US Stocks Flat, Set to End July on Positive Note- Weakness in some mega cap stocks weighing on index performance; Italian Stocks Up 5.1% on Month

GLOBAL CAPITAL MARKETS OVERVIEW, ANALYSIS & FORECASTS:

Author: Dr. Alexander APOSTOLOV (researcher at Economic Research Institute at BAS)

The US stock market was weak on the last trading day of July. Prior to this week, the corporate performance of two large stocks and more economic data, including employment reports, and investors betting on the Fed’s interest rate hike is coming to an end. Apple (Apple), Amazon(Amazon) and advanced microequipment (Advanced Micro Devices) will all publish reports this week. In terms of enterprises, Chevron (+3%) is the best performer in the Dow Jones Index. Previously, Goldman Sachs raised the company from buying to buying, and raised the target price. On the other hand, after a federal judge dismissed Johnson’s efforts to limit the responsibilities related to talcum powder, Johnson & Johnson was the largest laggard (-4.2%). So far that month, the Dow Jones index has risen by 3% and the S&P 500 index has risen by 2.9%. This will be its fifth consecutive month of rise, with the Nasdaq index rising by 3.8%.

Canada S&P/Toronto Stock Exchange Composite Index rose by 0.5%, hovering above the 20600 mark, the highest point in three months. Traders continued to evaluate key commodity markets and digest the latest corporate performance to Measure the performance of the Canadian corporate sector in the current high interest rate environment. Energy producers have risen, and Senkor and Cenovus energy have both risen by 2%. Prior to this, major producers were again expected to reduce production, thereby pushing up prices. Mining stocks have also risen, and Barrick’s gold has risen by 1% as gold prices have strengthened%.

The European stock market rose slightly on the last trading day of July, the Frankfurt DAX 40 index reached a record high of 16,540 points, and the pan-European STOXX 600 index hovered near the highest level since February 2022. Investors welcomed the slowdown in inflationary pressures in the euro area in July. Although there are signs that core inflation is weak, GDP growth has also rebounded in the second quarter. In terms of enterprises, Heineken lowered the profit growth forecast for 2023, and the education group Pearson confirmed its goal after experiencing profit growth in the first half of the year. In addition, Erste Group Bank's second quarter profit exceeded market expectations. Judging from the monthly performance, the DAX index is expected to close with a 2.8% increase, while the STOXX index will rise by 2.2% because investors want the European Central Bank and the Fed to temporarily suspend the current austerity cycle. In addition, the discussion on China's additional stimulus measures provided market support.

On Monday, the MTB index rose by 0.5% at 29645 points and ran to beat its European counterparts, reaching its highest level since 2008. Leonardo’s stock price soared by 3.7%. The company previously reported a surge in new orders in the first half of this year. Its CEO stated that the aerospace, defense and security company will focus on the rapidly growing cybersecurity and space industries. Traders are also digesting the European Banking Authority’s 2023 stress test, which concluded that the European Bank “ maintains flexibility under the adverse conditions of a severe recession in the European Union and the world, rising interest rates and rising credit spreads ”. Unicredit rose by 2.5%, United Sao Paulo Bank rose by 0.9%, and this year's profit expectations were raised on Friday. At the same time, the latest economic data shows that the Italian economy contracted unexpectedly in the second quarter, while inflation slowed in July more than expected. However, in the euro area, GDP has resumed growth and inflation has eased. In the month, the MIB index soared by 5.1% when it was rich%.

The CAC 40 index was collected at 7500 points on Monday, slightly higher than the flat line (+0.29%), which is the same as its European counterparts and is affected by the slight recovery of the euro zone’s economic growth and slowing inflation. Among the stocks, ArcellorMittal(+2.43%) and Senofi(+)2.24%( performed best, while TotalEnergies+)1.51%< TAG1> positively benefited from the evolution of crude oil. On the other hand, Teleperformance SE(-2.84%) continued to fall after its disappointing quarterly profit, and investors analyzed the report last week. In addition, Buig (-1.93% ) and Renault (-1.55% ) performed the worst. After Xili lowered this year's profit growth forecast, Bailega also fell by about 1%. Market participants are waiting for another wave of corporate financial newspapers this week, including those of Ansheng and the French Agricultural Credit Bank. That month, the CAC 40 index rose by 1.51%.

On Monday, the FTSE 100 index was collected at 7,700 points, slightly higher than the horizon, and the increase of the previous week was expanded to a two-month high point, because the market continued to digest corporate profits to understand the latest performance of the corporate sector in interest rate hike. Following measures taken by US and European counterparts, the Bank of England is expected to raise bank interest rates again this week. However, unlike the Fed and the European Central Bank, it is generally believed that the British Central Bank will continue to raise interest rates in the third quarter. The number of resource-supported stockpiles has risen sharply, and the prices of gold, basic metals, and energy have risen due to concerns about oil production cuts and the prospect of China’s economic stimulus. BP and Canon rose by 1.5%, and Shell rose by more than 1%. On the other hand, after the performance of the first half of the year was announced, Pei Sheng erased the morning disc increase and the closing volume fell by 0.6%.

On Monday, the Russian index of MOEX based on rubles soared by 2.2%, which was collected at 3074 points. This was the highest point since Russia’s invasion of Ukraine in February 2022 with the strong support of banks and metallurgists. Prior to the announcement of performance in the second quarter this weekend, the priority shares and common shares of the Russian Federation Savings Bank rose by more than 6. In addition, VTB continued the upward trend last week, rising by 3% in the market%. Last week, after the bank’s chief financial officer announced a robust performance in the first half of the year, it is expected that this year’s profit will be recorded. At the same time, the stock prices of Rosseti and its local subsidiaries soared after the announcement of strong profit growth and guidance, mainly due to the indexation of boiler tariffs this year.

The Asian stock market rose on Monday, following the rise of Wall Street, and the US personal consumption expenditure price index data in June continued to show that inflation has eased. Investors also digested data on the fourth consecutive month of contraction in China's manufacturing activities in July. At the same time, after the adjustment of the yield curve control policy of the Bank of Japan, the yield of the 10-year Japanese Treasury bonds reached a new high in nine years, and the market paid close attention. Australia, Japan, South Korea, Hong Kong and mainland China's stock markets have all risen.

The Hong Kong stock market rose 162.38 points on Monday, an increase of 0.82%, and it was collected at 20078.94 points. It rose for the third consecutive trading day, with an increase of 4.0% this month%. Beijing announced measures to stimulate consumption after the Politburo meeting last week, demonstrating its determination to revitalize the Chinese economy. A strong trading day on Wall Street Friday also boosted market sentiment, and optimism about the soft landing of the US economy after inflation was further alleviated. However, the Hang Seng Index echoed the premiere increase, and there are reports that China’s factory activity contracted for the fourth consecutive month in July, while the service industry grew the lowest in seven months. Almost all plates have risen, and restaurant operators have risen in Haidiao International (Haidiao International Hlds). Battery manufacturer Contemporary Amperex Tech rose 12.2% and 3.4% respectively after announcing strong profits%. China Hongqiao Group (5.2%), Chinese Pharmaceutical Group (4%), New Austria Energy (3.8%), USA (2.7%) and Tenjin Holdings also achieved substantial victories. (1.1%).

China index finger rose by 0.9%, collected at more than 3300 points, and the ingredient stock rose by 1.4%, collected at 11255 points. As investors responded to China's latest economic data, the mainland stock market rose for the second consecutive trading day. The latest data shows that the country’s manufacturing activities contracted for the fourth consecutive month in July, but it was higher than market expectations, and the growth of the service industry slowed to a seven-month low. Despite this, investors still hope that the Chinese authorities can honor their commitments and boost the economy with a weak recovery after the epidemic. Significant increases are in the Eastern currency information (2.8% ).

On Monday, the Nikkei 225 index rose by 1.9%, receiving above 33300 points, and the Dongxiang index rose by 1.6%, and received at 2327 points. Although the Japanese government's bond yield rose under pressure, the Dongxiang index still reached a new high of 23 years. The Japanese stock market also followed Wall Street on Friday because the easing of inflationary pressures in the United States reduced the possibility of the Fed tightening its currency further. Last week, the Bank of Japan maintained the ultra-low interest rate policy, but changed the wording to make its yield curve control policy more flexible, allowing the 10-year yield rate to exceed the 0.5% ceiling. Toyota (2.6%), Tokyo Electronics (2.8%), Mitsubishi Commercial (2.9%), Soft Silver Group (1%) 2.2% <TAG<1> and East Index.

The S&P/Australian Exchange 200 index rose by 0.3%, received more than 7420 points, recovered part of the lost land on the previous trading day, and the technology share rose. The Australian stock market also followed Wall Street on Friday because the easing of inflationary pressures in the United States reduced the possibility of the Fed tightening its currency further. The top increases in the technology sector are Carsales.com(2.2%), Wisetech Global(0.8%), Xero(0.8%), Rea Group(1.2%<TA<G1> and Block. Other index weight stocks also rose, including Fortescue Metals(0.6%), Woodside Energy(0.8%) and Commonwealth Bank(0.3%), Flight Centre(0.7>TA. In corporate news, Silver Lake Resources' stock price fell by 20% due to reports that its sugar area mining and processing activities will be idle in 2024.

India BSE Sensex index continued the increase in the morning disc, which rose 370 points on Monday and received it at 66530 points. With the support of metal producers, power operators and technology companies, the decline of the previous week was recovered. The technology giant of the Mumbai transaction rebounded from the plunge on Friday, because the US data released after the last trading day showed that US consumer demand remained flexible, improving the prospects of major customers in the industry. Tech Mahindra rose by 2.2%, TCS and Wipro rose by 1.8% and 1.6%, respectively%. Automobile manufacturers also recorded an increase, and Maruti Suzuki’s stock price rose by 1.7% before the quarterly performance was announced%. Finally, NTPC and grid stocks rose by 4% and 3%, respectively. After the former announced strong performance, it laid the foundation for power operators.

REVIEWING THE LAST ECONOMIC DATA:

Reviewing the latest economic news, the most critical data is:

- US: In July 2023, the Texas General Business Activity Index of the Federal Reserve Bank of Dallas rose to -20.0 for the second consecutive month, the highest level in four months. However, as a key indicator for measuring the state of the country’s manufacturing industry, the production index is still relatively stable at -4.8, indicating a slight contraction in output. The new order index has been negative for more than a year and has dropped slightly to -18.1. In addition, the capacity utilization rate and the shipment volume index are still at a negative value, but have improved to reach -2.4 and -2.2, respectively. Since February, the capital expenditure index has continued to fluctuate within a lower or slightly negative range, from -2.4 in July. Finally, labor market indicators indicate that employment growth is faster and work weeks are longer, while inflationary pressures have increased and wage growth has shown signs of slowing.

- EU: Preliminary estimates show that after the euro zone economy remained flat in the first quarter, it increased by 0.3% in the second quarter of 2023, slightly higher than the market's generally accepted growth of 0.2. The recovery of demand may be driven by easing inflationary pressures. However, rising interest rates and declining confidence continue to put pressure on the single currency economy. Among the largest economies in the European Union, France and Spain have shown sustained growth rates, while the German economy has stagnated, and Italy has unexpectedly contracted. The annual growth rate in the euro area is 0.6%, which is the weakest rate of expansion since the 2020-21 economic recession.

- EU: Preliminary estimates indicate that the annual inflation rate in the euro area has fallen from 5.5% in June to 5.3% in July 2023 for the third consecutive month, consistent with market forecasts. This is the lowest reading since January 2022, because energy prices have fallen further (-6.1% vs. -5.6%), and food, alcohol and tobacco costs have fallen (10.8% vs. 11.6%), The cost of non-energy industrial products fell by (5% vs.5.5%). On the other hand, the service industry inflation rate continues to rise from 5.4% to 5.6%. Compared with the forecast of 5.4%, the growth rate of alcohol and tobacco remains unchanged at 5.5%, which is higher than the overall growth rate for the first time since 2021. Compared with June, CPI in the euro area fell by 0.1%. The ECB's inflation target is 2%.

- IT: Preliminary estimates show that in July 2023, Italy’s annual inflation rate fell further to 6%, slightly lower than the market’s expected 6.1%, compared with 6.4% last month%. The main reason for the decline is the decrease in service costs associated with transportation (2.4% vs. 4.7%) and non-regulated energy (7% vs. 8.4%). The price of processed foods also rises at a milder rate (10.9% vs. 11.5%). On the other hand, the price of unprocessed food continues to rise (10.4% vs. 9.4%). At the same time, the core price dropped from 5.6% in July to 5.2%. After CPI remained unchanged in June, it rose slightly by 0.1% per month%.

- IT: According to the latest estimates, in the three months to June 2023, Italy’s GDP contracted by 0.3% quarterly, a decrease of 0.6% from the previous period, and performed inferior to market expectations of stagnation. This result is consistent with the slowdown in European growth, as the decline in output in the primary and industrial sectors offsets the moderate growth in the service industry. The data also shows that the Italian economy has shown greater vulnerability to the European Central Bank’s radical austerity policies, exacerbating its concerns about high debt. On an annual basis, Italy’s GDP grew by 0.6% during this period, setting the 10th consecutive growth period, albeit the slowest. Nevertheless, officials expect the Italian economy to grow strongly this year. Prior to the release of preliminary data in the second quarter, the Bank of Italy predicted that Italy’s GDP would grow by 1.1% in 2023, while the European Commission and Prime Minister Meloni’s cabinet predicted a growth rate of 1.2%.

- HK: Preliminary estimates show that Hong Kong’s economy grew by 1.5% year-on-year in the second quarter of 2023, which was lower than the market’s forecast of 3.6% growth, and slowed down from the previous quarter’s increase of 2.9. The slowdown in GDP is caused by a small increase in private consumption of (8.5% to 11%) in the first quarter and government expenditure (-9.6% to 1.1%) and fixed investment( -1% pairs. 9%) is driven by a decline. In terms of foreign trade, service exports (22.6% vs. 16.6% ) and service imports (30.2% vs. 20.7% ) grew strongly. However, this part was offset by a decline in commodity exports (-15.3% vs.-18.9% ) and commodity imports (-16.1% vs. -14.6% ). The seasonally adjusted quarterly economic contraction was 1.1%, compared with 5.4% in the first quarter, a new high in two years, and did not reach the market's expected 1%.

- UK: In June 2023, the net borrowing flow of British personal mortgage debt increased to 100 million pounds. In May, the net repayment was 100 million pounds and in April, the net repayment was 1.1 billion pounds, a record high, excluding the period since the outbreak of the new crown pneumonia. Total loans increased for the second consecutive month, from 19 billion pounds in May to 20 billion pounds in June. Similarly, the total repayment increased from 19 billion pounds to 19.8 billion pounds. In June, the actual interest rate “ actual ” interest rate for newly withdrawn mortgage loans rose by 7 basis points to 4.63%, while the interest rate for outstanding mortgage loans also increased by 10 basis points to 2.92%.

- UK: In June 2023, the net UK purchase approval as a future borrowing indicator increased from 511,000 last month to 547,000, exceeding the market's expected 490,000. This is the highest level of net purchase approval since October 2022. However, this figure is still lower than the monthly average of 62,700 in 2022. Similarly, the re-mortgage approval, which only includes re-mortgage with different lenders, increased from 341,000 in May to 391,000. In June, the newly withdrawn “ actual ” interest rate, that is, the actual interest rate paid, rose 7 basis points to 4.63%, and the interest rate of outstanding mortgage loans also increased by 10 basis points to 2.92%.

- GE: In June 2023, German import prices fell by 11.4% year-on-year, and the decline exceeded market expectations by 10.7% and 9.1%, respectively%. This is the largest decline since September 2009, and energy prices (-44.9%) continue to fall, namely natural gas (-50.6%), electricity (-57.6%), hard coal (-53.6% <TA<T> Oil. Excluding petroleum and petroleum products, import prices fell by 7.9%. The cost of intermediate products fell by 8.8%, and the prices of consumer goods and capital goods rose by 2.7% and 4%, respectively%. From a monthly perspective, import costs fell by 1.6%, exceeding the market's expected decline of 0.7% and May's 1.4.

- GE: In June 2023, the unintended chain ratio of retail sales in Germany fell by 0.8%, which was lower than the market forecast of 0.2% growth, compared with 1.9% after the increase last month%. This is the first decline in retail trade since March. At the same time, retail sales fell by 1.6% from June 2022, and food prices fell for 24 consecutive months. Considering that in the first six months of this year, retail trade fell by 4.5%, sales of food (-5.8%) and non-food (-3.6%) declined, while online and mail Purchase sales increased by 7.3%.

- CN: In July 2023, China's non-manufacturing PMI announced by the National Bureau of Statistics fell from 53.2 last month to 51.5. Although it was pointed out that after the elimination of epidemic control measures in Beijing at the end of last year, service industry activities have grown for the seventh consecutive month, the latest result is the slowest growth rate in this sequence. The new order (48.1 is 49.5) in June and foreign sales (47.7 is 49.0) for the third consecutive month, and it is faster. At the same time, employment is still weak, falling for the fifth consecutive month (46.8 to 46.8). At the same time, the delivery time index reached the lowest value in six months (51.4 to 51.9). In terms of price, the input cost increased by (50.8 to 49.0) after the decline in the first two months, while the sales price dropped at a weaker rate (49.7 to 47.8). Eventually, market sentiment softened to a seven-month low point (59.0 to 60.3).

- CN: In July 2023, the comprehensive PMI output index of the National Bureau of Statistics of China fell from 52.3 last month to 51.1. This is the lowest number since December 2022. After Beijing cancelled strict epidemic measures at the end of last year, the economic recovery was uneven. Factory activities have contracted for the fourth consecutive month, reflecting weak domestic and foreign demand and the continued downturn in real estate; and the expansion of the service industry has been the lowest in seven months.

- NZ: In the early transaction on the last trading day in July, New Zealand’s stock market rose by 27 points, an increase of 0.23%, to 11974, this month will rise by 0.5%, which will be the second consecutive increase, thanks to Wall Street’s Friday Active lead, because the key indicators of US inflation are further eased, Americans are more optimistic about the economy. At the same time, after the Politburo meeting, more measures to stimulate the Chinese economy emerged last week, including sound monetary policy and active financial support. In addition, according to reports, Beijing plans to establish an exchange dedicated to helping small businesses obtain funds. Locally, a series of New Zealand economic data will be published this week, including business sentiment in July, construction permits in June, and unemployment in the second quarter. Marsden Maritime Hlds has experienced significant increases in non-energy minerals, energy minerals, consumer services and utilities. (1.9%), Genesis Energy(1.1%), Skycity Entertainment(0.9%) and Ryman Helathcare(0.7%)

LOOKING AHEAD:

Today, investors should watch out for the following important data:

- CNY : Caixin Manufacturing PMI.

- AUD : Building Approvals m/m , Cash Rate, Commodity Prices y/y, and RBA Rate Statement.

- CHF: CHF Bank Holiday.

- CAD : Manufacturing PMI.

- EUR: Spanish Manufacturing PMI , Italian Manufacturing PMI , French Final Manufacturing PMI , German Final Manufacturing PMI , German Unemployment Change , Final Manufacturing PMI , Italian Monthly Unemployment Rate, and Unemployment Rate.

- GBP : BRC Shop Price Index y/y, and Final Manufacturing PMI.

- JPY: Unemployment Rate , Final Manufacturing PMI , and 10-y Bond Auction.

- NZD: Building Consents m/m, and GDT Price Index.

- USD: Final Manufacturing PMI,ISM Manufacturing PMI, JOLTS Job Openings, ISM Manufacturing Prices , Construction Spending m/m

FOMC Member Goolsbee Speaks, and Wards Total Vehicle Sales.

KEY EQUITY & BOND MARKET DRIVERS:

Кey factors in the stock and bond market are currently:

- US: U.S. stock futures rose on the last trading day of July, and the Dow Jones Index contract rose by about 70 points, while both the S&P 500 index and the Nasdaq 100 index rose by about 0.1%. Traders continue to pay attention to corporate performance, while betting on the Fed’s interest rate hike operation is coming to an end, and waiting for more economic data, including Friday’s employment report. Apple (Apple), Amazon(Amazon) and advanced microequipment (Advanced Micro Devices) will all release reports this week. FactSet data shows that 51% of the companies in the S&P 500 index announced their performance in the second quarter. As of last Friday, the combined revenue in the second quarter fell by -7.3%, compared with 9.1% last week%. So far that month, the Dow Jones index has risen by 3.1% and the S&P 500 index has risen by 3%. This will be its fifth consecutive month of rise, with the Nasdaq index rising by 3.8%.

- UK: The 10-year British Phnom Penh bond yield continues to consolidate its growth rate, exceeding 4.3%, reaching its highest level since July 17, and investors are preparing for the August policy meeting of the Bank of England. British officials are expected to raise interest rates by another 25 basis points, pushing borrowing costs to their highest level since the 2008 financial crisis in response to continued high inflation. However, the UK’s recent economic data is weaker than expected, reducing people’s expectations of the peak interest rate level of the Bank of England. At present, the pricing of interest rates in financial markets reached a peak of 5.75% in November.

- GE: Germany’s 10-year national debt yield rose slightly to 2.5%, the highest level since it reached a four-month high of 2.55% on July 11, because the market digested the latest economic data to suggest whether the European Central Bank will be in the upcoming September meeting Extend austerity policy. The inflation rate in the euro area fell to 5.3% in July, which is in line with expectations, but it is still significantly higher than the European Central Bank's 2% target. In addition, the core consumer inflation unexpectedly did not slow down, and the GDP of the currency group increased by 0.3% in the second quarter, exceeding expectations, which strengthened the reason for raising interest rates again this quarter. At a recent meeting, the central bank raised the key interest rate by 25 basis points in accordance with previous commitments, and opened the door for further interest rate hikes as economic data permits. The bank kept its quantitative austerity pace unchanged, but announced that it would stop paying the minimum reserve interest to tighten bank liquidity.

LEADING MARKET SECTORS:

- Strong sectors: Energy, Utilities, Real Estate, Financials, Materials, Consumer Discretionary.

- Weak sectors: Health Care, Information Technology, Consumer Staples.

TOP CURRENCY & COMMODITIES MARKET DRIVERS:

Кey factors in the currency and commodities market are currently:

- EUE: The euro rose slightly to $1.1, as investors digested new economic data and monetary policy prospects. Preliminary CPI data shows that the overall inflation rate in the euro area has fallen to 5.3%, the lowest level since January 2022, while the core inflation rate has stabilized at 5.5%, much higher than the European Central Bank's 2% target. At the same time, the economy resumed growth in the second quarter, with a growth rate faster than the expected 0.3%, exceeding the forecast of 0.2. At the same time, the ECB President Lagarde emphasized in an interview that interest rate hikes may be further increased or suspended in September, but whenever, in September or later, The suspension of interest rate hikes is not necessarily decisive. The European Central Bank raised borrowing costs by another 25 basis points in July. Most economists still believe that the central bank will raise interest rates by 25 basis points again by the end of the year.

- JPY: On Monday, the exchange rate of the Japanese yen against the US dollar fell to 142, but after the Bank of Japan eased control of interest rates and raised the 10-year Japanese government bond yield above the 0.5% ceiling, the Japanese yen will still hit its first monthly increase since March. The Bank of Japan maintains the policy interest rate unchanged, but takes measures to make the yield curve control more flexible, which actually shows that it will not be as tough as defending the 10-year yield ceiling of 0.5. This will be the first unexpected move since the governor of the Bank of Japan, Ueda, took office, which may stimulate people's bet on further policy normalization. For several months, the market has been speculating that due to continued inflation and rising global interest rates, which have continued to put pressure on Japanese bond yields and currencies, the last major central bank that maintains a dove position may eventually succumb.

- NZD: On Monday, the New Zealand Dollar 50 index rose by 109.41 points, an increase of 0.92%, received at 12056.15 points, close to the highest closing point since May 19, and rose by 1.2% at the closing time this month, thanks to the optimism of Wall Street Friday transaction,Because people increasingly hope that the Fed may tighten its policies when core inflation and wage costs are eased. There are reports that New Zealand’s business sentiment reached its highest level in the past two years in July, which also encourages investors to enter a new position. In China, New Zealand’s largest trading partner, the State Council issued measures on Monday to restore and expand consumption in automobiles, real estate, and services. Energy minerals have risen, followed by utilities, non-energy minerals, consumer services and retail trade. New Zealand catering brand companies ( Restaurant Brands NZ) rose sharply (4.2%), Gentrack Group Limited (3.7%), Briscoe Group(2.9%), Meridian Energy2.4%) and A2 Milk Co.(1.7%.

- USD: The dollar index stood firm near 102 on Monday, but this month will still fall by more than 1%. This is the second consecutive month of decline because US inflation shows signs of further cooling and supports the Fed’s expectation that the current austerity cycle may end. Data on Friday shows that the annual core PCE price in the United States rose by 4.1% in June, the lowest level since September 2021, lower than the market's expected 4.2%. Last week, the Fed implemented a generally expected rate hike of 25 basis points, which analysts believe may be the last rate hike in the current currency tightening cycle. The US dollar will fall on a monthly basis. As the Bank of Japan relaxes control of interest rates, the sell-off activities of the US dollar against the Japanese yen are most obvious.

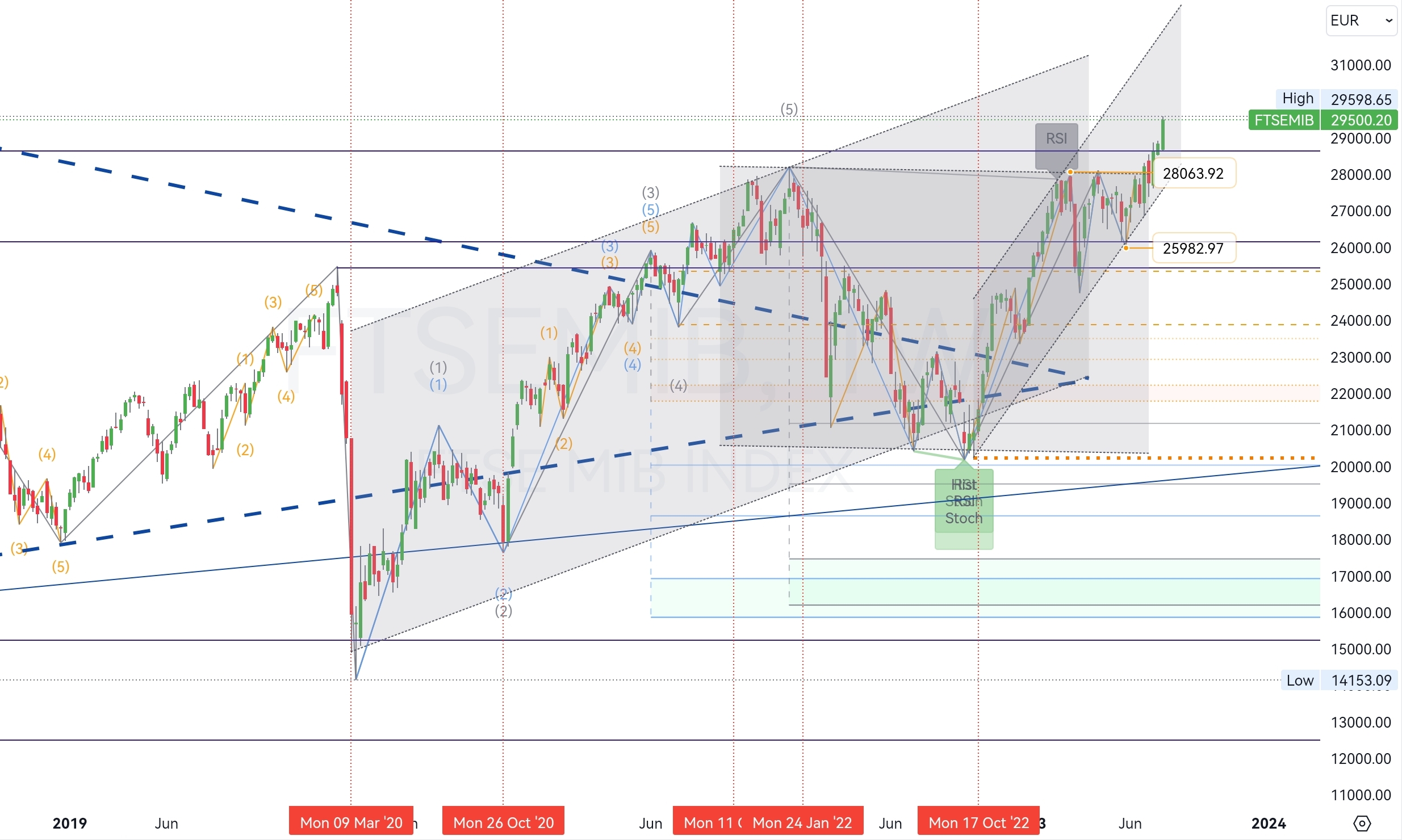

CHART OF THE DAY:

On Monday, the MTB index rose by 0.5% at 29645 points and ran to beat its European counterparts, reaching its highest level since 2008. Leonardo’s stock price soared by 3.7%. The company previously reported a surge in new orders in the first half of this year. Its CEO stated that the aerospace, defense and security company will focus on the rapidly growing cybersecurity and space industries. Traders are also digesting the European Banking Authority’s 2023 stress test, which concluded that the European Bank “ maintains flexibility under the adverse conditions of a severe recession in the European Union and the world, rising interest rates and rising credit spreads ”. Unicredit rose by 2.5%, United Sao Paulo Bank rose by 0.9%, and this year's profit expectations were raised on Friday. At the same time, the latest economic data shows that the Italian economy contracted unexpectedly in the second quarter, while inflation slowed in July more than expected. However, in the euro area, GDP has resumed growth and inflation has eased. In the month, the MIB index soared by 5.1% when it was rich%.

Long-term Channels Trading Strategy for: (Italy MTB index). Time frame (D1). The primary resistance is around (all time high). The primary support is around (28063). Therefore, the next most probable price movement is a (up) trend. (*see all other details on the chart).

Demo account

The Blue Suisse Trading Account with virtual funds in a risk-free environment

Demo accountLive account

The Blue Suisse Trading Account in our transparent live model environment

Open an Account