Many central banks are raising key rates

GLOBAL CAPITAL MARKETS OVERVIEW:

European shares extended losses on Thursday, with the Dax shedding 3.2 percent to a three-month low, as borrowing costs rose as central banks pledged to curb inflationary pressures, fueling recession fears. The Fed surprised markets by announcing its most significant rate hike since 1994, the Bank of England raised its bank rate for the fifth time in a row, and the Swiss National Bank raised its policy rate for the first time since 2007. The technology and retail sectors led losses, with shares of online fashion retailers ASOS and Zalando down 32% and 14%, respectively, after the former warned that inflationary pressures were affecting shopping behavior. Utilities were also hit after Gazprom slashed gas flows to Germany and Italy, with the Nord Stream 1 pipeline continuing to operate at 40% capacity. E. Shares fell 7%, with Eni down nearly 5%.On Thursday, the CAC 40 index fell 2.4% to close at 5,886, its lowest level since March 2021, erasing gains from the previous session as investors worried that more aggressive tightening would hit economic growth. Yesterday, the Fed raised the fund's rate by 75 basis points, the highest level since 1994, and Chairman Powell said the next rate hike could be the same. In addition, the ECB decided to expedite the completion of the design of a new anti-secession tool to prevent unnecessary jumps in euro zone bond yields. Cyclical and technology stocks fell the most, such as Renault (down 6.78%), Saint-Gobain (down 6.5%), STMicroelectronics (down 6.2%), and ArcelorMittal (down 5.5%). Meanwhile, Engie shares tumbled more than 7% as gas deliveries fell due to Moscow's export curbs. FTSE MIB index fell 3.3% to 21,727, its lowest close since January 2021, as the Federal Reserve hiked rates by 75 basis points, erasing concerns surrounding the European Central Bank's pledge to develop a tool to prevent euro zone bond yields. There is an unreasonable jump in enthusiasm. Technology, consumer goods, and autos were the biggest losers, with Moncler, STMicroelectronics, and Stellantis down more than 4.5%. The heavyweight banking sector also pared gains yesterday, with Medio Banka shares down 4.7%. Finally, the utility sector also fell sharply after Gazprom extended cuts on Italian gas, jeopardizing the stability of Italy's energy supply, which is highly dependent on Russia. Shares in Eni fell 4.8 percent, and Enel fell 2.2 percent. The MOEX Russia Index rose 2.2 percent to 2,370 on Thursday, extending gains from the previous session, supported by energy and mining stocks, as investors continued to assess the outlook for the Russian economy amid continued isolation from the West. Oil stocks were among the top gainers, with Lukoil and Tatneft gaining nearly 3% as the spread between Brent and Urals narrowed, and crude exports to India increased. Gains in the financial sector also supported the index, with banks rebounding from recent lows, with VTB and Sberbank closing up more than 1%. On the other hand, Gazprom shares ended lower as the gas giant continued to cut supplies to Europe. The flow of the Nord Stream 1 pipeline has remained at 40% capacity. At the same time, Italy's Eni said it received only 65% of its scheduled supply, adding uncertainty about future gas supplies in Europe. London stocks came under intense selling pressure on Thursday, with the blue-chip FTSE 100 down 3.1% to close at 7,045, its lowest level since March 8, as investors assessed the Bank of England's latest monetary decision. Meanwhile, a profit warning from online fashion retailer ASOS hit the retail sector. At its June meeting, the Bank of England was widely expected to raise its benchmark interest rate by 25 basis points to 1.25%, the fifth hike in a row and pushing borrowing costs to their highest level in 11 years. to curb soaring inflation. This followed a surprise 50 basis point hike by the Swiss National Bank on Wednesday and a 75-basis point hike by the Federal Reserve, which raised concerns that such aggressive tightening could tip the economy into recession. U.S. stocks opened sharply lower on Thursday as concerns remained over the impact of aggressive tightening on the growth momentum. The Dow fell more than 700 points, below 30,000 for the first time since January 2021, while the S&P 500 and Nasdaq lost 2.7% and 2.9%, respectively. Yesterday the Federal Reserve raised the fund's rate by the most since 1994, while today, the Bank of England raised rates for the fifth time in a row, and the Swiss National Bank raised its policy rate for the first time in 15 years surprising markets. Meanwhile, new data pointed to a slowdown in economic activity. Housing starts fell 14% in May to the lowest level since 2021, while the Philadelphia Fed's June business index showed that manufacturing activity contracted for the first time since May 2020. The S&P/TSX Composite fell more than 2% to 19,200, falling to a 12-month low, tracking a deteriorating global macroeconomic backdrop that could accelerate tightening after the Fed raised rates by 75 basis points in the previous session. The heavyweight energy sector was the biggest loser, with Safe Energy and UK Energy leading losses by 5% as recession fears dented energy demand. Mining stocks also posted big losses, tracking losses in gold and copper. On the data front, total wholesale sales in April were revised, showing the second contraction in the past three months. Hang Seng fell 2.2% to 20,845, its lowest level since May 27, and tracked overall negative cues after the Federal Reserve raised interest rates by the most since 1994 in response to rising inflation. Investors are increasingly concerned that high-interest rates and inflation will seriously damage economic growth. The technology index fell 3.3 percent, with Chinese companies down 2.6 percent. Heavyweights Alibaba, Tencent, and Meituan fell 3%-4%. On Thursday, the Shanghai Composite fell 0.6% to end at 3,285. In comparison, the Shenzhen Composite edged up 0.1% to close at 12,150 in mixed trade, consolidating recent gains as investors looked to the Chinese government for further policy support to help promote growth. The cabinet was quoted by Chinese state media on Wednesday as saying China would act decisively to increase support for the economy and introduce more policy measures, but not to release too much money. State media said the cabinet also reiterated its support for the "healthy development" of the platform economy. Meanwhile, stocks in mainland China were volatile as a rebound in global stocks following the Federal Reserve's bailout fizzled late in the Asian session. Growth stocks were mostly lower as investors took profits after their recent outperformance, with Everbright Securities (-7.2%), Contemporary Abe (-1.2%), and Orient Currency (-4.4%) falling sharply. The Nikkei 225 rose 0.4% to close at 26,431, while the broader Topix index rose 0.6% on Thursday to close at 1,868, up from a one-month low, tracking overnight gains on Wall Street as the Federal Reserve released a consensus forecast of 75. basis points, and said it was committed to curbing inflation. However, as a post-Fed bailout rally fizzled late in the Asian session, Japanese stocks lost most of their gains. Index heavyweights rose strongly, including Fast Retailing (1.4%), Toyota Motor (2.9%), and Sony Group (1.5%). Meanwhile, tech companies were mostly down, with SoftBank Group (-0.6%), Tokyo Electron (-0.8%), and Shinchuang Holdings (-1.7%). Elsewhere, investors assessed data showing Japan's widening trade deficit, with imports exceeding exports amid strong domestic demand, rising commodity prices, and a weak yen. Australia S&P/ASX 200 fell 0.15% to settle at an 18-month low of 6,591, offsetting early gains and tracking losses in U.S. stock futures as the post-Fed stock market rally weakened. Investors also digested Australia's solid jobs report, reinforcing bets that the country's central bank will raise interest rates by another half a percentage point in July. Market inner sectors were mixed, with index heavyweights lower including CSL Ltd (-0.9%), Westpac (-1.9%), Fortescue Metals (-1.1%), Computershare (-2.4%) and Transurban Group (down 1.6%). Meanwhile, Telstra (1.1%), Goodman Group (2.4%), Newcrest Mining (2.8%), South32 (2.1%) and Block Inc (1.5%) also recorded significant increases. Elsewhere, the Link Administration fell 10.4% after the country's competition watchdog raised concerns about Canada's Dye & Durham Ltd.'s proposed C$3.2 billion takeovers of the company. New Zealand S&P/NZ shares rose 17.22 points, or 0.16%, to settle at 10,653.14 on Thursday, their first gain in three sessions but not far from a 26-month low. Reports on Wednesday that U.S. stocks rallied strongly supported risk appetite, hoping that the economy will be better off in the long run if the Fed continues reining in prices now. The U.S. central bank on Wednesday approved the most significant rate hike since 1994, raising the federal fund's target rate by 75 basis points to between 1.5% and 1.75%. In China, there were signs of recovery in May, with industrial prices rising and retail sales falling less than expected. Domestically, the New Zealand economy suddenly contracted 0.2% quarter-on-quarter in the first quarter after growing by 3% in the fourth quarter. A negative contribution from net exports offset solid domestic spending. The biggest gainers were Bremworth Limited (6.7%), Vista Group International (6.5%), Sky Network Television (5.8%), and My Food Bag Group (4.7%).

REVIEWING ECONOMIC DATA:

Looking at the last economic data:

- CA: Wholesale sales in Canada fell 0.5% month-on-month to C$79.8 billion in April 2022, well below the initial forecast for a 0.2% increase and an upwardly revised 0.6% increase in March. The decline was supported by lower sales of miscellaneous goods (down 3.4%) and building materials and supplies (down 1.4%).

- US: The U.S. Federal Reserve Bank of Philadelphia’s manufacturing index fell to -3.3 in June 2022, well below the 5.5 growth forecast, marking the first contraction in factory activity since May 2020. New orders fell (12.4 to 22.1 in May), backlogs fell (7 to 17.9), and inventories fell (2.2 to 3.2). Meanwhile, price pressure eased slightly, but both prices paid (59.4 vs. 78.9) and prices received (49.2 vs. 51.7) remained high. On the other hand, while optimism about growth over the next six months has moderated, headcount has risen (29.2 and 25.5, respectively).

- US: In the week ended June 11, the number of new U.S. jobless claims fell by 3,000 to 22,900, below the market forecast of 210,000, again indicating an unusually tight labor market. Meanwhile, on a non-seasonally adjusted basis, initial jobless claims increased by 17,695 from the previous week to 204,461, led by Florida (up 2,098), Georgia (up 2,060), Pennsylvania (up 2,060). In addition, initial jobless claims rose significantly in Missouri (up 1,053) and Illinois (up 827). As a result, the 4-week moving average is 218,500, up 2,750 from last week's revised average.

- US: U.S. building permits, which represent future construction, fell at an annualized rate of 7% to 1.695 million in May 2022, the lowest level since last September and well below the forecast of 1.785 million. The number of licenses fell for the second time after remaining above 1.8 million for the past five months. Single-family authorizations fell 5.5% to 1.048 million, and charges for buildings with five or more units fell 10% to 592,000. Building permits declined in all four regions: the Northeast (down 20.2%), the West (down 7.1%), the Midwest (down 7.6%), and the South (down 4.7%).

- US: In May 2022, U.S. housing starts fell 14.4% month-on-month, the most significant decline since April 2020, as the housing market is facing high pressure from inflation and rising mortgage rates, coupled with increasing construction material costs and supply constraints, impacting the affordability of consumers. Total housing starts fell to 1.55 million last month from 1.81 million in April, the highest reading since May 2006. Single-family housing starts fell 9.2% to 1.051 million, while openings on five or more buildings fell 26.8% to 469,000. Operating rates in the South and West fell by 20.7% and 17.8%, respectively, but increased by 14.6% and 1.9% in the Northeast and Midwest.

- EU: In the first quarter of 2022, hourly labor costs in the euro area increased by 3.2% year-on-year, up from 1.9% in the previous quarter. Wages and hourly wages rose 2.7% (1.5% in the fourth quarter), and the non-wage component rose 4.8% (3.4% in the fourth quarter). Across all economic activity, growth was most robust in services (4% vs. 2.4%), followed by construction (3% vs. 2.1%) and industry (2.6% vs. 1.5%).

- JP: In May 2022, Japan's imports increased 48.9% year-on-year to a record high of 9,636.7 billion yen, which was higher than market expectations for a 43.6% increase and a 28.3% increase in April. It was the 14th straight month of double-digit growth and the fastest since May 1980, on strong domestic demand, surging commodity prices, and a weaker yen. Fossil fuel purchases surged 147.8%, boosted by oil (147.2%) and liquefied natural gas (154.7%); motor shares rose 36.0%, with semiconductors leading a 70.7% gain. In addition, imports from other countries also increased (32.8%); chemicals (25.4%); manufactured goods (31.0%), led by non-ferrous metals (17.5%); raw materials (45.1%), related to non-ferrous metal ores ( 75.7%); and mechanical (21.7%), driven by a computer (5.0%). In contrast, shipments of transport equipment fell by 14.3%. Imports from China (25.8%), US (24.2%), Taiwan (55.6%), South Korea (44.5%), Indonesia (101.8%), Germany (14.2%) and Australia (137.3%) rose; while Hong Kong fell up 10.6%.

In the first quarter of 2022, New Zealand's economy expanded 1.2% from a year earlier, slowing from a 3.1% increase a year earlier. Every quarter, GDP fell 0.2% in the three months to March after rising 3% in the previous quarter. In a quarter of shifts, omicron COVID-19 variants spread in the community. The March 2022 quarter saw lower travel due to border restrictions.

New Zealand's economy shrank 0.2% quarter-on-quarter in the three months to March 2022 after expanding by 3%, missing expectations. Primary industries (-1.2%) drove the contraction, followed by construction (1.7%) followed by commodity production (1.2%). Service activity stalled. On the spending side, exports were negative, with imports down 2.8%. On the other hand, private consumption (4.6%) and government spending (2%) increased. As a result, GDP grew 1.2%, down from 3.6% in the previous period.

LOOKING AHEAD:

Today, investors will receive:

- USD: Fed Chair Powell Speaks, Capacity Utilization Rate, Industrial Production m/m, CB Leading Index m/m, and Fed Monetary Policy Report.

- EUR: Final CPI y/y, Final Core CPI y/y, Italian Trade Balance, and ECOFIN Meetings.

- GBP: MPC Member Tenreyro Speaks, BOE Quarterly Bulletin, and MPC Member Pill Speaks.

- JPY: Monetary Policy Statement, BOJ Policy Rate, and BOJ Press Conference.

- NZD: BusinessNZ Manufacturing Index.

- CAD: Foreign Securities Purchases, IPPI m/m, and RMPI m/m.

KEY EQUITY & BOND MARKET DRIVERS:

- IT: Italian 10-year BTP yields fell below 3.9%, in contrast to French and German yields, as investors continued to assess the ECB's response to fragmentation concerns while pricing in rate hikes by major central banks. News of the ECB launching new tools after the emergency meeting has fueled speculation about how much the ECB will support indebted member countries to avoid a debt crisis and how this will affect the transmission of monetary policy tightening in July. Meanwhile, the Federal Reserve raised its fund rate by 75 basis points recently, while the SNB surprised markets by raising its policy rate by 50 basis points for the first time since 2007. The spread between the closely watched 10-year BTP and German Bund equivalents narrowed to 2.1 points despite a hawkish stance from central banks and European bond yields, reflecting a fall in Italian debt risk premiums and hopes. There will be no splits.

- FB: French 10-year OAT yields topped 2.3%, near an eight-year high of 2.4%, as investors priced in rate hikes by major central banks. The Fed raised its fund's rate by 75 basis points, the most significant increase since 1994, while the Swiss National Bank surprised markets by raising its policy rate by 50 basis points, and the Bank of England extended its tightening cycle for a fifth time Meeting. Meanwhile, investors continued to assess the possible impact of new measures by the European Central Bank to avoid a split in the eurozone on the transmission of tighter monetary policy and soaring inflation. Higher yields were concentrated in the euro zone's more robust economies, as demand for bonds in countries targeted by the new ECB support was less volatile. Meanwhile, the Bank of France revised its second-quarter growth forecast to 0.25% q/q, compared with a previous forecast of 0.2%.

- UK: UK 10-year gilt yields rose more than 2.6% in June, the highest level since July 2014, as it became clear that central banks around the world would continue to tighten monetary policy in response to soaring inflation. The Bank of England raised borrowing costs for the fifth time this month, and the Federal Reserve delivered its most significant rate hike since 1994. The Swiss National Bank also surprised markets by raising interest rates for the first time since 2007, while the European Central Bank is due to raise interest rates next month. However, there are growing concerns about how far the Bank of England can raise interest rates without triggering a recession. In addition, the latest data showed that real wages fell at a record pace in April as high inflation continued to squeeze consumers' living standards.

- UK: At its June 2022 meeting, the Bank of England raised its primary bank rate by 25 basis points to 1.25%, the fifth in a row, and pushed borrowing costs to an 11-year high to curb soaring inflation. 3 Policymakers voted for a more significant 50 basis-point hike, with the central bank boosting its commitment to bring inflation back to its 2 percent target and "act forcefully" if necessary. The central bank expects inflation to exceed 9% in the coming months and just over 11% in October, while GDP growth will slow sharply in the first half of the forecast period.

- TW: In June 2022, Taiwan's central bank raised its key discount rate by 12.5 basis points to 1.5%, the second consecutive hike, and pushed borrowing costs to their highest level since 2016. The move was in line with market expectations and came on the heels of the Fed's most significant rate hike since 1994. The central bank also said it would continue to adopt a tightening monetary policy stance, which will help strengthen the policy effect, curb domestic inflation expectations and maintain price stability. Policymakers also raised their annual inflation forecast to 2.83% (from 2.37% in March), while GDP growth is projected at 3.75% (from 4.05% in March).

- EU: European bond yields rebounded sharply on Thursday as investors priced in rate hikes by major central banks. The Federal Reserve raised its fund rate by 75 basis points, the most significant increase since 1994 but in line with current expectations. The SNB surprised markets by raising its policy rate by 50 basis points, the first upward revision since 2007. The 10-year German bund yield rose to an eight-year high of 1.9%, while French oat prices rebounded above 2.4%. Meanwhile, investors continued to assess the possible impact of new measures by the European Central Bank to avoid a split in the eurozone on the transmission of tighter monetary policy and soaring inflation. Yields on Italian 10-year BTP jumped above 4% after a sharp pullback on Wednesday. Still, the closely-watched spread between BTP and its German peers remained steady at 2.2 points, reflecting the lack of a significant rise in Italy's debt risk premium.

- US: Yields on the 10-year U.S. Treasury note held steady above 3.40%, near a more than three-year peak of 3.50%, as investors braced for more aggressive tightening by the Federal Reserve to curb sky-high inflation. The U.S. central bank raised its target interest rate by three-quarters of a percentage point on Wednesday to combat the highest inflation since late 1981 while expecting the economy to slow and unemployment to rise in the coming months. However, investors now worry that it would be the most significant rate hike since 1994 and could jeopardize the post-COVID-19 recovery.

- US: U.S. stock futures tracked the broader market down about 2%, with the major indexes on track for sharp losses as investors fretted about the impact of aggressive monetary policy tightening on the growth momentum. The U.S. central bank raised its target interest rate by three-quarters of a percentage point on Wednesday to combat the highest inflation since late 1981 while expecting the economy to slow and unemployment to rise in the coming months. The hike, the largest since 1994, comes as investors fear the move could jeopardize the post-COVID-19 recovery despite the Fed's efforts to curb inflation. Meanwhile, economic data on Thursday includes weekly jobless claims and housing starts.

- UK: FTSE 100 futures contracts fell on Thursday as investors reacted to the Federal Reserve's most significant rate hike since 1994 while awaiting the Bank of England's announcement later that it has raised borrowing costs for the fifth time. Meanwhile, according to the Institute of Grocery Delivery, UK grocery inflation will accelerate in the coming months, with summer food prices set to soar by 15%. On the corporate side, Halma and Syncona will report corporate results.

STOCK MARKET SECTORS:

- High: --

- Low: Energy, Consumer Discretionary, Materials, Information Technology, Financials, Communication Services.

TOP CURRENCY & COMMODITIES MARKET DRIVERS:

- JPY: The yen appreciated more than 1.5 percent to below $132 on Thursday, as there was a growing belief that the Bank of Japan would be forced to tighten policy alongside other central banks. Yesterday the Federal Reserve raised the fund's rate by the most since 1994, while today, the Bank of England raised rates for the fifth time in a row, and the Swiss National Bank raised its policy rate for the first time in 15 years surprising markets. In addition, the Japanese government recently stated that it expects the central bank to take "appropriate and necessary measures" given the sharp depreciation of the yen and the rising cost of living.

- RUB: The rouble was at 56 roubles per dollar in mid-June, near a seven-year high of 54.8 roubles hit in late May, as capital controls and soaring prices for Russia's main export continued to support the ruble. While individuals can now buy foreign currency, hard currency savings have lost their appeal because Russian banks have imposed high fees and negative interest rates on foreign currency deposits from “unfriendly” countries. In addition, the Moscow Exchange suspended Swiss franc trading in response to Berne sanctions. Meanwhile, soaring oil prices and rising sales to Asia have kept demand for the ruble relatively strong despite more significant uncertainty over energy supply levels in Europe. The ruble strengthened despite the Bank of Russia slashing its key interest rate to 9.5% before the invasion and some relaxation of capital controls.

- GBP: Sterling fell to the $1.2 mark, near a two-year low of $1.197 this week, after the Bank of England raised its benchmark interest rate by 25 basis points to 1.25% as expected. The euro remained under pressure as the Bank of England's rate hike did not match the Federal Reserve's 75 basis point hike and the Swiss National Bank's surprise 50 basis point hike despite a three-year high in borrowing costs. In addition, inflation in the UK is at its highest level in 40 years and is expected to hit double digits in the third quarter and 11% in the latest estimate for October. To make matters worse, recession fears remain widespread, with the UK economy shrinking by 0.3% in April and 0.1% in March.

- EUR: The euro regained ground after hitting a five-year low of $1.035 in mid-May. Risk sentiment returned to markets following the Federal Reserve's latest monetary policy statement, and investors stayed away from the haven dollar. The Federal Reserve raised the federal funds rate by 75 basis points, the most significant increase since 1994. Chairman Powell said a similar move could be made at the next meeting, making it clear that the central bank will go all out to crack down on Soaring inflation. Still, the euro is likely to remain under pressure as investors continue to doubt the ECB's ability to significantly raise borrowing costs, even after the ECB announced new measures to ease market turmoil, sparking a fresh round of criticism of the euro zone's southern periphery Debt crisis worries.

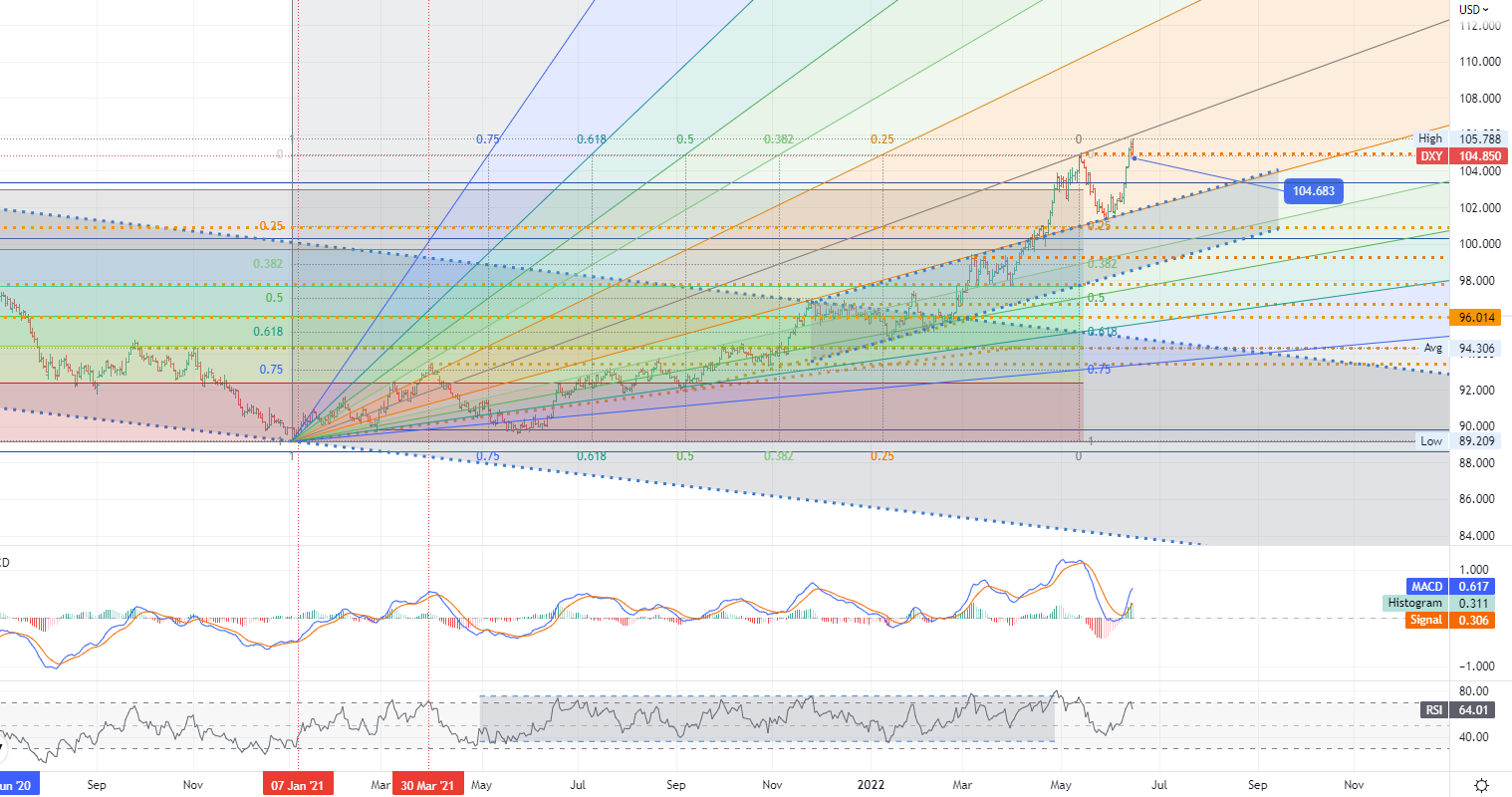

CHART OF THE DAY:

After stabilizing at a nearly 20-year high of 105, the dollar index fell more than 1 percent on Thursday to below 104 after yesterday's move by the Federal Reserve forced other central banks to consider raising interest rates faster and faster. The Fed posted a 75-basis point increase, the most significant increase since 1994, while Chairman Jerome Bowell said a 50 or 75 "seems most likely" at its next meeting in July basis point growth. In addition, the Swiss National Bank unexpectedly raised its policy rate by 50 basis points to -0.25%. In contrast, the Bank of England raised borrowing costs for the fifth time and said it was ready to take more significant steps if necessary.

- US dollar index (DXY) - D1, Resistance around ~ 105.788, Support around ~ 104.683 & 101.000

Demo account

The Blue Suisse Trading Account with virtual funds in a risk-free environment

Demo accountLive account

The Blue Suisse Trading Account in our transparent live model environment

Open an Account