Bounce from a short-term oversold condition

GLOBAL CAPITAL MARKETS OVERVIEW:

Wall Street's major indexes started a holiday-shortened week, with investors taking advantage of the prior week's sell-off to open new positions. The Dow closed 642 points, while the S&P 500 and Nasdaq gained 2.5%. Airline stocks rose the most ahead of the expected travel boom, with Spirit soaring nearly 10% after JetBlue raised its takeover bid. Tech stocks, which have been battered recently, also got some respite, with shares of Microsoft, Amazon, Alphabet, Facebook, and Apple up more than 3% and Tesla soaring 12%. Still, investors are bracing for further volatility in the stock market, with Federal Reserve Chairman Jerome Powell due to testify before Congress on Wednesday and Thursday. The S&P/TSX rose 0.38% to end at 19,257.29 on Tuesday, extending gains for a second session, as energy stocks rose sharply after a rebound in oil prices. Meanwhile, upbeat domestic retail sales data bolstered sentiment, giving investors' confidence that Canada's economy can weather the country's central bank's aggressive monetary tightening. On Tuesday, the MOEX Russia Index fell 1.9% to close at 2,359 as investors focused on Russia's energy supplies to Europe and Asia. Gazprom shares fell 3.5%, extending losses for the third session to a two-week low, as expectations for European gas flows to return to their original volumes continued to decline. The state-backed giant announced a suspension of supplies to Greece and refused to increase capacity through Ukraine. At the same time, the Nord Stream 1 pipeline remains at less than 40% capacity, and Italy has half its planned supply. The oil sector also saw a sharp drop, with data showing a surge in exports to Asia as lower European demand weighed on Urals crude prices. India's oil imports have increased by more than 800% than before the Ukrainian invasion, while exports to China hit a record high in May. Meanwhile, VTB and Sberbank fell 2.7% and 1.7%, respectively, partially offsetting yesterday's gains. European shares rose for a third straight session on Tuesday, with the regional STOXX 600 and DAX 40 up 0.4% and 0.2%, respectively, driven by materials and consumer discretionary stocks. Investors have been opening new positions taking advantage of the lower valuations. However, lingering fears that rising inflation and higher interest rates will drag the eurozone economy into recession have limited mainly the euro zone's upward momentum. Meanwhile, Britain's largest rail strike in 30 years began today over a dispute over wages and conditions. FTSE MIB index recovered early gains to close at 22,090, with tech and banking stocks strongly offsetting losses in utilities after ECB President Christine Lagarde stressed that the central bank would start monetary tightening next month if necessary, Take flexibility when it comes to cycles. STMicroelectronics rose 2.4 percent, leading the tech sector higher. Meanwhile, the Milan-based financial heavyweight extended its positive momentum, supported by relatively stable BTP prices. Meanwhile, Leonardo's shares rose nearly 3.5 percent after its electronics unit DRS agreed to buy Israeli radar maker RADA outright. On the other hand, the expectation that energy suppliers will have to pay more for gas after Russia slashed gas supplies to Italy weighed on utilities, which extended losses that averaged more than 1%. The CAC 40 rose 0.75% to end at 5,964.66, extending its rally but failing to regain its footing above the 6,000 points it gave up on Thursday. Markets are back in risk assets after last week's tragic sell-off. But investors remained cautious as President Emmanuel Macron failed to secure a majority in parliament, and fears of a global recession after the European Central Bank reaffirmed interest rate hikes sparked political uncertainty. Technology, banking, and luxury goods led the gains. Air Liquide rose 3.05% among individual stocks after signing a long-term renewable energy purchase agreement with Vattenfall in the Netherlands. In addition, Valvena rose more than 17% on the news that Pfizer acquired an 8.1% stake in Valvena. Loreal was the biggest gainer among luxury stocks (+2.3%) as its chief executive was confident about the outlook for the beauty industry and led gains among other luxury stocks. On Tuesday, the Shanghai Composite fell 0.26% to close at 3,307. In comparison, the Shenzhen Composite fell 0.51% to close at 12,424, consolidating recent gains after mainland Chinese stocks have rallied strongly over the past two months, outperforming global markets peers. The gains were driven by expectations that China's policies would become more accommodative to help support the country's economic recovery from the pandemic lockdown. However, on Monday, China's central bank paused its easing policy and left its benchmark lending rate unchanged to avoid further divergence between monetary policy and other economies. Still, analysts expect more stimulus for the rest of the year. That has prompted investors to profit as they await clarity on future policy moves. Growth stocks fell sharply, including China's Northern Rare Earth (down 8.3%), Tianqi Lithium (down 2.9%), and Sunshine Power (down 5.7%). the Nikkei 225 rose 1.84% to close at 26,246, while the broader Topix index rose 2.05% to 1,856, rebounding from a three-month low, with all sectors participating in the rally. Investors also bought battered stocks after a sustained sell-off, fearing that aggressive monetary tightening could drag the global economy into recession. Tech stocks led gains, led by strong gains from SoftBank Group (2.9%), Tokyo Electron (2.6%), Lasertec (3.5%), Exchange (17%), Renesas Electronics (4.2%), and Recruit Holdings (2.9%). Other index heavyweights also rose, including Japan's Yusen (3.1%), Toyota Motor (2.4%), Mitsubishi UFJ (2.8%), Mitsubishi Heavy Industries (2.9%), and Sony Group (4%). Meanwhile, the Japanese government expressed concern over the yen's rapid depreciation on Monday, saying it was watching closely for an appropriate response. Australia S&P/ASX 200 rose 1.41% to close at 6524 on Tuesday, up from a 19-month low as investors snapped up battered energy and mining stocks on fears that an aggressive monetary tightening could put the global economy under pressure. Meanwhile, investors remained cautious after Reserve Bank Governor Philip Lowe reiterated that Australians should brace for further rate hikes while stressing that upcoming data will determine future policy moves. Energy companies led gains, with solid gains from Woodside Energy (3.3%), Santos Ltd (1.2%), and Whitehaven Coal (5.3%). Mining stocks also rose, including BHP Billiton (1.7%), Fortescue Metals (3.5%), and Rio Tinto (2.3%). Elsewhere, financials and clean energy-related stocks rose while healthcare companies lagged the market. New Zealand S&P/NYSE rose 111.19 points, or 1.07%, to 10,701.59, rising for the first time in three years, shrugging off a 26-month low hit in the previous session buoyed by sharp gains in U.S. futures and profits in European stocks. In China, shares rose slightly on news that Evergrande Group will announce an initial restructuring plan by the end of July and will stick to the original deadline. Market participants ignored reports that New Zealand's consumer confidence fell to a record low of 78.7 in the second quarter as financial pressures increasingly squeezed household budgets. The biggest gainers were DGL Group (6.6%), New Zealand Restaurant Brands (6.5%), Burger Fuel Group (6.3%), and Marin Global Limited (5.9%). Meanwhile, concerns over sharp central bank rate hikes and global recession risk remain.

REVIEWING ECONOMIC DATA:

Looking at the last economic data:

- US: Existing-home sales in the U.S. fell 3.4% to a seasonally adjusted annual rate of 5.41 million units in May 2022, the lowest level since June 2020 and mainly in line with expectations. Sales fell for a fourth month as rising mortgage rates and decades of high inflation eroded household incomes. Total housing inventory was 1.16 million, up 12.6% from April, and the median existing-home price for all housing types was $407,600, up 14.8% from 2021. "Sales are expected to decline further in the coming months, given the challenges to housing affordability from the sharp rise in mortgage rates this year," said Lawrence Yun, chief economist at NAR.

- US: In May 2022, the Chicago Fed National Activity Index fell to an eight-month low of +0.01 from +0.40 the previous month. Production-related indicators contributed -0.01, down from +0.29 in April, while the personal consumption and housing categories contributed to -0.11 from 0.10. Employment-related hands contributed +0.08, down from +0.07, while sales, orders, and inventories increased their contribution. The index's three-month moving average, CFNAI-MA3, fell to +0.27 in May from +0.39 in April.

- CA: Preliminary estimates suggest that retail sales in Canada may increase by 1.6% month-on-month in May 2022. Considering that in April, retail sales rose 0.9% from the previous month, beating a preliminary estimate for a 0.8% increase and recovering from an upwardly revised 0.2% increase in March. Sales rose in 6 of the 11 sub-sectors, with department store turnover increasing (4.2%) and food sales increasing significantly. Gas station sales activity was also higher (3 percent), even as gasoline prices in Canada fell 0.7 percent over the month. On the other hand, turnover at auto and parts dealers fell (down 0.3%) due to lower vehicle sales (down 0.8%). As a result, retail sales rose at an annual rate of 9.2% in April, up from a revised 2.8% in the previous month.

- CA: In May 2022, new home prices in Canada rose 0.5% from the previous month, after rising 0.3% the last month. Home prices rose in 14 of the 27 large cities surveyed, while prices in the other half were unchanged as construction costs continued to grow. However, rising mortgage rates appear to be affecting the resale market more than the new-build market, reducing demand and prices for resale real estate. Halifax led gains up to 2.4%, followed by St. Catharines-Niagara (up 1.7%), Windsor (up 1.7%), and Calgary (up 1.4%). New home prices rose 8.4% in May from a year earlier, the slowest increase since March 2021.

- GB: The Federation of British Industry's order book balance fell to 15 in June 2022 from 26 the previous month, below market expectations of 22. Manufacturing output growth slowed in the three months to June (25 to 30 in May), and growth is expected to slow further in the next three months, though expectations remain well above the long-term average. In June, domestic price growth was expected to slow significantly over the next three months (58 to 75), the lowest forecast for sales price inflation since September 2021. "While manufacturing output remains supported by the backlog of orders, growth appears to moderate. Finished goods inventories now appear broadly adequate, and we may see early signs that waning activity is starting to slow the pace of price increases in the sector.", said CBI Deputy Chief Economist Anna Leach.

- IT: Italy's current account deficit stood at 2.19 billion euros in April 2022, compared with a surplus of 6.39 billion euros a year earlier. This is the fourth consecutive current account gap, with the commodity account turning from an excess of 6.81 billion euros to a deficit of 1.78 billion euros in the previous year and the secondary account gap widening to 1.4 billion euros from 1.14 billion euros. On the other hand, the services deficit narrowed to 1.17 billion euros from 1.16 billion euros, and the primary account surplus widened to 2.15 billion euros from 2.08 billion euros.

- HK: Hong Kong's current account surplus widened from HK$60.7 billion a year earlier to HK$78.5 billion in the first quarter of 2022 or 11.6% of GDP. The cargo surplus increased from HK$6.3 billion in the first quarter of 2021 to HK$14.3 billion in the first quarter of 2022; the services surplus increased from HK$37.8 billion to HK$43.8 billion. Major revenue inflows and outflows were HK$358.2 billion and HK$334.9 billion, respectively, resulting in a net inflow of HK$23.2 billion in the first quarter of 2022, compared with a net inflow of HK$21.5 billion in the same period in 2021. At the same time, secondary income inflows and outflows were HK$5.2 billion and HK$8 billion, respectively, with a net flow of HK$2.8 billion, down from a net outflow of HK$5 billion a year ago.

- EU: In April 2022, the euro area current account gap was 5.4 billion euros, compared with a surplus of 32.3 billion euros in the same month of the previous year, and the commodity account turned from an excess of 28.4 billion euros to 4.6 billion euros due to the surge in oil and gas prices due to Russia's war on Ukraine Euro deficit. In addition, the primary income account showed a deficit of 2.5 billion euros, compared with a surplus of 7.4 billion euros last year. On the other hand, the secondary income gap fell from 11.7 billion euros to 11.5 billion euros. Meanwhile, the services surplus rose to 11.2 billion euros from 8.3 billion euros.

- NZ: The New Zealand consumer confidence index fell further to 78.7 in the second quarter of 2022 from 92.1 in the previous period. It was the lowest reading on record and reflected growing pessimism about the economic outlook. As consumer prices and mortgage rates continue to rise, households increasingly worry about their finances. In addition, the disruption caused by the Omicron outbreak has also affected confidence.

LOOKING AHEAD:

Today, investors will receive:

- GBP: CPI y/y, Core CPI y/y, PPI Input m/m, PPI Output m/m, RPI y/y, MPC Member Cunliffe Speaks, and HPI y/y.

- CAD: CPI m/m, Common CPI y/y, Median CPI y/y, Trimmed CPI y/y, Core CPI m/m, and Gov Council Member Rogers Speaks.

- NZD: Trade Balance, and Credit Card Spending y/y.

- CHF: SNB Chairman Jordan Speaks, and SNB Quarterly Bulletin.

- AUD: MI Leading Index m/m, and CB Leading Index m/m.

- JPY: Monetary Policy Meeting Minutes, Fed Chair Powell Testifies, and Consumer Confidence.

KEY EQUITY & BOND MARKET DRIVERS:

- CA: Canada's 10-year government bond rose to around 3.5%, its highest level in nearly a week and near its highest level since May 2010, as bets on rate hikes increased ahead of the release of domestic CPI data retail sales and labor market data enhanced. Markets expect the Bank of Canada to raise interest rates by 75 basis points at its July 14 meeting, the most significant rate hike in 24 years. Following a 50-basis point hike in June, the country's central bank pledged a 31-year high of 6.8 %. As a result, domestic inflation returns to its 2% target. In addition, policymakers said they would shrink the central bank's balance sheet if inflation persisted while signaling further interest rate hikes.

- IT: Italian 10-year BTP yields fell further back to 3.7% in June, contrary to European counterparts, after ECB President Christine Lagarde stressed that fragmentation concerns would be resolved if risks were assured. Fears of a new debt crisis in fragile eurozone economies come amid an accelerated tightening cycle by major central banks, including a 25-basis point rate hike by the European Central Bank in July. However, despite the hawkish streak, Lagarde reiterated that the ECB would have enough flexibility to implement tighter policy, thereby narrowing the spread between the 10-year BTP and the equivalent of German Bunds to 2 points for three weeks, The lowest level since 2019, reflecting a decline in Italian debt risk premiums and hopes of non-splitting.

- US: Stock futures contracts linked to the three major stock indexes rose about 2 percent on Tuesday morning, putting Wall Street on track to start a holiday-shortened week of gains as bargain hunters bought depressed stocks. Last week, the Federal Reserve announced its highest rate hike in 28 years to curb sky-high inflation. This, combined with signs of slowing economic activity, has fueled fears that such aggressive tightening will drag the world's largest economy into recession. Investors are now bracing for further volatility in the stock market, with Federal Reserve Chairman Jerome Powell testifying before Congress on Wednesday and Thursday. On the data front, existing home sales should provide more clues about the economy's health.

- AU: Minutes from the Reserve Bank of Australia's June meeting showed that the Reserve Bank of Australia will raise interest rates further in the coming months as inflation pressures and interest rate levels remain low. "The size and timing of future rate hikes will continue to be guided by upcoming data and the Fed Committee's assessment of the inflation and labor market outlook, including risks to the outlook," it added. The Committee reiterated its commitment to taking the necessary steps to ensure that inflation returns to its target level over time. Meanwhile, Australian Premier Philip Lowe said in a speech that Australia's inflation would peak at around 7% by the end of the year as pandemic-related supply chain disruptions are resolved. He mentioned that tightening monetary policy and global interest rate hikes will work together to reduce inflation by creating a balance between the supply and demand of commodities.

STOCK MARKET SECTORS:

- High: Energy, Consumer Staples, Consumer Discretionary, Health Care, Information Technology.

- Low: --.

TOP CURRENCY & COMMODITIES MARKET DRIVERS:

- RUB: The Russian ruble touched a seven-year high of 50 rubles per dollar before falling back to 55 rubles as prices for Russia's main export surged and lower imports continued to support the ruble. Despite more significant uncertainty over energy supply levels in Europe, surging demand for Russian oil and gas in Asia on higher energy commodity prices supported the ruble at an intense level. At the same time, imports have plummeted due to stricter sanctions from the West, halting domestic demand for dollars and exacerbating the high fees and opposing interest rates banks are required to charge on currency deposits from “unfriendly countries.” As a result, the ruble has held up despite efforts by Russian authorities to depreciate the ruble to optimal levels. The Kremlin eased earlier rules on mandatory foreign exchange sales for export-led companies, while the central bank unexpectedly slashed interest rates to 9.5% before the invasion at its last meeting.

- JPY: The yen weakened to its weakest level against the dollar in more than 20 years, breaking the $135 mark after the Bank of Japan kept its ultra-easy monetary policy unchanged, continuing to maintain policy divergence with its global peers. The central bank also resisted market pressure on the yen and government bonds amid speculation, mainly by foreign investors, that the central bank might adjust its current yield control policy. As widely expected, the Bank of Japan kept its key short-term interest rate unchanged at -0.1% and the 10-year bond yield around 0% at its June meeting. The Fed committee also said it would propose unlimited bond purchases to defend the implied 0.25% daily cap and repeat market-operating guidelines it set in April. Meanwhile, the Bank of Japan made a rare reference to money markets, saying it needed to observe its impact on the economy and markets.

- USD: The U.S. dollar index fell back to 104.3 on Tuesday, recovering some recent performance, but still near a 20-year high reached last week, as expectations that the Federal Reserve will continue to tighten monetary policy underpinned the greenback aggressively. Fed last week raised its benchmark interest rate by 75 basis points, the most significant increase since 1994. In the latest comments, Federal Reserve Governor Christopher Waller said Saturday that he would support another rate hike of a similar size at the central bank's July meeting if economic data turns out as he expects. Meanwhile, Cleveland Commonwealth Bank President Loretta Mester warned Sunday that the risk of a U.S. recession is growing and that it will take several years to return to the central bank's 2 percent inflation target. Investors are now looking forward to Federal Reserve Chairman Jerome Powell's appearances in Congress on Wednesday and Thursday for clues on where U.S. monetary policy might go in the future.

CHART OF THE DAY:

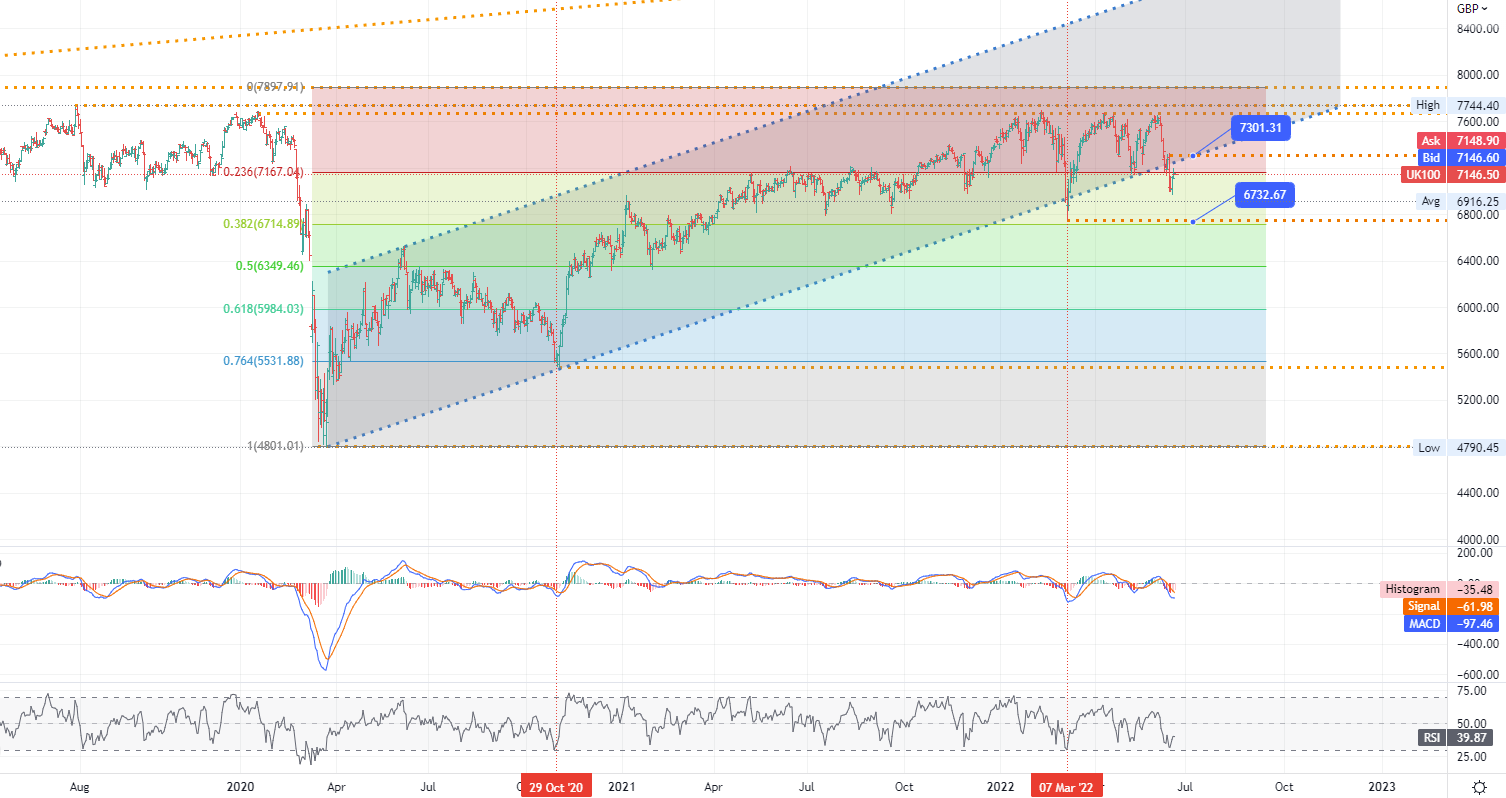

The FTSE 100 rose 0.42% to close at 7,152.05, extending gains for a second session, led by energy stocks. Packaging company DS Smith was the biggest winner (+3.72%), with a solid full-year profit and revenue increase due to strong demand and higher prices. Conversely, Ocado shares fell 2.51% after the online supermarket announced plans to add more than $1 billion in liquidity. Meanwhile, investors awaited U.K. consumer price data for May Wednesday after inflation surged to a 40-year high in April.

- UK FTSE 100 index - D1, Resistance (consolidation) around ~ 7301.31, Support (target zone) around ~ 6732.67

Demo account

The Blue Suisse Trading Account with virtual funds in a risk-free environment

Demo accountLive account

The Blue Suisse Trading Account in our transparent live model environment

Open an Account