rate decision, which is widely expected to raise rates by 25 basis points later in the day . In Australia, the latest data showed that annual inflation fell to 6.0% in the second quarter from 7.0% in the first quarter, the lowest since the third quarter of 2022 and below market expectations of 6.2%. The Reserve Bank of Australia kept the cash rate at 4.1% at its July meeting. Meanwhile, data last week showed New Zealand's inflation slowed to 6% in the second quarter of 2023, but remained outside the central bank's 1% to 3% target range. The Reserve Bank of New Zealand has been wary of the outlook for domestic inflation, raising borrowing costs by 525 basis points to a 14-year high of 5.5% since 2021 last year. Meanwhile, the dollar was steady around 101.1 ahead of the Federal Reserve's monetary policy decision later today.

- USD: The U.S. dollar index held steady above 101 on Wednesday, holding on to recent gains as investors braced for a key Fed policy decision. The Fed is widely expected to raise interest rates by 25 basis points, but doubts remain about whether the central bank will stop tightening or raise rates further after July. Meanwhile, the U.S. economy continued to show resilience, with consumer confidence jumping to a two-year high in July amid a strong labor market and easing U.S. inflation. Elsewhere, the European Central Bank is also due to raise borrowing costs by another 25 percentage points on Thursday, while the Bank of Japan is expected to maintain its ultra-loose monetary policy on Friday. The greenback remained sideways against the euro, sterling and yen, while it rose sharply against Pacific currencies after weaker-than-expected Australian inflation data.

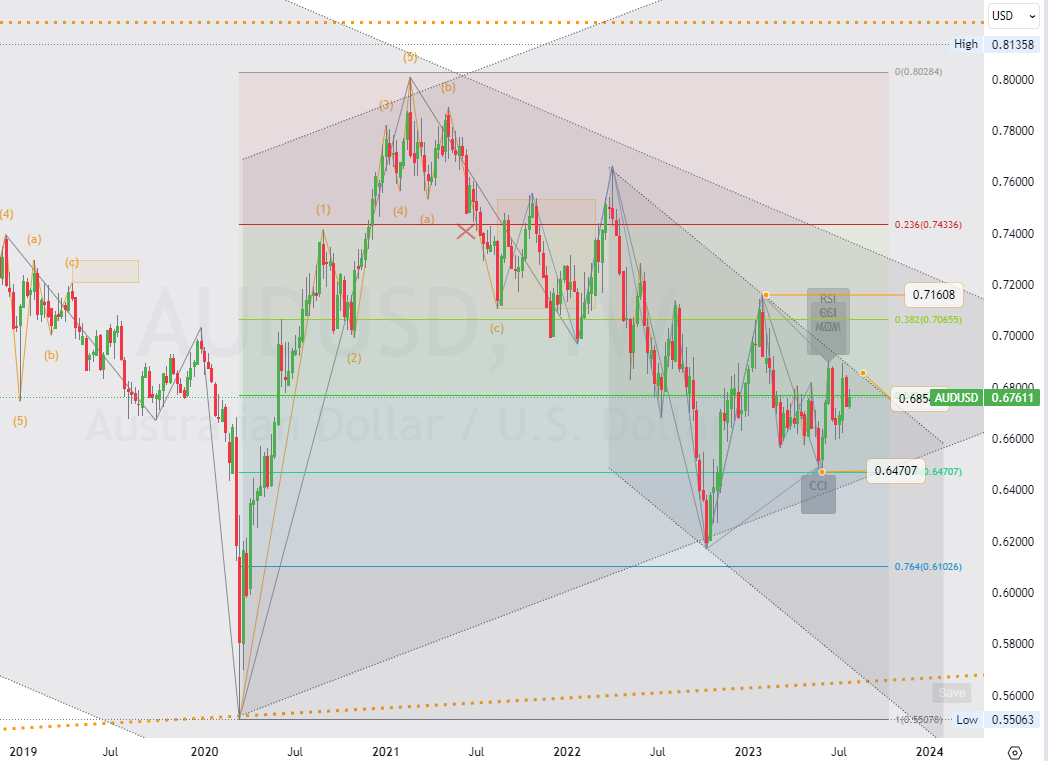

CHART OF THE DAY:

The Australian dollar fell to around $0.675 after domestic inflation slowed more than expected in the second quarter, easing pressure on the Reserve Bank of Australia to tighten policy further. Data show that in the second quarter of 2023, the Australian consumer price index rose by 6% year-on-year, which was lower than the 7% increase in the first quarter and lower than the market expectation of 6.2%. Earlier this month, the Reserve Bank of Australia decided to hold interest rates steady to assess the impact of previous rate hikes on the economy. However, the central bank warned that, based on incoming data, further tightening may still be needed to bring down persistent inflation. The Australian dollar also fell ahead of rate hikes by the Federal Reserve and the European Central Bank this week.

Long-term Channels Trading Strategy for: (AUDUSD).Time frame (D1). The primary resistanceis around (0.68500). The primary support is around (0.64707). Therefore, the next most probable price movement is a (consolidation) trend. (*see all other details on the chart).

Demo account

The Blue Suisse Trading Account with virtual funds in a risk-free environment

Demo accountLive account

The Blue Suisse Trading Account in our transparent live model environment

Open an Account