Market weathers negative-sounding developments - gold higher ahead of FOMC minutes

• GLOBAL CAPITAL MARKETS OVERVIEW:

The Standard & Poor's 500 Index ended its three-day decline. The Nasdaq rose 0.7% on Wednesday. Driven by the rise of technology stocks, the yield fell after higher-than-expected inflation data. The annual and monthly inflation rates in the United States in September were higher than expected, and the core data were in line with expectations. The minutes of the Fed’s last policy meeting showed that officials generally agreed to gradually reduce emergency support for the influenza pandemic in mid-November or mid-December, and, as market participants generally expected, this process may be in 2022. It ended around the middle of the year, but it did not impact the market. In terms of earnings, the performance of JP Morgan Chase and BlackRock exceeded expectations. The Toronto Stock Exchange Standard & Poor's/TSX Composite Index rose 0.9% on Wednesday to close at 20,618 points, extending the second trading day's gains, affected by the rise of materials stocks, including precious metals and base metal mining companies and fertilizer companies. Push. On Wednesday, the price of gold rose 2% to US$1,800, which is the highest level since September 15 after the latest US CPI data indicated that the economy continues to face inflationary pressures, triggering concerns about slowing growth. At the same time, the minutes of the Federal Open Market Committee meeting show that the Fed may begin to scale down in mid-November. European stock markets closed mostly higher on Wednesday. The Frankfurt DAX index rose 0.7% to 15,253 points. After Germany's SAP raised its guidance for the whole year, shares of technology companies rose 2.6%. In addition, JP Morgan Chase and Delta Air Lines have a good start to the US earnings season, with better-than-expected data. At the same time, investors are waiting for the release of the minutes of the Fed’s meeting to understand the extent to which policymakers are "progressing" on the US economy and labor market, as well as further hints about the timing of reductions. Recent data shows that US consumer price inflation is still well above the Fed’s target of 5.4%, while the job market continues to recover gradually. On Wednesday, the CAC40 index rebounded 0.8% to close at 6597 points. Traders digested the first batch of earnings in the third quarter while facing inflation dilemmas and lower growth prospects. French technology stock Capgemini (+4.0%) was boosted by the spirited performance of its German counterpart SAP. In addition, luxury stocks also performed well after LVMH (+3.2%) achieved double-digit organic growth in all business groups in the third quarter of 2021. At the same time, US consumer prices rose by 5.4%, the fastest growth rate in 11 years, higher than market expectations of 5.3%, which further proves that the Fed will soon begin to scale down. The FTSE MIB fell 0.1% on Wednesday to close at 25,959 points. It rose 0.2% in the previous trading day, dragged down by the banking and energy sectors, yields and oil prices fell. Concerns about a slowdown in global economic activity and rising inflation continue to intensify, suppressing the possibility of interest rate hikes. In addition, the U.S. CPI is 5.4%, which is still far above the Fed’s target, and the minutes of the Fed’s meeting later today should provide clues as to how long the central bank will begin to tighten. At the same time, investors are paying close attention to the third-quarter earnings season to assess the impact of rising input costs on the company, although JP Morgan Chase and BlackRock have shown a good start. FTSE 100 index edged up 12 points, or 0.2%, to 7142 points. The lively company performance is enough to offset concerns about the prospect of inflation and interest rate hikes. Barratt Developments shares rose 6% after the company reported sales above pre-pandemic levels and said it is expected to achieve its 2022 and mid-term targets, pushing home builders up 3.9%. In terms of economic data, traders digested the UK’s monthly GDP report in August, which showed that the UK economy grew by 0.4% in August. It is expected that the Bank of England will raise interest rates as early as December. Major stock markets in the Asia-Pacific region were mixed on Wednesday, with warnings of rising global inflation and positive China trade data in September. The stock markets of China, South Korea, New Zealand, and Southeast Asian countries rebounded, China's unexpectedly strong trade data eased concerns about the economic slowdown, and the Indian stock market index hit a record high. Australian and Japanese stocks closed lower at the same time, dragged down by industry-specific concerns. Elsewhere, due to typhoon Kompasu, the Hong Kong financial market was still closed that day. The Nikkei 225 rebounded briefly but quickly rebounded. On Wednesday, it fell 90 points or 0.32% to close at 28140. Investors waited for the US inflation data to be announced later today. The decline in the industrial, shipping and utility industries outpaced the increase in Japanese retailers. Japan Paint led the decline, falling by 8.55%, lowering its profit forecast due to rising costs and supply concerns. At the same time, retailers bucked the market and fell. J.Front Retailing led to the decline. Earlier, it announced positive earnings. The market is optimistic about companies that benefit from the economic reopening. The Standard & Poor's/ASX 200 index fell 8 points or 0.11% on Wednesday to close at 7273. The index fluctuated near the flat line. The decline in the mining and banking sectors overwhelmed the rise in real estate and gold stocks. Fortescue Metals fell 5.34%, which may hit a 52-week low. BHP Billiton Group and Rio Tinto Group fell 1.03% and 3.19%, respectively, as weak iron ore prices dragged down the Australian mining industry. Commonwealth Bank fell 1.59%, and Westpac fell 1.29%, as the latter’s huge write-downs continued to pressure the banking industry. The NZX 50 index rose 29 points, or 0.22%, to close at 13,025 points, breaking the six-day decline in the Asia-Pacific region mixed on Wednesday. Countries continue to respond to inflationary pressures and the continued impact of the new crown epidemic. A2 Dairy Company rebounded sharply to 12.38%, boosting the index and shaking off the sell-off caused by allegations of providing misleading forecasts. At the same time, an ANZ Bank survey showed that New Zealand’s business confidence fell from -7.2 in September to -8.6 in October because Auckland is still locked down in the fight against the more contagious variant of the Delta.

• REVIEWING ECONOMIC DATA:

Looking at the last economic data:

- US: On Wednesday, after new CPI data showed that inflationary pressures remained high in September, the U.S. dollar index reduced some early losses to around 94.5, returning to levels since September 2020, which increased the Fed’s need to perform faster than expected. Possibility of speed tightening. The Federal Open Market Committee meeting minutes to be released later in the day should provide a clearer picture of the central bank's next move.

- US: After the latest data showed that the US annual and monthly inflation rates in September were higher than expected, and the core data were in line with forecasts, US futures were flat on Wednesday. Traders tried to assess the impact of increased inflationary pressures on the Fed's reduction plan. The Federal Open Market Committee meeting minutes, scheduled to be released later in the day, are expected to provide more clues about the central bank's plans. At the same time, the earnings season began, and the earnings of JPMorgan Chase and BlackRock exceeded expectations. According to Refinitiv, the new earnings season is expected to show a 30% year-on-year growth in third-quarter earnings, and traders will try to assess the impact of rising costs on company performance.

- US: The annual inflation rate in the United States rose from 5.3% in August to a 11-year high of 5.4% in September 2021, higher than market expectations of 5.3%. The central upward pressure comes from housing costs (3.2% and 2.8% in August); food (4.6% vs. 3.7%, the highest level since December 2011), namely household food (4.5% vs. 3%); new cars ( 8.7% vs. 7.6%),; and energy (24.8% and 25%, respectively). On the other hand, the prices of used cars and trucks have declined (24.4% and 31.9%, respectively); transportation services (4.4% vs. 4.6%), clothing (3.4% vs. 4.2%), and medical services (respectively 0.9% and 1%). As a result, the monthly consumer price rose by 0.4%, higher than the forecast of 0.3%, and the food and housing index contributed more than half of the monthly increase. The core index excluding food and energy rose 0.2% month-on-month and 4% year-on-year, unchanged from August and in line with expectations.

- US: US CPI data may show that due to the lack of improvement in supply chain bottlenecks and soaring energy prices, the inflationary pressure facing the economy in September is still rising, which has further triggered people's concerns that high inflation will last longer than expected. Consumer prices may increase by 5.3% year-on-year in September, the same as in August, and stabilized at 0.3% month-on-month. However, core inflation is expected to rise by 0.2% from 0.1%, while the annual inflation rate may remain 4%. Traders will pay close attention to the CPI data to further understand when the Fed begins to scale down. The market has already considered that the stimulus plan will be announced next month, but the higher-than-expected CPI data may force the Fed to accelerate its tightening.

- AU: Fitch Ratings revised its outlook on Australia’s “AAA” rating from negative to stable. Despite recent setbacks due to pandemic-related lock-in, it is expected to continue to recover strongly from the pandemic crisis. In the medium term, fiscal and external performance will improve. The rating is based on the country’s strong institutions and effective policy frameworks that supported nearly three decades of continuous economic growth before the outbreak and helped limit the severity of current shocks. At the same time, Fitch lowered its GDP growth forecast for 2021 from 5.8% to 3.7%, and it expects growth to rise to 4.5% in 2022.

- JP: In mid-October, the yen-to-dollar exchange rate was about 113.5, hovering near the 3-year low touched in December 2018. The dollar generally strengthened. Investors still believe that the Fed will begin to tighten monetary policy in November. At the same time, the Bank of Japan is expected to continue its extremely loose monetary policy because Japan has been in a state of deflation since October 2020, mainly due to the continued COVID-19 pandemic that has led to weak consumption. In addition, the recent increase in energy prices has worsened the terms of trade from Japan, which will harm the country’s current account.

- CN: China’s total social financing (TSF) is a broad indicator of credit and liquidity in the economy. It fell from 2.96 trillion yuan last month to 2.93 trillion yuan in September 2021, which was lower than market expectations of 3.105 trillion yuan. Yuan. As of the end of September, the total outstanding social financing was 308.05 trillion yuan, an increase of 10.0% over the same period last year. TSF includes forms of off-balance-sheet financing outside the traditional bank lending system, such as initial public offerings (IPOs), trust company loans, and bond sales.

- CN: In September 2021, Chinese banks added 1.66 trillion yuan in RMB loans, up from 1.22 trillion yuan last month but lower than market expectations of 1.85 trillion yuan. The reason is that people doubt whether the central bank will provide more stimulus measures. To support a slowing economy. However, concerns about the risk of debt and real estate bubbles may delay any meaningful actions. The broad M2 money supply increased by 8.3% year-on-year, higher than August's 8.2% growth and 8.1% expectations. Outstanding RMB loans increased by 11.9%, the lowest since 2002 and lower than market expectations of 12.1%.

- EU: In August 2021, industrial output in the Eurozone fell by 1.6% from the previous month and increased by 1.4% after revision in July, in line with market expectations. The most significant decline in monthly output was capital goods (-3.9%) and consumer durables (-3.4%), followed by intermediate products (-1.5%) and non-durable consumer goods (-0.8%). On the other hand, energy production rebounded 0.5% after three consecutive declines. As a result, the industrial output value in August increased by 5.1% year-on-year, slightly higher than the 4.7% commonly believed by the market, mainly due to the substantial increase in the production of non-durable consumer goods.

- UK: In August 2021, the output of the British factory increased by 4.1% year-on-year, in line with market expectations, but the growth rate was the smallest in six months. Monthly manufacturing increased by 0.5%, and transportation equipment manufacturing increased by 3.9%, although the output of this subsector was still 24.2% below February 2020 levels; this was offset by a 5.1% decline in the manufacturing of essential drugs and pharmaceutical preparations.

- UK: In August 2021, British construction output increased by 10.1% year-on-year, the smallest increase in five months but far higher than the 5.7% expected. All new jobs (12% vs. 15.3%), repairs and maintenance (6.9% vs. 9.4%), and new housing (5.2% vs. 12.7%) showed a minor increase. However, the monthly construction output fell by 0.2% in August, and the current production level is 1.5% lower than before the coronavirus pandemic. Since the outbreak of the epidemic so far, the recovery of various industries has been mixed. The infrastructure level was 45.4% higher than the level in February 2020, and the level of private business was lower than 26.3% in February 2020.

- UK: Imports to the UK in August 2021 fell by 0.5% from the previous month to 53.5 billion pounds, rising by 3.1% in the last month. This is the first decline in total imports after six consecutive months of growth, as purchases of goods have fallen by 1%, while imports of services have risen by 1.2%. Among commodities, the decline in imports was mainly fueled (-10.1%), mainly due to the decrease in crude oil purchased from Norway and the United States; chemicals (down 9.5%); material manufacturing (-7.7%), and food And activity properties (-6.4%). Exports of goods from non-EU countries (1.8%) and EU countries (0.1%) declined.

- NZ: Preliminary data shows that the New Zealand ANZ Bank's business outlook index fell from the final -7.2 in September to -8.6 in October 2021 due to colossal inflation and cost pressures. Inflation expectations are still higher than 3%, at the top of the Royal Bank of New Zealand's target range; cost pressures are still enormous; credit easing is weakened. At the same time, employment expectations have hardly changed. At the same time, the prospects for its activities remain strong, the willingness to invest has risen, profit expectations have rebounded, and the desire for export has increased. In addition, capacity utilization has increased.

- NZ: In October 2021, the Consumer Confidence Index of the Melbourne Institute of Western Pacific, Australia, fell 1.5% month-on-month to 104.6. Concerns about the long-term economic outlook overwhelmed the relief brought about by relaxing restrictions on the new crown epidemic. In the next five years, the financial situation will decline by 5.6% to 108.1, and the economic crisis in the next 12 months will decrease by 1.7% to 103.2. In addition, the family's economic status fell by 1.3% compared with a year ago to 92.3%. In contrast, household financial indicators rose by 0.5% in the next 12 months to 109.7. In addition, the time spent on purchasing major household items increased by 0.9% to 109.9%. Bill Evans, the chief economist for the Western Pacific Region, said that the popularity of Sydney and Melbourne has improved. Still, the popularity of areas outside these cities has dropped sharply because the interviewees’ concerns about the resumption of interstate travel may give these areas Be cautious about bringing more infections.

• LOOKING AHEAD:

Today, investors will receive:

-

• KEY EQUITY & BOND MARKET DRIVERS:

- The benchmark U.S. 10-year Treasury bond yield fell to 1.54% on Wednesday. After investors digested higher-than-expected CPI data and Federal Open Market Committee meeting minutes, the yield rose to 1.596% earlier in the trading day. In September, the US consumer price inflation rate rose slightly to 5.4%, in line with the 11-year peaks in June and July, and was slightly higher than market expectations of 5.3%. Investors have been worried that soaring commodity prices will drag down economic growth and push up inflation, despite the pause in oil gains. At the same time, the minutes of the Fed’s meeting showed that, as expected, the process of shrinking may begin in mid-November.

- The minutes of the last meeting of the Federal Open Market Committee (FOMC) showed that the Fed did not decide to continue to purchase assets reasonably in September, but policymakers generally believe that if the economic recovery remains typically on the right track, the gradual contraction will end around the middle of next year. Therefore, the process may be appropriate. Participants pointed out that if it is decided at the next meeting to start reducing purchases, reducing purchases can start from the monthly purchasing calendar starting in mid-November or mid-December. Policymakers also considered an illustrative path of reduction, including a monthly reduction in the rate of asset purchases, a reduction of US$10 billion in national debt, and a reduction of US$5 billion in institutional mortgage-backed securities (MBS).

- Ardelyx (ARDX) shares fell 19%: the company reported a 65% reduction in employees, which is part of a restructuring plan.

- Delta (DAL) Shares Shed 4%: Airline Says Rising Kerosene Prices Threatens Its Profit.

- Koss (KOSS) shares up 3% after the company defeats Apple in two patent disputes.

- Neuronetics (STIM) shares declined 20%: BTIG downgraded the security, citing a "puzzling" outlook for the fourth quarter.

- Plug Power (PLUG) shares up 10% after rating upgrade and positive comments from Morgan Stanley.

- Sarcos Technology and Robotics Corp. (STRC) Grows 3%: Jefferies Launches Research Coverage with Buy Recommendations.

- Sarepta Therapeutics (SRPT) shares lost 10% after announcing a $ 500 million share offer.

- Smart Global (SGH) shares up 12% after quarterly solid reports and forecasts.

- Vistra (VST) shares rose 8%: the company approved a $ 2 billion buyback plan.

• STOCK MARKET SECTORS:

- High: Utilities, Materials, Consumer Discretionary, Information Technology, Real Estate.

- Low: Financials, Energy.

• TOP CURRENCY & COMMODITIES MARKET DRIVERS:

- The dollar fell against all G10 currencies on Wednesday. Published on Wednesday, the report on consumer inflation in the United States signaled a higher likelihood of the start of a cut in the Fed's bond-buying program in the last month of autumn. The Open Market Committee will announce its decision on November 3. The source of inflation is no longer concentrated in those categories related to the economy's recovery after the pandemic (this was exactly what allowed the Fed to talk about the temporary nature of inflation). Most alarmingly, inflation has begun to manifest itself in property prices, which occupy a third of the consumer basket. After publishing inflation data for September, the overnight rate swap market is 100% likely to include a 25 bp rate hike in its quotes. Already in September 2022. The next increase is implied by March 2023, and the third step is to mid-2023. The federal funds rate futures market has a 100% chance of accounting for a 0.25% rate hike by November 2022. The rise in September in contrast to the swap market is implied with a probability of 87% compared to 78% the day before and 55% a week ago. The markets' initial reaction to the inflation numbers pushed the 10-year US Treasury yields to 1.60%, the dollar index jumped sharply to 94.50 points, and the EURUSD rate fell to 1.1536. However, after the yield resumed the decline and fell to 1.5280%, while the euro rate climbed to new highs on Wednesday and surpassed Tuesday's highs (session peak) around 1.1572. The end reaction looks unusual. Here the situation can be explained by concerns that the market is starting to build on the risk that the Fed may, due to inflation, have to start raising rates earlier and at a faster pace, which could jeopardize the rate of economic growth. Due to this negative factor for risk appetite, bonds could increase demand, which stimulated a decrease in their yields. This negatively affected the dollar. 17 out of 23 Emerging Markets currencies strengthened against the dollar on Wednesday. The ruble and the Brazilian real, Turkish lira, and Colombian peso were under pressure. In the ruble, a technical correction has been overdue for several days, which was triggered by a rebound in oil prices from $ 85 / bbl. by Brent. China’s offshore renminbi rose to 6.43 against the U.S. dollar, the highest level since September 15. Investors welcomed China’s strong trade data, showing that imports and exports continued to grow at a steady rate in September, both hitting record highs. At the same time, after a meeting between senior Chinese and American officials over the weekend, expectations that the United States may partially cancel trade tariffs rose, supporting market sentiment. In other respects, as the Federal Reserve will gradually reduce its massive stimulus plan next month, the US dollar is still close to a one-year high.EUR / USD - 1.157 (+ 0.37%), GBP / USD - 1.3646 (+ 0.45%), USD / JPY - 113.47 (-0.11%), Dollar Index - 94.21 (-0.32%), USD / RUB - 72.0781 (+ 0.53%), EUR / RUB - 83.3975 (+ 0.65%).

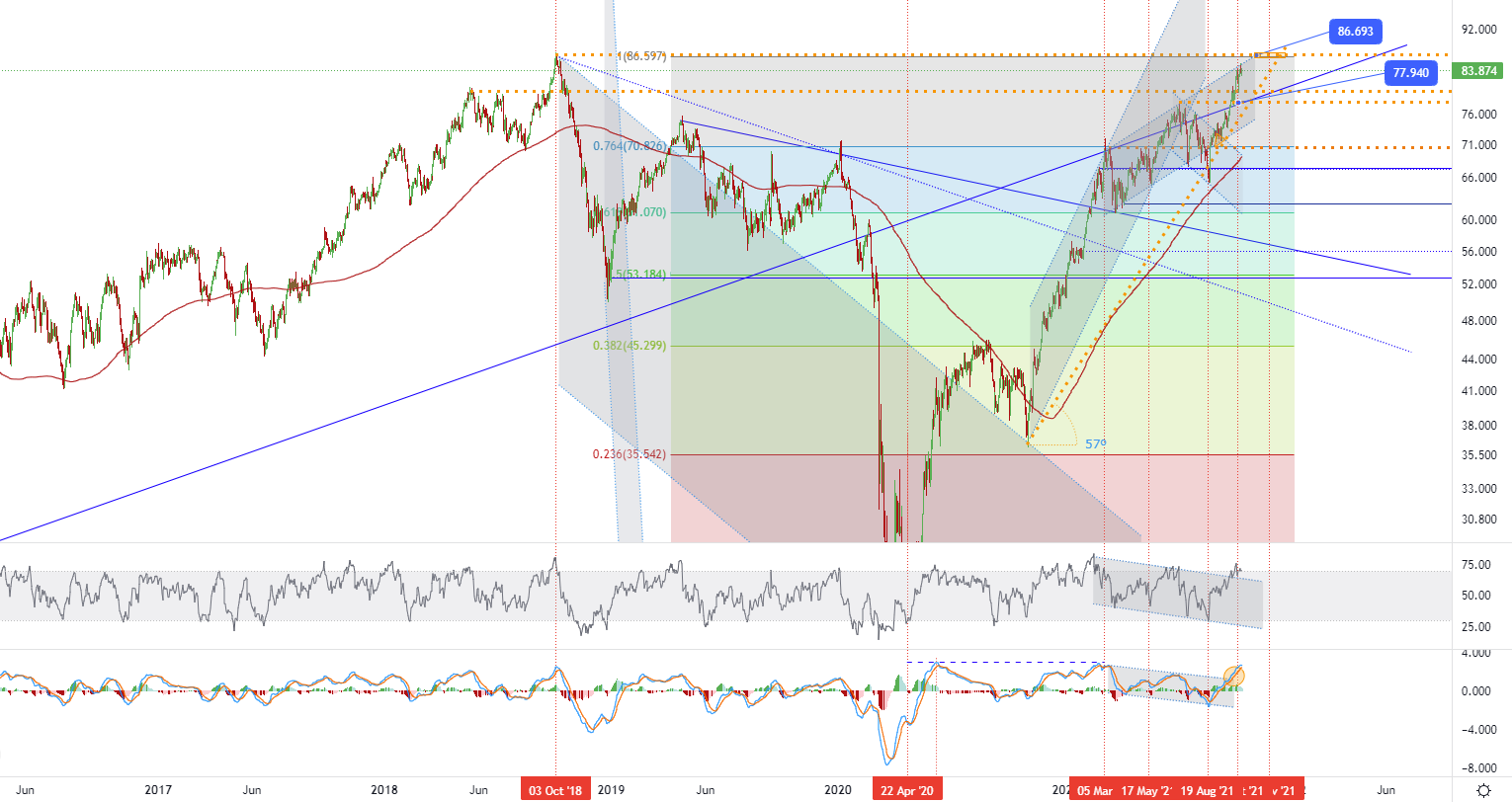

• CHART OF THE DAY:

World oil consumption in the third quarter of 2021 amounted to 98.33 mbpc (million barrels per day), and supply - 95.65 mbpc, according to the figures published OPEC report. Accordingly, the supply at the end of the quarter turned out to be lower than demand by 2.68 Mbps, which led to an increase in world prices in September-October 2021. Production in OPEC countries in Q3 amounted to 26.92 Mbps (+1.39 Mbps by .), in countries outside OPEC - 63.53 Mbps (+0.26 mbps q / q). Average oil consumption in 2021 will amount to 96.60 mbp (-0.08 mbp to the September report). This is 5.82 mbps more than in 2020. Oil supply in 2021 is estimated at 96.61 mbps, which is 2.9 mbps more than in 2020. By the end of this year, a balanced oil market is expected. Preliminary data for August showed a decrease in total inventories in OECD countries by 19.5 million barrels m / m to 2.855 billion barrels. Stocks remained 363 million barrels lower than a year ago and 183.0 million barrels more bass than the five-year average. In components, crude oil inventories decreased by 23.0 million barrels, while oil product inventories increased by 3.2 million barrels m / m.OECD commercial stocks declined 0.1 days from a month ago, reaching 62.5 days in August (12.3 days below August 2020 and 0.3 days above the 2015-2019 average). World oil consumption in 2022 will grow by 4.15 mbps against the level of 2021 and amount to 100.76 mbps (-0.07 mbps against the September report), and the mark of 100 mbps will be exceeded in the third quarter of 2022. demand will be supported by a strong recovery in major consumer economies and better management of the COVID-19 pandemic. In the third quarter of 2021, the oil supply by non-OPEC countries amounted to 63.53 mbp, and the OPEC oil supply - 26.92 mbp. Oil supply in non-OPEC countries was lowered due to adjustments amid damage from Hurricane Ida in the United States, maintenance at the Tengiz field in Kazakhstan, and force majeure in Canada at the Suncor oil sands area. US production in 2021 is revised downward by 0.12 mbps to 11.06 Mbps. The initial demand for OPEC oil was calculated at 29.60 mbps, but the supply of OPEC countries in Q3. 2021 amounted to 26.92 mbps. As a result of insufficient supply from OPEC, the supply deficit remained on the market, covered by accumulated reserves. According to OPEC, Russia, Canada, Brazil, and Norway will remain the drivers of oil supply growth. At the end of 2021, oil production in non-OPEC countries is expected at 63.64 mbp (+0.66 mbp y / y), in OPEC countries - at 27.80 mbp (+5.04 mbp y / y). In 2022, oil demand is expected to increase to 100.76 mbps, and supply from non-OPEC countries will grow by 3.02 mbps y / y to 66 mbps. OPEC supply is expected to rise 1.01 mbps y / y to 28.80 mbps. By the end of 2022, the oil market is expected to be balanced. The following technical and monitoring committee meeting at the OPEC + ministerial level will be held on November 4, 2021. • Brent Crude oil - D1, Resistance (target zone) around ~ 86.69, Support (consolidation) around ~ 77.94, 70.50 & 67.40.

• Brent Crude oil - D1, Resistance (target zone) around ~ 86.69, Support (consolidation) around ~ 77.94, 70.50 & 67.40.

Demo account

The Blue Suisse Trading Account with virtual funds in a risk-free environment

Demo accountLive account

The Blue Suisse Trading Account in our transparent live model environment

Open an Account