Hawkish Fed expectations continue to weigh on sentiment

GLOBAL CAPITAL MARKETS OVERVIEW:

U.S. stocks gave up gains and turned negative in Thursday's session, with traders balancing better-than-expected economic data and the prospect of a rate hike while monitoring corporate earnings. The U.S. economy grew by a much better-than-expected 6.9% in the fourth quarter. While the Federal Reserve said it could tighten monetary policy faster than expected yesterday, some market participants are now betting on five rate hikes this year. The Dow fell more than 80 points after gaining more than 600 points, the S&P lost 0.6%, and the tech-heavy Nasdaq Composite fell 1.1% after gaining 1.6% at an intraday high. On the corporate front, Tesla shares tumbled nearly 9% after the automaker warned supply chain problems could continue into 2022, while Intel fell 6% on a mixed first-quarter outlook. In addition, McDonald's earnings missed expectations, and the company's shares fell 0.3%. European shares closed higher at the end of a volatile session on Thursday, with Frankfurt's DAX 30 up 0.2% and other major stocks up between 0.4% and 1.1%, largely on the back of an upbeat earnings season. Deutsche Bank posted its biggest profit since 2011 last year, rising more than 4%, beating expectations for a fourth-quarter loss, while French-Italian chipmaker STMicroelectronics posted a better-than-expected report. , up 2% after it announced plans to double its investment this year. On the other hand, German business software group SAP fell 6.7% after the group said it had agreed to buy a majority stake in private U.S. fintech firm Taulia. In other corporate news, UniCredit signed an agreement with unions to voluntarily cut 1,200 jobs, partly offset by 725 new hires. Elsewhere, investors digested comments from Federal Reserve Chairman Jerome Powell that policy tightening will continue this year to curb inflation. On Thursday, the FTSE MIB index rose 1% to close at 26,882 points, extending a 2.3% gain in the previous session, as U.S. economic growth data came in better than expected, corporate earnings were strong, and investors digested the Fed's tough forward guidance. The U.S. economy posted an annual spending rate of 6.9% in the fourth quarter, beating expectations for a 5.5% rate, while the Federal Reserve signaled a rate hike in March. On the corporate front, STMicroelectronics rose 1.8% after raising its 2022 net sales forecast to $14.8-$15.3 billion, citing increased demand and increased capacity investments of $3.4-$3.6 billion. Meanwhile, UniCredit rose 0.9% after signing an agreement with unions to cut 1,200 jobs, offset by 725 new hires voluntarily. On the political front, Italian lawmakers are expected to elect a new head of state in the fifth round of elections tomorrow, as blank votes dominate today's vote as parties discuss potential candidates. The CAC 40 offset early losses on Thursday, rising 0.6% to end at 7,024 on better-than-expected U.S. growth data and strong corporate earnings. The U.S. economy posted an annual spending rate of 6.9% in the fourth quarter, beating expectations for a 5.5% rate. Meanwhile, investors priced in a Fed rate hike in March, with a rate hike likely at every Fed meeting in 2022. On the corporate front, STMicroelectronics rose 1.8% after raising its 2022 net sales forecast to $14.8 billion to $15.3 billion, citing increased demand and increased capacity investments of $3.4 billion to $3.6 billion. Total Energies (1.4%) and Engie (2.5%) also rose. Canada's main stock index, the s&P/TSX, resumed its uptrend on Thursday after closing flat in the previous session, as gains in oil prices supported the heavyweight energy sector. Meanwhile, bank stocks were in positive territory as decisions by the Bank of Canada and the Federal Reserve on Wednesday continued to play a role in investors' choices. Traders also digested upbeat GDP data from the world's largest economy and Canada's top trading partner. Domestically, average weekly earnings rose 1.9% in November from the previous month, the sixth straight month of growth. Major stock markets in the Asia-Pacific region tumbled on Thursday, tracking overnight losses on Wall Street after the Federal Reserve set a more hawkish tone in March, signaling that it will raise interest rates and leaving the door open for steeper rate hikes. Technology stocks were the worst performers. The Nikkei 225 (down 3.1% to 26,170) and the KOSPI (down 3.5% to 2,614) led losses across the region. The Shanghai Composite Index fell 1.8% to close at 3394 points, the Hang Seng Index fell 2% to close at 23807 points, and the Australian Securities Exchange fell 1.8% to close at 6838 points, entering the adjustment range. The S&P/ASX 200 index fell 1.77% to close at 6838 on Thursday, down more than 10% from a record close in August and into correction territory. A hawkish Fed stance also weighed Australian tech and biotech stocks, offsetting gains in energy and mining companies. The U.S. central bank said it might raise interest rates in March and reiterated its plan to end its bond-buying program in the same month. High-growth technology and biotech stocks led the declines, with CSL Limited (down 3.45%), Sonic Healthcare (down 2.08%), Xero (down 6.69%), Noble Leisure (down 4.52%), and Wisetech Global (down 9.85%) ) dropped significantly. Gold stocks also fell on lower prices for the underlying commodity and retailers and manufacturers. Meanwhile, energy companies and heavyweight miners rose on higher oil and iron ore prices, with BHP Billiton (1.42%), Rio Tinto (2.06%), Woodside Petroleum (2.49%), and Santos Ltd (3.57%). %)rise.

REVIEWING ECONOMIC DATA:

Looking at the last economic data:

- US: The Kansas City Fed's manufacturing production index rose to 20 in January 2022, the highest level in three months, from a revised 11 last month. In January, factory growth was driven more by durable goods factory activity, particularly in primary metals, machinery, electrical, furniture, and transportation equipment manufacturing. Production, employment, and order backlog indices grew faster, while growth in supplier lead times continued to moderate slightly. New export orders also rose slightly. “Regional factory activity expanded at a faster rate in January. However, more than half of companies said they had 10% or more of their workers out at some point in January due to Covid-19. Although companies reported Covid-19, labor shortages, and ongoing supply chain issues, expectations for future activity remain strong,” said Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City.

- US: In December, contracts to buy U.S.-owned homes fell 3.8% in November and 2.3% in November, much worse than the 0.2% market forecast. It was the most significant drop in the number of homes for sale in eight months, as a reduced housing supply left consumers with few choices. In addition, contract activity declined in all four major U.S. regions. The NAR report said that existing-home sales are expected to fall 2.8% in 2022 and home prices to rise 5.1% in 2022, despite builders ramping up production.

- US: The U.S. economy grew 6.9% year over year in the fourth quarter of 2021, well above the 2.3% in the third quarter and well above the forecast of 5.5%. It was the most robust GDP growth in five quarters, with the most significant rise in private inventories (4.9 percentage points) contributing to auto dealerships. Companies have been reducing lists since early 2021. Personal consumption rose 3.3%, driven by a 4.7% surge in spending on services such as health care, entertainment, and transportation. Fixed investment rebounded 1.1%, led by intellectual property products, but a reduction in structure partially offset this. However, residential investment continued to decline, down 0.8%. At the same time, net trade did not contribute to economic growth, with exports of consumer goods, industrial supplies, food, and tourism leading by 24.5%; imports by 17.7%. Taking 2021 into consideration, the economy will grow by 5.7%, which is 1984.

- US: The number of Americans filing new jobless claims in the week ended Jan. 22 fell by 30,000 from the previous period to 260,000, in line with market expectations. It was the first reduction in applications in four weeks, after three straight weeks of increases in first-time applicants amid a surge in omicron coronavirus cases across the country. The 4-week moving average of claims was 247,000, up 15,000 from the previous week's revised average of 232,000, removing weekly volatility. On a non-seasonally adjusted basis, first-time applicants fell 73,000 to 267,000, with Pennsylvania (down 8,000), New York (down 6,000), and New Jersey (down 5,000). The number of first-time applicants has dropped significantly.

- HK: Hong Kong's trade deficit in December fell by HK$32.8 billion from HK$45.7 billion a year earlier. Exports rose 24.8% to a record HK$489.5 billion, driven by sales of motors, instruments, electrical appliances, and related components (29.8%) and office machines, and automatic data processing machines (44.0%). Among the most significant trading partners, exports to mainland China increased by 20.8%, exports to the United States increased by 19.9%, exports to India increased by 84.0%, and exports to Taiwan increased by 31.7%. Meanwhile, import growth slowed by 19.3% to an all-time high of HK$522.3 billion, mainly driven by electrical machinery, instruments, electrical appliances and related components (25.5%) and office equipment and automatic data processing equipment (37.2%). . Among major suppliers, imports from China increased by 20.9%, imports from the United States increased by 24.5%, imports from Singapore increased by 29.5%. Imports from South Korea increased by 16.1%. In 2021, Hong Kong's overall trade deficit will be 347.1 billion yuan, with exports rising by 26.3% to HK$4,968.1 billion and imports rising by 24.3% to HK$5,311.2 billion.

- CA: Canada's CFIB's Business Barometer Long Term Index, based on a 12-month outlook, fell 8.3 points to 54.3 in January 2021, the lowest since October 2020. In addition to concerns about new restrictions and ongoing labor shortages, many businesses report supply chain challenges.

- CA: Average weekly earnings for non-farm employees in Canada rose 1.9% to CAD 1130.81 in 2021 in November and ended the month little changed. Still, it was the sixth straight month of increases in average weekly earnings. Forestry, logging and support saw the biggest increases (12.8% to $1,337.63); mining, quarrying, oil and gas extraction (9.4% to $2,251.87); administration and support, waste management and remediation services (6.7% to $966.68) Canadian dollars); and construction (6.2% to $1,421.83). Regionally, Nunavut saw the fastest revenue growth (5% to $1542.43); Yukon (3.8% to 1327.14); Alberta (3% to 1231.81); and Nova Scotia (2.7% to $978.45).

- AU: In December 2021, the Melbourne West End Economics Institute Leading Economic Index fell 0.03 percent from a year earlier, registering negative growth for the first time in three months, after rising 0.21 percent in November. Meanwhile, the six-month annualized growth rate rose to 0.15% in December from -0.19% in November, indicating the likely pace of economic activity relative to trends over the next three to nine months. The index growth rate fell by 1.4PPT in the second half of 2021, rising from 1.4% in July to 0.15% at the end of the year. There are four reasons for the slowdown: commodity prices (-0.6 percentage points in Australian dollars); total hours worked (-0.5 points). Residency approvals (-0.2 points); and the S&P/ASX200 index (-0.2 points). The remaining four components - the yield spread, the Westpac Melbourne Institute Unemployment Expectations Index, the Westpac Melbourne Institute Consumer Expectations Index, and US Industrial Production - had a neutral impact on a combined basis.

LOOKING AHEAD:

Today, investors will receive:

- USD: Core PCE Price Index m/m, Employment Cost Index q/q, Personal Income m/m, Personal Spending m/m, Revised UoM Consumer Sentiment, and Revised UoM Inflation Expectations.

- EUR: French Consumer Spending m/m, French Flash GDP q/q, German Import Prices m/m, Spanish Flash GDP q/q, M3 Money Supply y/y, German Prelim GDP q/q, Private Loans y/y, and Italian 10-y Bond Auction.

- JPY: Tokyo Core CPI y/y.

- AUD: PPI q/q.

- CHF: KOF Economic Barometer.

KEY EQUITY & BOND MARKET DRIVERS:

- RU: The yield on the 10-year OFZ bond fell to 9.5% from a near six-year high of 9.8% on Jan. 26 as military tensions with Ukraine eased temporarily. Russian bonds rose after the U.S. rejected Russian demands for a security arrangement in Europe. Kremlin spokesman Dmitry Peskov said Moscow would not close the door on diplomacy. Still, investors remained cautious about Russian assets. The threat of sanctions and volatility caused by geopolitical tensions led the Treasury Department to cancel the OFZ bond auction for the second week in a row. Meanwhile, Bank of Russia Governor Elvira Nabiulina said the global pressures driving inflation represent a change in trends and will continue to rise for the foreseeable future. Russia's consumer inflation rate held at 8.4% in December, despite a sharp rise in 2021, ahead of a slowdown in the Russian policy rate to 2022.

- AU: Australia's 10-year government bond yield was near 2 percent, hovering at its highest since March 2019, as global bond markets jittered over a hawkish shift in the Federal Reserve's interest rate outlook. As expected, the U.S. central bank signaled a rate hike in March and has not ruled out further hikes at its next meeting this year. Meanwhile, investors are betting that the Reserve Bank of Australia's benchmark rate will be set at 0.25% in May this year, with more growth to follow in the next four years, followed by high inflation in the final quarter of 2021 to the expected data. In addition, core inflation climbed to a seven-and-a-half-year high of 2.6%, above the midpoint of the central bank's 2%-3% target range. The RBA does not expect underlying inflation to breach 2.5 percent until late 2023, a key indicator of its interest rate outlook.

- JP: On Thursday, the yield on benchmark Japanese 10-year government bonds jumped more than 15% to an 11-month high of 0.159% after the Federal Reserve made a hawkish change in its rate outlook. Still, the Bank of Japan's goal of keeping yields in the 0.25% range by buying bonds in the secondary market helps prevent yields from rising too much. Meanwhile, two-year and five-year government bond yields climbed to six-year highs of -0.055% and -0.01%, respectively. The Federal Reserve signaled a rate hike in March, as expected, but hasn't ruled out a rate hike at every future meeting.

- US: The yield on the benchmark 10-year Treasury note eased to 1.83% as traders digested a slew of economic data after the Federal Reserve set a more hawkish tone in the previous session. The world's largest economy grew at an annualized rate of 6.9% in the fourth quarter, beating market expectations for a 5.5% increase. In comparison, durable goods orders fell more than expected by 0.9% in December from the previous month. Meanwhile, jobless claims reached 260,000 last week, in line with market expectations. On Wednesday, the Federal Reserve signaled an expected rate hike in March while suggesting more frequent and more extensive rate hikes are likely this year. Chairman Powell also said that inflation is expected to be higher and likely not to decline to pre-pandemic levels anytime soon.

- US: U.S. futures held on to gains in a volatile session on Thursday after data showed the U.S. economy expanded at an annualized rate of 6.9% in the fourth quarter, well above expectations for a 5.5% increase and accelerating from a 2.3% expansion in the previous period. Yesterday, the Dow Jones Industrial Average and the S&P 500 closed lower after the Federal Reserve signaled that it would raise the federal funds rate in March. Chairman Powell's comments suggested the central bank would tighten monetary policy faster than expected. Some markets participated. Investors are now betting on five rate hikes this year. On the corporate front, shares of Tesla and Intel fell in premarket trading despite solid earnings reports. The automaker warned that supply chain issues could continue into 2022, and Intel's outlook for the first quarter was mixed. In addition, McDonald's revenue also missed expectations. Apple will report after the market closes today.

- CN: Yields on China's 10-year government bond rebounded from a 20-month low to above 2.73%, in line with regional bond yields, as traders reacted to a hawkish shift in the Fed's forward guidance, with rates expected to rise in March, while Beijing is considering tearing down real estate developer giant Evgrand. The company's restructuring package should sell most assets other than its separately listed property management company and electric vehicle division. Meanwhile, in early 2021, national government spending rose by 0.3% from a year earlier, the slowest pace in nearly 20 years, while fiscal revenue increased 10.7%, reflecting limited budgetary support for the sluggish economy. Yields hit 2.66% on Jan. 25, the lowest level since May 2020, after the People's Bank of China decided to cut key interest rates for the second time in a row while signaling more support for a slowing economy.

- UK: The CBI distributive trades survey's retail sales balance in the UK rose 20 percentage points from a month ago to +28 in January 2022, easily beating market expectations of +11, but suggesting that as the Omicron wave spreads, the UK Operating under tightened coronavirus restrictions, sales remained below seasonal standards. However, retail sales rose more than average compared to last year, as non-major retail stores in the UK closed. At the same time, despite this base effect, order growth with suppliers has slowed significantly. As a result, sales are expected to grow at a slightly slower pace in the year to February, while order growth is expected to pick up.

- UK: Helped by a weaker pound and a rebound in banking, the FTSE 100 rebounded in Thursday's session, outperforming its European peers and more than offsetting jitters from a hawkish Fed turn. Standard Chartered (+4.1%), HSBC (+3.2%), Natwest Group (+2.6%), and Barclays (+2.2%) rose on the back of rising government bond yields as the Federal Reserve Traders are betting on further rate hikes by the Bank of England after signaling a rate hike in March. On the earnings front, easyJet reported a total loss after tax of £858 million for fiscal 2021, compared with a loss of £1.079 billion for fiscal 2020. However, the low-cost carrier said it would boost capacity to two-thirds of pre-pandemic levels to absorb the resurgence in bookings as the impact of Omicron fades. Meanwhile, beverage maker Diageo's profit in the first half of fiscal 2022 climbed to £1.965 billion from £1.58 billion in the same period in fiscal 2021.

- EU: In February 2022, Germany's GfK consumer climate index edged up to -6.7 from a downwardly revised -6.9 in January, better than market forecasts of -7.8. It was the first improvement in consumer sentiment in three months as households hoped to improve inflation and possible relief from the outbreak in the spring. The base effect of a reversal of VAT in January 2021 will allow inflation to moderate, but consumer price expectations remain well above recent years. Experts also believe that the outbreak will ease in the spring, which will lead to some restrictions being lifted, GfK consumer expert Rolf Bürkl said.

STOCK MARKET SECTORS:

- High: Communication Services, Consumer Staples, Energy, Materials.

- Low: Consumer Discretionary, Industrials, Financials, Real Estate.

TOP CURRENCY & COMMODITIES MARKET DRIVERS:

- CAD: The Canadian dollar traded around 1.27 against the greenback amid a stronger dollar, not far from a one-month low of 1.27566 hit on Jan. 5. The U.S. dollar index traded above 97, close to levels not seen since June 2020, after stronger-than-expected U.S. fourth-quarter GDP growth reinforced the Federal Reserve’s more hawkish stance. Still, at home, the Bank of Canada kept interest rates steady at its first meeting in 2022, disappointing some investors but suggesting a rate hike will happen soon, possibly at its next meeting on March 2.

- USD: The U.S. dollar index rose to 97.2 for a fourth straight session on Thursday, hovering at its highest level since June 2020, after stronger-than-expected U.S. fourth-quarter GDP growth reinforced the Federal Reserve’s more hawkish stance. On Wednesday, the U.S. central bank said inflation remained well above its 2 percent target against the backdrop of a strong labor market, with rate hikes likely to accelerate and expand in the coming months.

- RUB: The Russian ruble rebounded to 77.7 roubles per dollar from a 14-month low of 80.3 roubles per dollar on Jan. 26 as fears of military action in Ukraine receded temporarily. Although the United States has rejected Russia's security demands for Ukraine to join NATO, Russian foreign ministry officials have repeatedly stressed that a war with Ukraine is unacceptable. However, investors remained cautious about Russian assets due to the threat of sanctions from Western countries. Meanwhile, Russia’s central bank is expected to raise interest rates further next month to curb inflation, undoing previous expectations of lower rates in 2022. Annual inflation was 8.4% in December, one of the highest levels since January 2016 and well above the central bank's 4% target, prompting CBR Governor Elvila Nabiulina. Nabiullina said consumer prices are expected to rise for the foreseeable future.

- EUR: The euro fell below $1.12, hovering near its lowest point since June 2020, as the Federal Reserve said it would begin tightening in March and Chairman Jerome Powell said "there is a considerable Room for rate hikes" investors scrambled to buy the dollar. This week, the euro has come under pressure after data showed that eurozone economic growth slowed sharply in January, and worries about a potential military conflict in Ukraine weighed on riskier currencies. Elsewhere, eurozone money markets are pricing in two ten basis point rate hikes by the European Central Bank by the end of the year.

- CNY: The offshore yuan weakened by $6.35 against the dollar on Thursday, its most significant one-day drop since June 2021, as the U.S. dollar said it could raise interest rates in March and begin shrinking its balance sheet soon after the Federal Reserve noted Major peers rose sharply. The hawkish solid outlook in the U.S. contrasts with China's policy easing measures to reduce an economic slowdown. The People's Bank of China slashed several critical short- and medium-term interest rates and analysts expect more easing measures to lower the reserve requirement ratio. Thursday's action erased the yuan's year-to-date gains, driven by strong corporate demand, a widening trade surplus, and strong exports.

- JPY: After falling sharply in the previous session, the yen continued to fall on Thursday, surpassing 114.5 yen per dollar. The U.S. dollar rallied against major currencies after the Federal Reserve said it could raise interest rates in March and soon shrink its balance sheet. The yen came under intense pressure late last year as significant economies said they were ready to normalize monetary conditions. At the same time, the Bank of Japan vowed to maintain its ultra-easy monetary policy to achieve its 2 percent price stability target. Meanwhile, the Bank of Japan noted that inflationary pressures are building in its latest quarterly outlook report, with core consumer prices expected to hit 1.1% in the fiscal year ending March 2023 and warned that raw material costs continue to soar. Maybe faster than expected.

- AUD: The Australian dollar weakened to a seven-week low of over $0.71 on Thursday. The Aussie was under heavy pressure from a rising dollar, and intense risk aversion after the Federal Reserve said it could raise interest rates in March and soon shrink its balance sheet. Investors also weighed the prospect of an earlier rate hike in Australia, where core inflation accelerated to 2.6% in the fourth quarter of 2021, faster than the 2.3% forecast and registered in the RBA's 2-3% target range. However, the latest inflation figures challenge the RBA's stance. It has repeatedly insisted that domestic interest rates are unlikely to rise until 2023 or until inflation continues to push towards its 2-3 percent target range.

- NZD: The New Zealand dollar fell to a 15-month low of 0.665 on Thursday, even as the country's full-year inflation surged to a three-year high of 5.9 percent in 2021. Prime Minister Jacinda Ardern said a sharp rise in the cost of living was widely expected, blaming "oil prices and international tensions." At the Feb. 23 policy meeting, soaring consumer prices raised the risk of a 50 basis point rate hike as inflation is expected to remain high. The Reserve Bank of New Zealand already raised rates twice last year to 0.75%, and it expects it to reach 2.5% by mid-2023. Meanwhile, the New Zealand dollar has come under heavy pressure from a rising U.S. dollar, and risk aversion after the Federal Reserve said it could raise interest rates in March and begin shrinking its balance sheet soon after.

CHART OF THE DAY:

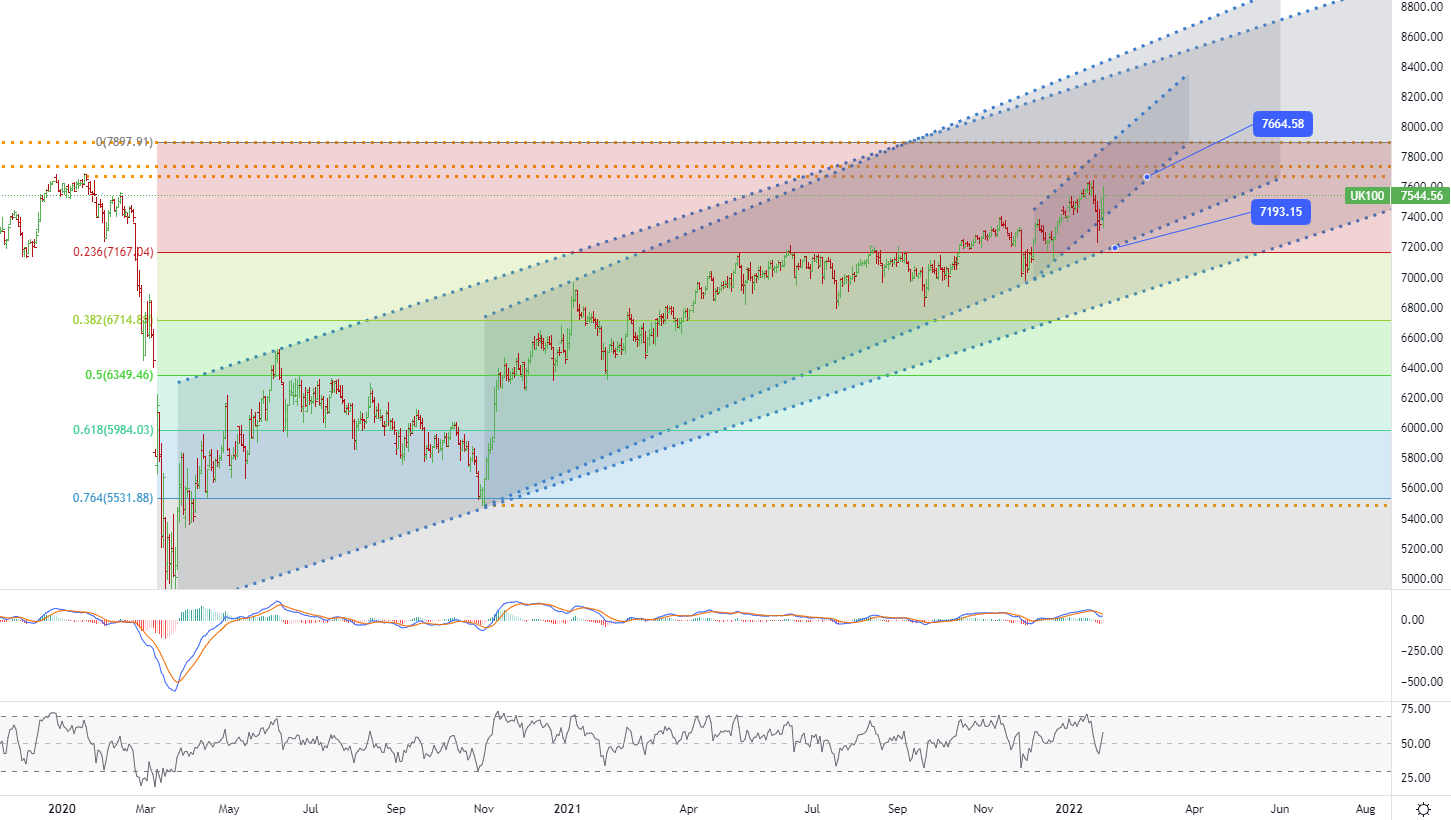

On Thursday, the FTSE 100 rose 1.1% to close at 7,550, in line with its European peers, and extended gains for a third straight session, as a weaker pound and a rebound in banking offset expectations for a hawkish Fed turn. Worry. Standard Chartered (+5.1%), HSBC (+3.4%), Natwest Group (+2.1%), and Barclays (+1.1%) rebounded on the back of rising government bond yields as the Federal Reserve Traders are betting on further rate hikes by the Bank of England after signaling a rate hike in March. On the earnings front, easyJet reported a total loss after tax of £858 million for fiscal 2021, compared with a loss of £1.079 billion for fiscal 2020. However, the low-cost carrier said it would boost capacity to two-thirds of pre-pandemic levels to absorb the resurgence in bookings as the impact of Omicron fades. Meanwhile, beverage maker Diageo's profit for the first half of fiscal 2022 climbed to £1.965 billion from £1.58 billion in the same period in fiscal 2021. - UK FTSE 100 index - D1, Resistance around ~ 7664, Support around ~ 7193

- UK FTSE 100 index - D1, Resistance around ~ 7664, Support around ~ 7193

Demo account

The Blue Suisse Trading Account with virtual funds in a risk-free environment

Demo accountLive account

The Blue Suisse Trading Account in our transparent live model environment

Open an Account