US indexes close at record highs amid mega-cap strength - lingering growth concerns

• GLOBAL CAPITAL MARKETS OVERVIEW:

European stock markets closed lower on Thursday, breaking the six-day record gains driven by strong corporate earnings. Commodity-related stocks were affected by the decline in oil and metal prices. The pan-European STOXX 600 index fell 0.5%, the first day of decline in seven trading days, of which energy stocks and mining stocks fell by about 2%. Oil stocks were hit by the sharp drop in crude oil prices, as the market worried about oversupply and China's possible release of strategic fuel reserves. In contrast, copper prices fell to their lowest level in more than a month, causing the share prices of mining companies to fall. European stock markets opened steadily. The German DAX index, the Swiss SMI index, and the French CAC 40 index all hit record highs during the session but gave up gains at the close. The stronger-than-expected earnings season and loose monetary policy helped the STOXX 600 index to hit new highs recently. However, uncertainty about the resurgence of the new crown epidemic and the degree of lockdown required to contain the spread of the virus is spreading. The latest data shows that the third-quarter profit of STOXX 600 index constituent companies is expected to increase by 60.4% from the same period last year to 103.6 billion euros (117.2 billion US dollars), which is lower than last week's forecast of 60.7%. The German DAX index closed down 0.18%, the French CAC-40 index closed down 0.21%, and the British FTSE index closed down 0.48%. The US stock market S&P 500 Index and Nasdaq Index rose slightly on Thursday, setting a new closing high, as investors focused on the optimistic financial reports of retail and technology companies, surpassing the Federal Reserve (FED) The influence of policymakers' hawkish comments on inflation. In contrast, the Dow continued to lag and fell for the third time this week, dragged down by the sharp drop in Cisco Systems. Inflation is still the focus of investors' attention. The President of the Federal Reserve Bank of New York, Williams, said that inflation in the United States has become more widespread and expectations for future price increases are rising. Policymakers will pay close attention to this trend. The S&P 500 and Nasdaq rebounded late in the morning, with the latter being supported by Nvidia's (Huida/Nvidia) surge. The chip maker's stock price rose 8.2% after the company announced quarterly results that exceeded expectations and predicted strong fourth-quarter revenue. The stock's performance helped the Philadelphia Semiconductor Index rise 1.8%, setting its second closing record in three trading days. The S&P consumer discretionary sector led the gains, rising 1.5%, and retailers such as Macy's and Kohl's had a strong performance. Wal-Mart and Target also announced optimistic results earlier this week. Macy’s surged 21.1%, the largest one-day percentage increase decades after the company raised its annual profit forecast and hinted at plans to spin off its e-commerce division. Cole Department Store soared 10.6% after raising its financial forecast. The S&P 500 retail stock index surged 2.8%, breaking a record high on the third trading day of this week. Investors believe that the sector’s financial report shows that strong consumer demand still exists despite rising inflation. Retailers expect A strong holiday shopping season will usher in. However, concerns about further rising price pressures and the uncertainty of the Fed’s tightening policy plans have stalled the US stock market this week. The Dow Jones Industrial Average fell 60.1 points, or 0.17%, to 35,870.95 points; the S&P 500 Index rose 15.87 points, or 0.34%, to 4,704.54 points; the Nasdaq Index rose 72.14 points, or 0.45%, to 15,993.71 points. The Dow did not perform as well as other stock indexes. The network equipment maker Cisco's stock price plunged 5.5% after the company expected its revenue this quarter was lower than expected due to supply chain shortages and delays. Visa Inc fell for the second day in a row, down 0.8%, the lowest closing level since February 3, after news that Amazon may stop accepting Visa credit cards issued in the UK. 40 S&P 500 index stocks hit 52-week highs, nine stocks hit new lows, 103 Nasdaq index stocks hit new highs, and 407 hit new lows. Approximately 11.09 billion shares were traded on US stock exchanges, and the average daily trading volume over the past 20 trading days was 11.14 billion shares. Japanese stocks fell on Thursday, led by cyclical stocks and oil companies. Still, after media reports that Prime Minister Fumio Kishida's economic stimulus plan would be larger than initially expected, the stock market narrowed its decline. The Nikkei index closed down 0.30% to 29,598.66 points but recovered largely from the decline after the Nikkei report was announced. According to the report, Japan’s economic stimulus plan may include record fiscal expenditures of approximately 55.7 trillion yen due to huge cash distributions. This is far higher than market expectations of 30 to 40 trillion yen, but analysts cautioned that many investors need to see the government's planned expenditure items. The Topix Stock Index fell 0.14% to 2,035.52 points. The Nikkei reported that the cabinet would formally approve Kishida's economic stimulus plan on Friday. Before disclosing the Nikkei Shimbun’s report, the Japanese market’s tone was weak as the US stock market closed overnight due to concerns that the Federal Reserve (Fed/FED) might have to raise interest rates more aggressively in the future to curb inflation. Cycling stocks such as shipping and steel manufacturing were among the top decliners. The East Securities Maritime Transport Index fell 4%, of which Kawasaki Motors fell 7.2%, and Japan Post fell 4.4%. Steel manufacturing stocks fell 1%, and industry leader Japan Steel fell 1.9%. Petroleum-related stocks also suffered setbacks, as crude oil prices fell after Reuters reported that the United States required China and Japan to consider releasing crude oil reserves to respond to high oil prices coordinately. International oil development Inpex fell 7.1%, and Idemitsu Kosan fell 3.6%. The Moscow Exchange index closed 46 below the all-time high of 4,292.68 points. The ruble index started on Thursday below the previous day's closing levels but recovered quickly and traded in the 4150-4140 p range for most of the day (consolidation in the area of Wednesday highs), finding no drivers for a confident continuation of positive dynamics. The external background did not offer support for Russian stocks. Minor sentiment reigned on stock exchanges in Europe against the backdrop of renewed restrictions on unvaccinated citizens in several countries. At the same time, Brent oil prices are attacking support at 80 / bbl on fears of pressure from possible supplies from the US strategic reserve for the second day in a row. In general, the resumption of lockdowns raises concerns about the pace of recovery in demand. As a result, closer to the start of American trading, selling pressure on the Russian stock market began to prevail. The Moscow Exchange index fell to its worst levels since October 1, and the technical picture hints at the potential for testing the 100-day moving average line with the current value of 4002 points. This paves the way for an even more significant market weakness. One sectoral index rose, and nine declined. The oil and gas sector fell 2.6% and became the outsider of the day (-1.6% in November). The IT sector grew by 0.2% and became the day's leader (+ 2.3% in November). Of the 43 shares of the Moscow Exchange index, 17 rose in price, and 26 lost in value. On Friday, Taiwan's stock market closed a slight decline, discontinuing the “five-year red,” and the week closed up 1.72%. Analysts said that Taiwan stocks once rushed to close to the 18,000 round mark after opening high. However, they were "close to the close" and pulled back to order at the previous high pressure; there are no bad news and no failures in the short-term, and the market will be firm, and there will be Opportunity to break through the ten thousand mark and to challenge the historical high point. Taiwan's weighted stock price index closed down 0.11% to 17,818.31 points; today's initial transaction value was 397.165 billion Taiwan dollars, revised to 401.078 billion on the trading day.

• REVIEWING ECONOMIC DATA:

Looking at the last economic data:

- US: The US Department of Labor announced on November 18 that after seasonal adjustments, the number of first-time jobless claims for the week ending November 11 decreased by 1,000 from the previous week’s revised value (up to 2,000) to 268,000, continuing to hit 2020. It was the lowest since March 14, 2015 (256,000 people), the seventh consecutive week of decrease. Still, it was slightly lower than the 261,000 economists' average estimate than the 2019 average of 218,000.

As of the week of November 11, the 4-week moving average of the number of people who applied for unemployment benefits for the first time decreased by 5,750 to 272,750 from the revised value of the previous week, which was also the lowest since the week of March 14, 2020 (225,500). As of the week ending November 6, after seasonal adjustments, the number of consecutive applications for unemployment benefits decreased by 129,000 from the previous week's revised value to 2,080,000, a record low since March 14, 2020 (1,770,000). The 4-week moving average of the number of consecutive applications for unemployment benefits in the current week decreased by 100,000 to 2,157,250 from the revised value of the previous week, the lowest since the week of March 21, 2020 (2,071,750). As of the week ending November 6, the seasonally adjusted insured unemployment rate fell by 0.1 percentage point from the previous week to 1.5%. As of the week ending November 6, Kentucky (+6,716), Ohio (+3,846), Tennessee (+2,411), Illinois (+1,893), and Michigan increased the number of initial unemployment benefits. States (+1,564); California (-4,222), the District of Columbia (-1,794), and Louisiana (-1,028) have decreased more. As of the week ending October 30, the areas with higher insurance unemployment rates include the District of Columbia (3.5%), Puerto Rico (3.5%), California (3.0%), Alaska (2.5%), Hawaii (2.5%), Illinois States (2.5%), New Jersey (2.4%), Nevada (2.2%), Virgin Islands (2.2%), Oregon (1.9%). In the United States, non-agricultural employment increased by 531,000 in October, which was better than market expectations for an increase of 450,000. The unemployment rate fell to 4.6%, a record low in 20 months. The number of new non-agricultural employment in August was revised up from 366,000 to 483,000; the number of new non-agricultural employment in September was also revised up from 194,000 to 312,000. As the epidemic slows, more working people are returning to the workplace. The US Department of Labor reports that employment in the leisure and hospitality industry, professional and business services, manufacturing, transportation, and warehousing has increased significantly. However, compared with the level before the epidemic, the number of employed people in the United States still fell by more than 4 million.

- US: US President Biden confirmed on Thursday that the United States is considering a diplomatic boycott of the Beijing Winter Olympics, a move to protest China's human rights record, including what the United States says is the genocide of Muslim minorities. When Biden held talks with Canadian Prime Minister Trudeau, when asked whether the United States would consider a diplomatic boycott of the Beijing Winter Olympics, Biden replied: "This is something we are considering." A diplomatic boycott will mean that US officials will not attend the opening ceremony of the Beijing Winter Olympics in February. The US decision not to send a diplomatic mission will be an accusation against Chinese President Xi Jinping. Just a few days ago, Xi Jinping and Biden held a video summit to ease the tension between the two countries. This is the first extensive talk between the two sides since Biden took office in January. Activists from both parties and some members of Congress have been urging the Biden administration to boycott the event diplomatically. The US government accuses China of genocide Muslims in Xinjiang. Beijing denies this accusation. On Thursday, White House spokesman Psaki said that the United States is considering a diplomatic boycott of the Beijing Winter Olympics out of concerns about the human rights situation in Xinjiang and has nothing to do with the video summit between Biden and Xi Jinping.

- JP: Some of the world's largest crude oil buyers said on Thursday that they are considering using strategic oil reserves after multiple sources told Reuters that the United States requires coordinated action to cool global energy prices. Since Wednesday, oil prices have fallen by about 4%, and this shock therapy seems to have worked. According to several people familiar with the matter, the Biden administration of the United States has asked the world's largest oil buyers, including China, India, and Japan, to consider releasing crude oil reserves. The United States made this unusual request when economic activities rebounded from the trough at the epidemic's beginning, pushing up gasoline prices and other consumer costs. President Biden was busy coping with the political pressure that this brought. After the US government asked some major crude oil buyers to release natural oil reserves, US crude oil and Brent crude oil futures fell. U.S. President Biden U.S. asks major crude oil buyers such as China, India, and Japan to consider releasing natural oil reserves. The yellow line represents Brent crude oil futures, the blue line represents US crude oil futures, and the white stripe represents US gasoline futures. The move by the United States also reflects the disappointment of the United States with the Organization of Petroleum Exporting Countries (OPEC) and its oil-producing allies. They rejected Washington’s repeated calls for accelerating the increase in supply. Sources told Reuters earlier that in recent weeks, Biden and his senior aides have discussed the possibility of a coordinated release of oil stocks with close allies, including Japan, South Korea, India, and China. China’s State Reserve Bureau said on Thursday that it is working on releasing its crude oil reserves. However, it declined to comment on the United States’ request for major oil-consuming countries to consider coordinating the release of oil reserves. An official from the Japanese Ministry of Economy, Trade, and Industry said that the United States had asked Tokyo to deal with high oil prices. Still, he could not confirm whether this request includes the coordinated release of reserves. The official said that by the law, Japan could not reduce prices by releasing funds.

• LOOKING AHEAD:

Today, investors will receive:

- USD: FOMC Member Waller Speaks, and FOMC Member Clarida Speaks.

- EUR: German PPI m/m, ECB President Lagarde Speaks, Current Account, and German Buba President Weidmann Speaks.

- GBP: GfK Consumer Confidence, Retail Sales m/m, Public Sector Net Borrowing, and MPC Member Pill Speak.

- CAD: Core Retail Sales m/m, Retail Sales m/m, and NHPI m/m.

- JPY: National Core CPI y/y.

- NZD: Credit Card Spending y/y.

• KEY EQUITY & BOND MARKET DRIVERS:

- Cherkizovo reduced its net profit by 45.9% YoY in Q3 2021 to RUB 2.5 billion. The company's costs grew faster than the prices of its main products.

- In the third quarter of 2021, Bank Saint Petersburg increased its IFRS net profit by 1.5 times y / y. This was facilitated by a reduction in reserves and an increase in lending activity. In the third quarter of 2021, Mechel reduced EBITDA by 5% QoQ, while net debt / EBITDA fell to 3.2x. Weakness in the company's performance was more than offset by favorable market conditions.

- The free cash flow of Gazprom Neft increased by 11% QoQ in Q3 2021 to RUB 180 billion. The company took full advantage of the favorable market conditions. Nvidia's results for the third quarter of fiscal 2022 are well above expectations. A good report is driven by solid demand for chips from the video game segment and data centers

Baidu reports mixed 3Q2021 results, double-digit revenue, and customer base growth coupled with management's flimsy forecast for the next quarter.

- JD.com's strong Q3 2021 report reflects the company's resilience to regulatory pressure. Revenue and active customer base growth remain in the high double-digit area.

- Alibaba Group (BABA) shares fell 11% after a weak quarterly report.

- Macy's (M) shares gained 15% after the quarterly report, which analysts Evercore ISI called "explosive."

- Hilton Grand Vacations (HGV) shares up 4.1%: Jefferies upgrades its rating to Buy from Hold.

- shares of Maxeon Solar Technologies (MAXN) fell 16%: the report on revenue for the third quarter and a similar forecast for the fourth quarter were below analysts' expectations.

- Rivian Automotive (RIVN) shares continued the correction started the day before. Today the company's shares fell 16%.

- Standard Lithium (SLI) shares lost 8%: Blue Orca Capital tweeted that it was short.

- Victoria's Secret (VSCO) shares rose 17% after releasing a solid quarterly report.

- China and Hong Kong Apple concept stocks rose in early trading on Friday. Cowell Electronics once rose 11.4% in intraday trading and closed more than 7% in early trading; shares of the well-known "fruit chain" company Goertek rose 9.6% to a record high and closed up about 5 in early trading. %. Earlier reports said that Apple is speeding up car development projects and shifting its focus to self-driving cars.

- Luxshare Precision once rose 7.5% in early trading and ended up 3.6% in the early trading; Lens Technology closed up more than 4%; Tianyin Holdings, Dongshan Precision, Xinwangda, and BYD Electronics closed up 0.8-2% in early trading between.

According to Bloomberg News on Thursday, citing people familiar with the matter, Apple is working hard to accelerate the development of its electric vehicles and shift the project's focus to fully autonomous driving again. According to the report, the company strives to be listed as early as 2025.

- Apple's US stocks closed up 2.85% on Thursday, with a total market value of US$2.59 trillion, which also enabled it to surpass Microsoft and become the world's most valuable company again.

• STOCK MARKET SECTORS:

- High: Consumer Discretionary, Information Technology.

- Low: Energy, Utilities, Financials, Materials, Consumer Staples.

• TOP CURRENCY & COMMODITIES MARKET DRIVERS:

- Oil remained in the red but attempted to gain a foothold below $ 80 per barrel of Brent have not been crowned with success. The main risk remains the likelihood of coordinated oil sales from the strategic reserves of the largest importers. However, while the US approaches this issue quite freely, the representatives of Japan and South Korea emphasized that they do not have the legislative opportunity to sell oil to reduce prices. The very fact of the US appeal is not denied. China confirmed that it was considering the sale of oil from reserves but, according to Reuters, left without comment a possible connection with the US appeal. In the short term, coordinated sales may collapse oil quotes, but it is also worth remembering that reducing strategic reserves makes these countries more vulnerable to force majeure. Brent - $ 79.85 (-0.54%), WTI - $ 77.01 (-0.70%), Aluminum - $ 2598 (-0.71%), Gold - $ 1866.1 (-0.22%), Copper - $ 9360.86 (-0.47%), Nickel - $ 19,230 (-0.65%).

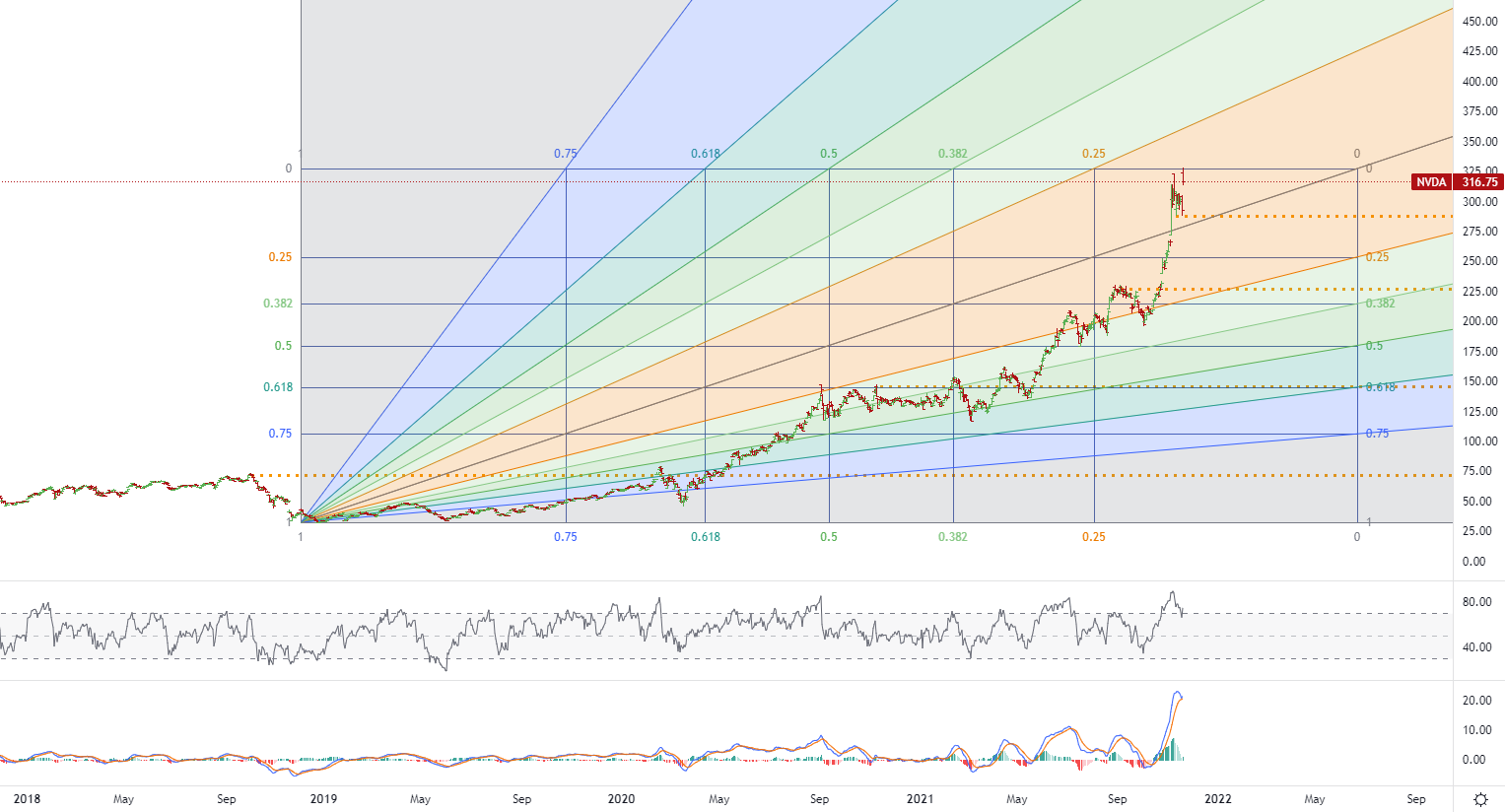

• CHART OF THE DAY:

Nvidia's quarterly report far exceeded expectations. Revenue grew by 50% y / y to $ 7.103 billion ($ 6.8 billion was expected). Adjusted: EPS rose 60% YoY to $ 1.17 ($ 1.10 expected). At the same time, the gross margin increased by 150 bps—YoY to 67%. The company's business showed strong growth in both main areas: the gaming segment increased revenue by 42% YoY to $ 3.22 billion; revenue from data centers increased 55% YoY to $ 2.94. The results highlight that the company remains a leader in graphics for gamers by implementing ray-tracing and artificial intelligence (AI) for maximum realism. The demand for graphics chips from the gaming segment is especially high ahead of the holiday season, which further fueled the results. Strong results in the data center segment also emphasize that the company is increasing its market share, mainly at the expense of Intel. The automotive segment in the future may become an additional driver of growth as uncrewed vehicles are widely adopted. This segment brought in $ 135 million in the third quarter (+ 8% YoY) or 1.9% of total revenue. The semiconductor business remains quite cyclical, so the company seeks to improve chips and obtain more recurring licensing revenue, which usually gives the business a higher value estimate. The company announced the strategic concept of "Omniverse," which involves the creation of client avatars to perform various kinds of actions in the virtual space. Using "Omniverse" powered by Nvidia graphics chips (GPUs) in the cloud could open up a new source of licensing revenue. Implementation and revision of "Omniverse" may take a lot of time, but existing technologies already allow us to discuss it quite seriously. • Nvidia - D1, Resistance around ~ 327.10, Support (target zone) around ~ 288.51.

• Nvidia - D1, Resistance around ~ 327.10, Support (target zone) around ~ 288.51.

Demo account

The Blue Suisse Trading Account with virtual funds in a risk-free environment

Demo accountLive account

The Blue Suisse Trading Account in our transparent live model environment

Open an Account